He gold is having an exceptional year, with an increase of more than 20%. However, there are mining companies that have far exceeded this return. What are they? Are they still an opportunity?

I want to start with the gold chart:

The upward trend in gold is undeniable and has surpassed its historical maximum this year.

Another alternative to gold is a mining company ETF, such as GDX, which includes the main companies in the sector:

gold2.png

And how are you doing?

gold3.png

After several uncertain months, GDX took off this year and has accumulated a rise of 27%.

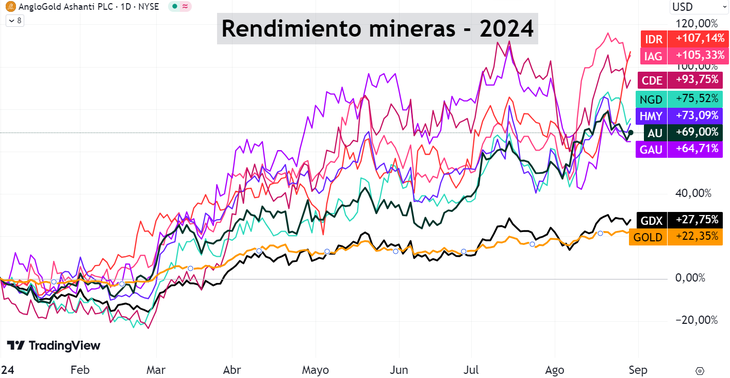

And what were the top 7 mining companies of the year? Let’s see:

gold4.png

- Idaho Strategic Resources (IDR) – Market Cap: USD 170M – Return in 2024: +107%

Idaho Strategic Resources, a US-based mining company, focuses on the extraction of gold and other strategic minerals.

- Iamgold (IAG) – Market Cap: USD 2.850M – Return in 2024: +105%

Iamgold is a Canadian mining company engaged in the exploration, development and production of gold, with operations primarily in West Africa, South America and Canada.

- Coeur Mining (CDE) – Market Cap: USD 2.470M – Return in 2024: +94%

Headquartered in the United States, Coeur Mining specializes in gold and silver mining. It operates in North America, with mines in Alaska, Nevada and South Dakota.

- New Gold (NGD) – Market Cap: USD 1.990M – Return in 2024: +76%

New Gold is a Canadian mining company focused on the exploration, development and operation of gold and copper mines. It operates primarily in Canada, where it operates two mines: the Rainy River Mine in Ontario and the New Afton Mine in British Columbia.

.

- Harmony Gold Mining (HMY) – Market Cap: USD 6.460M – Return in 2024: +73%

Harmony Gold, a South African mining company, is one of the largest gold producers in the country and also has operations in Papua New Guinea.

- AngloGold Ashanti (AU) – Market Cap: USD 12.5B – Return in 2024: +69%

UK-based AngloGold Ashanti is one of the world’s largest gold mining companies. It operates in several countries, including South Africa, Ghana, Australia and Brazil, with significant projects ranging from underground mines to open-pit operations.

- Galiano Gold (GAU) – Market Cap: USD 395M – Return in 2024: +65%

Canada-based Galiano Gold is primarily engaged in gold mining at its Asanko mine in Ghana, West Africa.

While gold and the gold mining ETF (GDX) returned 22% and 27% respectively, the companies in this ranking have outperformed in impressive ways.

Can gold continue to rise? Of course. It remains very attractive and recommendable for any investment portfolio for three key reasons: it has very good fundamentals, it is clearly on an upward trend and it has a low correlation with traditional assets.

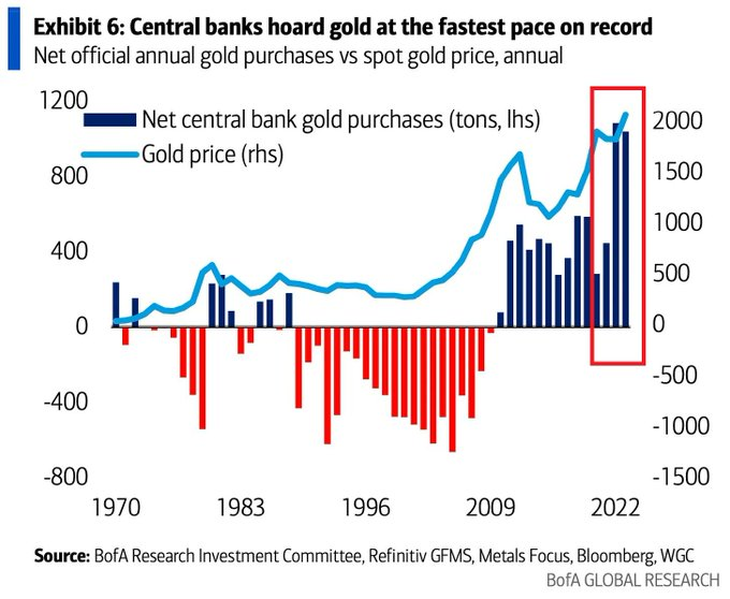

As a bonus: Central banks are accumulating gold at record levels.

gold5.png

And if gold continues to rise, the outlook for mining companies is even more positive. Obviously, they have another risk. Therefore, operate with caution.

If you want to know more about investments, I invite you to visit our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be construed in any way as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents only the opinion of the author. In all cases it is advisable to seek professional advice before investing.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.