With a market that maintains its upward trend above 6,000 points, and good results by companies in their reports in the fourth quarter of 2024, it is worth reinforcing certain ideas to rearrange our portfolio.

We continue with the same conviction in terms of the generation of long -term value based on high capitalization and growth technological companies. Despite higher rates, the American economy maintains its long -term growth level and if the investment causes increases in productivity, inflation can be kept at bay, even with a higher target by the Fed.

Therefore, we continue to identify value in technology companies within the sector of great capitalization and growth. We continue to believe that this segment is the place to be positioned, and we continue to incline our portfolio in that direction, under a well -balanced yield portfolio.

With that objective we incorporate NVIDIA (NVDA) a segment company, to the Amazon Electronic Commerce Giant (AMZN) and three ETF´s yield that grant greater diversification to the portfolio.

yields

Entering the ETF´s Cedears (Exchange-Treded Funds)

The three yields of ETF´s reinforce the diversification of our portfolio in an environment where, although in terms of multiples the market looks overvalued, we continue with our vision that a bearish market after Trump’s triumph in the coming months looks unlikely. However, we are not as optimistic at the index level as the main investment banks that forecast expected returns by 2025 around 10% -12%.

Thus, the incorporation of ETF of Energy (XLE), the technology (XLK), and that of the pharmaceutical sector and health care (XLV) allow a better risk-back balance to our portfolio, under the current environment.

Recall that an ETF (Exchange-Traced Fund) is a “quoted fund”, composed of assets of certain characteristics according to its investment objective. These quote and negotiate in the secondary market, and act as the underlying asset of the Cedears in the local market. In general, ETFs try through passive administration to replicate the behavior of stock indices, or sectors, as with these three instruments incorporated into our portfolio.

Amazon and Nvidia reinforce our conviction

The incorporation of Amazon and Nvidia have to do with our future perspective, given their long -term valuation range. In the case of AMZN, our upper rank of value is US $ 263 per share, while the shares currently quote around US $ 228. In the presentation of its quarterly results on February 6 AMZ awaits a higher capital spending in 2025. The companyHe closed the fourth quarter of 2024 with a 10% growth in sales and a net income of US $ 1,86 per share, exceeding market forecasts, where its operating cash flow increased by 36%. For its part Amazon Web Services (AWS), its cloud computing division grew 19%, although slightly below expectations. This segment offers a wide range of services, including storage, processing, databases, artificial intelligence and Machine Learning, among others. It is one of the company’s main sources of income and a global leader in cloud infrastructure, competing with Microsoft Azure and Google Cloud.

In turn, Nvdia after the Cimbronazo after the emergence of the new Chinaquotes around the US $ 139, while the upper end of our value range is located at US $180, granting a great opportunity for value. In short term the market will be expectant to present the quarterly results of this technological giant on February 27.

In line with our vision of recent years, we hope that the growth of large capitalization companies will remain strong, and both Amazon and Nvidia will increase our exposure to this area, while ETFs grant us a better balance before a market that looks for some short -term correction after an accumulated return in the last two years greater than 50%.

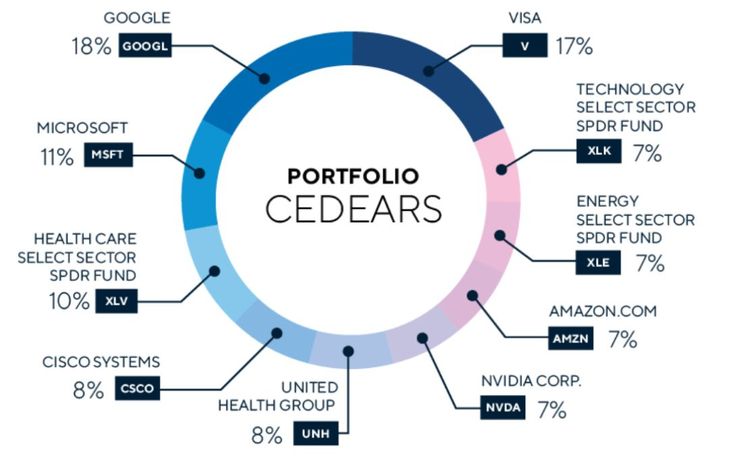

Thus, the Recommended CEDEARS CRITERIA PORTFOLIOit is formed as follows:

CEDEATS CRITERIA.JPEG

Cedears of Criteria Portfolio.

Criteria

*ASSET MANAGEMENT OF CRITERIA

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.