The Government revealed that, after two months of currency bleeding due to sales by the Central Bank in the official market, it managed to close August with a purchase balance of US$380 million. Thus, Gross reserves had a meager monthly growth of US$318 millionfar from the US$1.2 billion that Luis Caputo had promised to the representatives of stock exchange companies during a meeting at the end of July. But there was one fact that caught the attention of some tables in the City: A one-off bank loan in dollars to a local firm granted on August 28 was the factor that ended up preventing the BCRA’s coffers from ending up with a negative balance for the third consecutive month..

On that day, local banks’ loans in foreign currency grew by US$327 million.according to official data. Economist Salvador Vitelli, head of research at Romano Group, said that it was the largest daily increase in stock in 20 years. This was a rather out-of-context move; in the previous sessions, as in recent months, dollar loans to the private sector were practically stagnant and showed small variations.

This type of financing has a direct impact on the supply of foreign currency in the official market.. It happens that, by regulation, the dollars obtained by companies through these credits in the local market must be liquidated. That is, Companies keep pesos and borrowed currencies end up in reservesWhen the loan expires and the firms must pay it to their bank, the process is reversed and, therefore, it becomes a source of pressure on the BCRA’s coffers.

In this way, the striking movement of August 28 was decisive for the monthly exchange balance. Reservations International debt had ended July at US$26.399 billion and rose last Friday to US$26.717 billion, which meant an increase of just US$318 million. The credit operation carried out on Wednesday last week helped to ensure that the balance was not negative.Official information does not allow us to know the details of this loan. One operator even speculated that a public company could have been the recipient of the financing.

Beyond that, the truth is that the financial operation broke with the dynamics of the last three months. Before, Between the end of February and mid-May, there was a boom in the granting of foreign currency loans to local companies. (tempted by lower dollar rates than in pesos) which helped on the exchange front a BCRA that gives up 20% of the liquidation of exports due to the dollar blend. In that period, the stock grew by almost US$3,000 million. In fact, according to calculations by economist Damián Pierri, if that factor had not existed, in the March-April two-month period the reserves would have fallen by US$626 million, instead of closing on the rise, as finally occurred.

image.png

In mid-May, the abrupt drop in the monetary policy rate interrupted this growth. and the granting of bank loans in foreign currency stagnated. The stock remained practically stable for the next three months.This coincided with the drain on reserves (which have fallen by more than US$2.2 billion since then), also motivated by debt payments and the gradual normalization of the flow of import payments.

“Since the monetary policy rate has dropped, borrowing in pesos is now a given. With these active rates in pesos, loans in dollars have stopped and loans in pesos have appeared again, which is what we are seeing. This is what should happen,” described Pierri, an associate researcher at the Interdisciplinary Institute of Political Economy of Buenos Aires at the UBA and CONICET, in conversation with Ámbito.

For Pierri, that context “has not changed.” Therefore, considered that The movement of August 28 cannot be thought of as a change in trend. “The rate in pesos has been rising little by little, but not enough to justify such a jump. Everything suggests that it was a one-off operation.. Before (in March, April), there was a positive slope; this time there was a slight jump,” he explained.

Dollar: Concerns over reserves continue

However, concern about the shortage of foreign currency remains the order of the day, with a economic team that decided to prioritize the containment of inflation at the cost of giving up reserves. This is attested by the intervention on financial dollars to close the gap and the retrotraction of the tax rate COUNTRY TAX which will encourage imports. Net reserves are negative by around US$6 billion and the question in the market is how much further they could fall this year.

To maintain the continue-continue of the exchange rate scheme (continuity of the cepo through), the Government is betting on bleach as a bridge to obtain dollars. Likewise, the income that is eventually obtained through this means will have a greater impact on gross reserves.

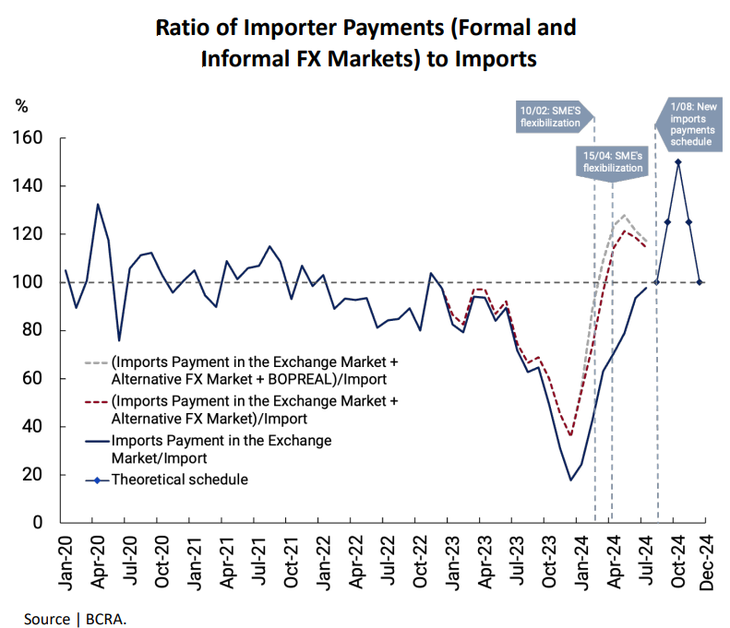

image.png

Meanwhile, The BCRA is preparing for a period of increased demand for foreign currency. The presentation made on August 23 by its vice president, Vladimir Werning, confirmed that the entity expects that between September and November payments for imports through the official market will far exceed purchases from abroad that are actually made. in that period due to the overlapping of the old four-installment cancellation scheme with the current two-installment scheme, as had been anticipated Scope. To such an extent that in that period the Central will have to face a demand for reserves equivalent to an extra month of imports.

Thus, the country risk remains above 1,450 basis points. Beyond the fact that Caputo assures that he will not need to access international markets until January 2026 to refinance the payments of external debtthe market and economic agents are looking at the mountain of maturities for more than US$18 billion next year (between Treasury bonds, BOPREAL, IMF and other multilateral organizations).

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.