The SME retail sales 25.5% annually rose in January -at constant prices -while 0.5% fell in the monthly comparison. This increase recorded in the first month of the year demonstrates a recovery of retail trade, initiated in December 2024. It should be noted that, despite the substantial increase registered, businesses They could not recover the fall of the same month last year, that had reached the historical minimum of -28.5%.

With this reference, and taking into account that the first months of 2024 had significant fallsyou can expect that the next year variations continue along the path of recovery.

In January, the SME trade faced a challenging scenario, marked by seasonality, the exodus of consumers to bordering countries and low liquidity after the December holidays. While many entrepreneurs consulted highlighted as positive the stability of prices and a slight real improvement with respect to last year, Most agree that sales are still lower than expected.

Economic uncertainty continues to affect merchants, reflecting in the growing increase in the operational costs of companies. However, entrepreneurs maintain positive expectations for the rest of the year, waiting for the return to classes to drive consumption in February and March.

67A89B858B4BC_706x431.png

Entrepreneurs maintain positive expectations for the rest of the year

Pyme retail sales: sector analysis

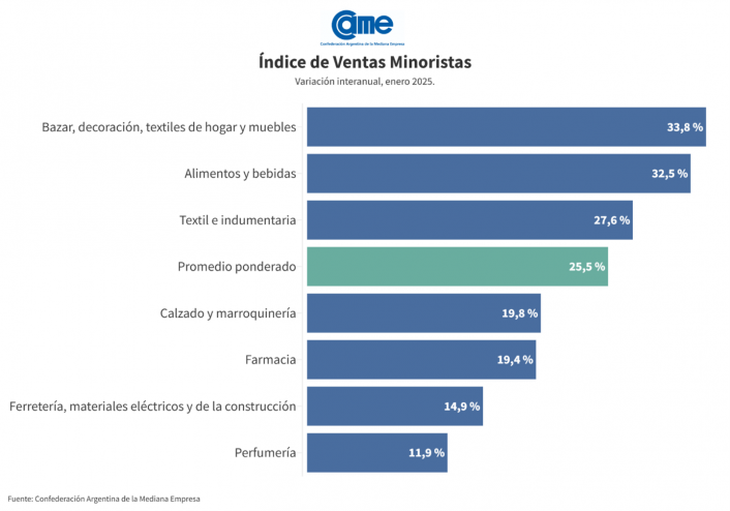

In January, The seven surveyed items recorded year -on -year rises in their sales. The greatest increase was detected in bazaar, decoration, home textiles (+33.8%), followed by food and drinks (+32.5%) and textile and clothing (+27.6%).

In the endless comparison, two items presented positive variations, bazaar, decoration, home and furniture textiles (+3.9%) and textile and clothing (+3.1%).

Food and drinks

Sales rose 32.5% in the year -on -year comparison – at constant prices – while in the unstacted intermennsual comparison a 1% drop was observed. This strong recovery of the item is mainly driven by the comparison base, since in January 2024 it had had a 37.1%retraction.

Bazaar, decoration, home textiles and furniture

Sales rose 33.8% year -on -year – in constant prices – while in the intermennsual comparison desestationalized there was also an increase (+3.9%). The year -on -year growth is marked, among other factors, due to the low comparison base since this item in January 2024 had a 20.5%drop. However, positive intermensual variation denotes a real recovery despite the typical seasonality of January.

Footwear and leather goods

Sales grew 19.8% year -on -year in January – at constant prices – while in the de -stationalized intermennsual comparison the item had a 1.9% retraction. The comparison base of this item in 2024 is a fall of -20.8%. That is, part of this growth is recovery of the lost.

Pharmacy

Sales rose 19.4% annually in January – at constant prices – but 3.2% fell in the intermennsual comparison. While the result of the month was good, it was not enough to compensate for the 45.8% annual fall that the sector sales had in January last year.

Perfumery

Sales rose 11.9% annual in January – at constant prices – while in the intermennsual comparison there was a fall of 0.3%. While this year -on -year recovery is relevant, the fall of 32.6% of January 2024 is not recovered.

Hardware store, electrical materials and construction materials

Sales rose 14.9% annually in January – at constant prices – and dropped 3.5% in the intermennsual comparison. As with the other items, there is an increase in sales in interannual terms, but without recovering completely from the fall of January 2024 (-31.3%).

Textile and clothing

Sales grew 27.6% year -on -year in January – at constant prices – and 3.1% in the intermennsual comparison. This year -on -year growth added to a positive year closure (it was the only item that grew in 2024) shows a real recovery and growth of the sector shops.

67A89B859253E_706x494.png

In January, the seven surveyed items registered year -on -year increases in their sales.

Challenges and opportunities for the sector

One of the main current challenges is the Difficulty facing the payment of wages. Food and beverage shops lead the list of more affected sectors, with 21.2% of merchants reporting problems in this aspect. The textile and clothing sector is not alien to this situation, with 19.2% facing similar difficulties.

However, Some businesses have managed to better manage the situation through strategies such as aggressive promotions and reduction of operating costs. For example, a footwear trade in Buenos Aires chose to reduce its attention schedules during the low season, while a clothing store in Santa Fe implemented discounts for cash payment to encourage immediate consumption.

SME stores have reflected various perceptions about their current economic situation and future expectations. In general terms, 24% of businesses believe that their economic situation has improved compared to the previous year, while 56% perceive them without changes and 20% indicate that it has worsened. Among the items, the hardware store, electrical and construction materials shows the highest percentage of improvement (26%).

As for expectations for the year, 58% of shops expect the situation of your company to improve, 37% believe that it will remain the same and only 5% anticipate a worsening. The most optimistic item is footwear and leather goods (65%) that expects improvements.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.