Something extraordinary is happening in the gold market. While its price is at historical maximums, the bullions are going from London and accumulate in New York. What is happening?

Let’s start with the gold graph:

Gold is living one of the best moments in recent years. The uncertainty generated by Trump and the US fiscal deficit further feed the golden thesis of gold that, even with high rates, has risen strongly.

What is happening with London and New York?

In recent months there has been a great gold shortage in London. If one wanted to withdraw billets from the Bank of England he had to wait for four and eight weeks, when before time it was just a few days.

Behind this there is a clear reason: gold is leaving London at an accelerated pace and much ends in New York.

Why is this movement happening?

On the one hand, the fears of tariffs by Trump. There are rumors that the US president could impose imported gold rates. Although there is no official confirmation, some investors advanced and moved their bullion to the US.

In addition, there is a matter of price arbitration. The price difference between the London market and that of New York generated opportunities for those who wanted to physically transfer gold.

However, there is a third factor that few are mentioning and that could be key: China.

For years, the physical gold flow follows a route: it begins in London, passes through Switzerland and ends in China. In fact, according to customs data, Switzerland processes and re -exports about 1,000 tons of gold every year to the Asian market. In recent months, this rhythm was increasing.

An OTC (over-the-counter) market is where assets are negotiated directly between the parties, without going through a formal bag. According to a recent Goldman Sachs report, gold purchases by China in the London OTC market overcome ten times what official figures indicate. This is a crucial factor to explain the shortage of gold in London and the increase in accumulated bullion in New York.

Along with this shortage in London, something equally surprising is happening in New York: a historical increase in gold reserves in the vaults.

Since November, coinciding with Trump’s victory, the amount of stored gold has grown at a rate not seen since the crisis of 2020 by the COVID:

gold2.jpg

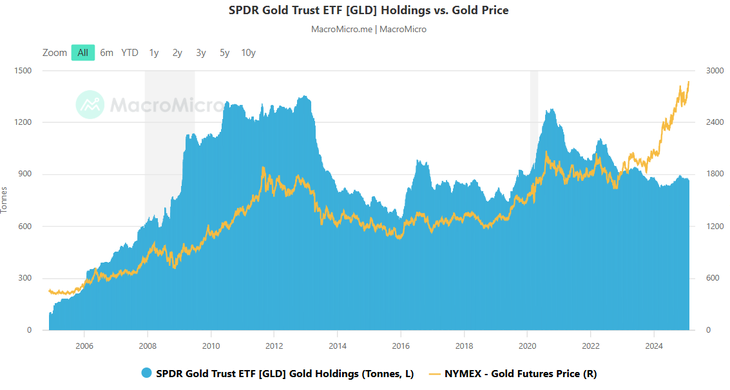

Another key point is the divergence between the price of gold and the flows of the Golden Ethfs:

Gold3.png

Traditionally, when gold rises, the ETF backed by gold (GLD) also does so. However, since 2022, the ETF has lost volume, while the central banks bought at record levels.

This divergence is a strong sign that great players trust more in physical gold than in gold backed by ETFs.

What does this mean for investors?

The fact that gold is marking historical maximums without a generalized euphoria is a sign that the upward trend could continue.

In addition, record purchase by central banks and accumulation in New York reinforces the idea that institutional demand remains firm.

And with the mining companies what happens? They have had difficulties, because extraction costs have also increased. However, the trend is clearly bullish and, if the price of gold continues to rise, its margins could quickly improve.

Is it time to continue buying gold? Nothing seems to indicate that the opportunity is ending.

Finally, I want to invite you to download for free a report that I prepared so you can prepare for 2025. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.