Something weird is happening. And it is not another fact: you can mark a before and after.

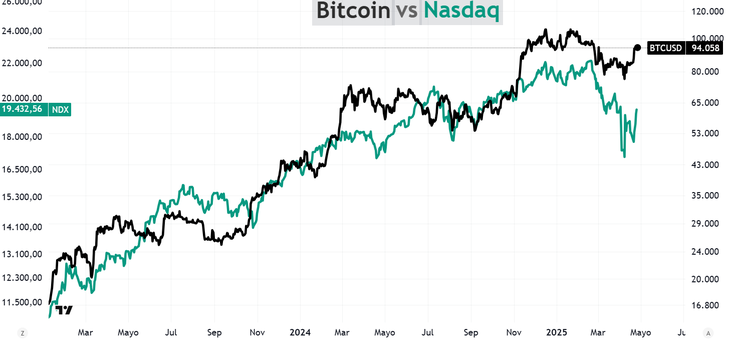

In the midst of the last strong market fall (Trump and its tariffs), the shares in the US collapsed. And Bitcoin? Barely corrected. And then he went up. Even above the levels prior to the start of the bleeding.

That is, while the actions fell mercilessly, Bitcoin sustained. And when the market calmed down a little, it accelerated upwards. And in recent days, he marked maximums of a month and a half. Relative strength of Bitcoin, without a doubt. And that, in market jargon, is a positive signal.

Was Nasdaq-bitcoin society broken?

Bitcoin1.png

Let’s look at the short term more:

Bitcoin2.png

For years, Bitcoin behaved as a “more risk asset.” When Nasdaq rose, Bitcoin also did. And vice versa. They moved in tandem. With a very high correlation. What is that of correlation? It tells you how two assets move from each other. If it is 1, they move the same. If it is 0, they have nothing to do. If it is -1, they move in opposite directions.

But in these last weeks something changed. The Nasdaq fell strong. Bitcoin no. He took off. The correlation deflated. And that says a lot. Is Bitcoin starting to have his own life? It is a possibility.

Why does this happen? No one has the answer. But there are several factors that influence.

On the one hand, the weakness of the dollar globally. Let’s look at the DXY, an index that measures the force of the dollar against a basket of foreign currencies such as the euro, the yen and others.

Bitcoin3.png

The dollar weakened more than 9% since the maximum of the year. And when the currency loses strength, investors look for other alternatives to protect value.

In addition, the world is trembling: Trump, China, inflation, high rates. In this context, some begin to look at Bitcoin as a refuge that, unlike the dollar or the euro, cannot be printed. And that weighs.

Bitcoin as a refuge? Wasn’t it a risk asset?

Yes of course. It was for a long time. But that does not mean that I cannot change.

There is a new narrative under construction: Bitcoin as a reserve of value. Different from gold, of course. But not to replace it, but to complement it.

Conclusion: Is it time to look different at Bitcoin?

If this new independence stage of Wall Street is confirmed, Bitcoin can start playing another role in the portfolios. And it can be very positive. Because? Because it would be transformed not only into an asset with possible good returns (as demonstrated in its history), but also as coverage.

Finally, I want to invite you to download this suggestion for free. There you will find 7 concrete ideas with really surprising alternatives, which present a great risk-back relationship. You can download it in this link: https://clubdeinversores.com/pdf-7-ideas-de-inversion-para-2025/

Note: The material contained in this note should not be interpreted under any point of view as an investment council or recommendation for the purchase or sale of a particular asset. This content has only educational ends and represents only an opinion of the author. In all cases it is advisable to advise with a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.