Market analysts observe better returns when extending duration, after the Central Bank’s decision not to touch the rate when announcing the reduction of the crawling peg.

With the drop in crawling and the slowing inflation, The market anticipates a cut in interest rates, which generates a growing interest in longer-term fixed rate instruments. This change could mark a turning point in the prominence of the Lecap, that dominated the market in 2024, and give way to the Boncap as the new stars of the market in 2025.

The content you want to access is exclusive to subscribers.

Context of lower nominality

The investors foresee a decrease in the pace of crawling peg starting in February and a drop in inflation, driven by a lower devaluation. This lower nominal scenario could also include a interest rate cut by the Central Bank of the Argentine Republic (BCRA).

For Delphos Investment The question lies in when the BCRA will implement this reduction, since Maintaining the monetary policy rate at its current level (with Lefis yields around 2.7% TEM) would result in a spread between the MPR and the crawling peg that would be the highest since May 2024 (1.7% TEM)”.

In this context, they see opportunities in the longest part of the fixed rate curve, “where we still see room for compression“. In this sense, he highlighted that, “with yields of 2.10% TEM and monthly implicit inflation between Q30J6 and TZX26 above 1.1% for the first quarter of 2026, We consider that the T30J6 is at an attractive level and with space for additional compression. Therefore, we recommend this bond for those investors with less risk aversion.”

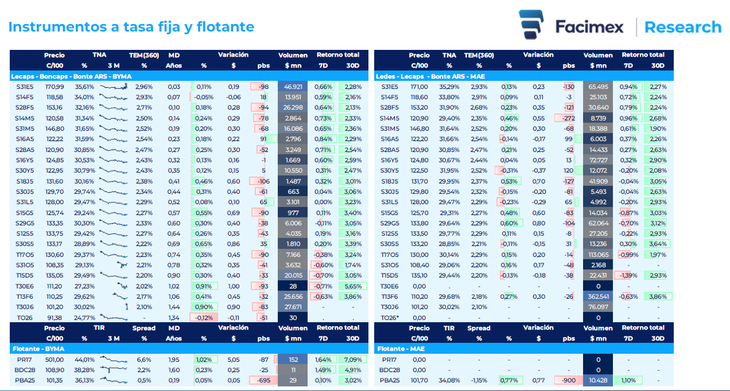

To have an idea, the shorter Lecaps present annual nominal rates of 31% to 34% for maturities until March, while the Boncaps with maturities in January, February and June 2026 show returns between 30% and 29% (TNA), which positions them as a attractive alternative for investors seeking to extend duration and obtain better returns in a scenario of economic stability.

facimex.png

Lecaps and Boncaps returns, courtesy of Facimex Valores

Finally, Mariano Ricciardi, CEO of BDI Consultora highlighted to Ámbito that the real rate should remain positive, that is, higher than inflation and the devaluation rate, which would make the rate adjustment not so pronounced. The objective is to seek to make the pesos attractive, as a prior step to an eventual removal of the exchange rate.

“With a crawling peg at 1%, inflation could decline to 1.5%-1.7% in the next 6-9 months, facilitating the elimination of the stocks. The challenge is to maintain positive real rates to avoid a flight to the dollar , given that currently the reserves are negative and the dollar shows an exchange rate lag with respect to other countries in the region,” Ricciardi estimated.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.