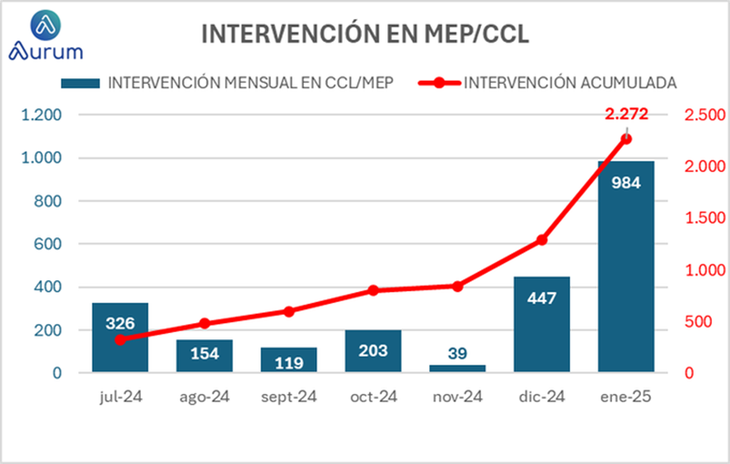

In January, the Central Bank destination US $ 2,307 million to sustain the MEP and the CCL. The costs of sustaining this policy begin to accumulate

Since the government of Javier Milei implemented a monetary scheme that froze the large monetary base at $ 47.7 billion in July last year, The intervention of the Central Bank of the Argentine Republic (BCRA) in the financial dollar markets has been a central pillar of its economic strategy. However, The costs of sustaining this policy begin to accumulatewith increasingly visible effects on the current account of the BCRA and international reserves.

The content you want to access is exclusive to subscribers.

In January, the BCRA allocated US $ 984 million to the intervention of the dollar in financial marketstotaling US $ 2,272 million from the beginning of the program. At the same time, it bought US $ 8.283 million in the official changes market, which implies that approximately 27% of these purchases have been used to contain the exchange gap between the official dollar and financial dollars. To this figure is added the impact of “Blend dollar”which allows exporters to liquidate 20% of their sales in the financial market. In January alone, this operation generated an additional offer of US $ 1,323 million, which raises the total intervention to a record of US $ 2,307 million in the month.

Image.png

While the government argues that these interventions do not seek to directly control the contribution of the financial dollar, but to stabilize the amount of pesos in circulation, market dynamics suggests otherwise. BCRA operations in the bond market, often concentrated in the minutes before closing, indicate a clear intention to mark a reference price for the MEP and CCL. In an economy where dollar price is a key thermometer, containing the exchange gap seems to be the primary objective.

An unsustainable scheme in a context of dollars

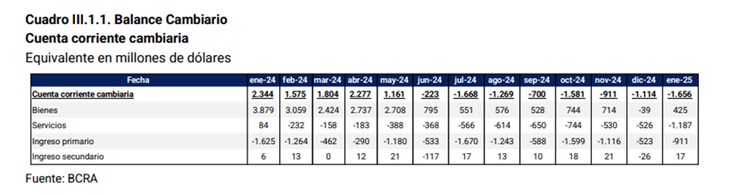

Despite the accumulation of purchases of dollars, BCRA reserves continue to recover. The payment of debt commitments, especially the amortization and rental of bonds in hard currency during January, has absorbed a significant part of these purchases. But the underlying problem lies in the persistent fragility of the exchange current account, which in January registered a deficit of US $ 1,656 million, accumulating eight consecutive months in red.

Image.png

The recent “Mercado Evolution of Changes and Exchange Balance” of the BCRA details the composition of this deficit. While the trade balance of goods exhibited a slight surplus of USD 425 million, the services account showed a deficit of US $ 1,187 million in the month. Within this item, payments for “trips, tickets and other card payments” were responsible for a net exit of US $ 1,112 million, reflecting the persistent demand for currencies by the private sector before a favorable exchange rate to vacation abroad.

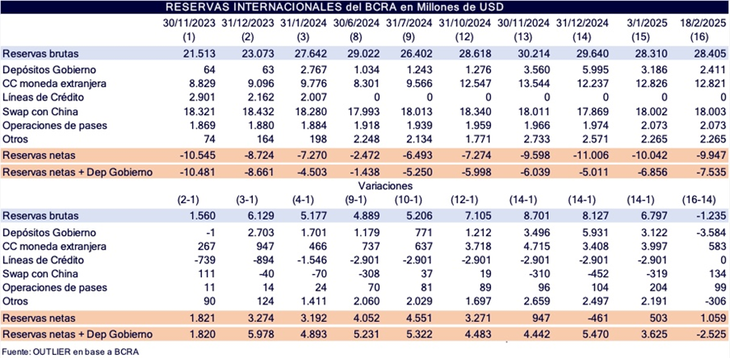

All this occurs in a context of negative reserves, as estimated by the Outlier consultant, close to US $ 10,000 million. Value similar to what is received by this government in 2023.

Image.png

The official strategy to sustain the gap becomes increasingly expensive, with a reserves drain that complicates macroeconomic stability. The decision to reduce the rhythm of devaluation of “1% crawling “ Monthly in a context of still high inflation has generated new pressures on the economy, forcing the government to raise interest rates to sustain the appeal of the “Carry Trade” and avoid a greater capital output.

The IMF, an uncertain bet

In this scenario, the government deposits its hopes in the possibility of reaching a new agreement with the International Monetary Fund (IMF) that includes fresh disbursements. However, organism technicians have expressed concern about the inconsistencies of the exchange scheme. Unless there is a high -level political intervention, it is unlikely that the IMF grant funds from free availability without demanding changes in the current exchange program.

The Milei Administration has made significant progress in its first year, including the reduction of public spending, the fiscal surplus, the correction of relative prices and a slowdown in inflation. However, exchange policy remains its Achilles heel. The exchange delay is becoming increasingly expensive and, with or without IMF money, the current scheme seems unsustainable in the long term. Without a transition to a regime of greater exchange flexibility, the risk of a messy adjustment remains latent, putting in check the stability achieved so far.

Economist

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.