According to the report National Institute of Statistics and Census (INDEC) through the Mining Industrial Production Index (IPIM)in July 4,991.1 tons of “lithium carbonate”which registered an increase of 47.4% compared to the same month in 2023. This production corresponds to only three projects currently in activity: Olaroz and Phoenixfrom Arcadium Lithium, and Caucharí-Olarozfrom EXAR Mining. Centenary Micefrom Eramine South America, is still in testing periods and is set to begin production before the end of the year.

The fall in prices is mainly due to an excess of supply and moderation in sales of electric vehicles worldwide, whose production depends largely on lithium for batteries. The main contraction in the international price is mainly due to the elimination of Chinese government subsidies for the purchase of electric cars in that country.

Given this adverse scenario for the lithium industry, Mining companies began to implement “cost reduction” strategies to ensure the viability of their projects. However, a recent report by the economist Maximilian Ramirez on this sector, provides improvements in future projections.

How much will the price of lithium rise in the coming years?

The lithium market is relatively small compared to other metals, so it is traded directly between producers and customers in medium and long-term contracts.Ramirez stressed.

Metal exchanges began to incorporate it in order to provide greater transparency to the market. In turn, there are various products, qualities and specifications, which makes the standardization of their price complex, generating levels of opacity in the market. Therefore, the prices published by consultants are referential and have as a source the international trade figures of exporters and importers.

Since 2006, prices for lithium carbonate increased significantly, driven by the demand for batteries that was not being met by the pace of expansion of supply. Almost a decade later, they went from an average price from US$6,500 per ton in 2015 to US$14,200 in 2018.

image.png

The evolution of the average price of lithium carbonate in the period 2006 – 2027 shows an upward trend with discrete increases due to specific events.

SIACAM and Bloomberg

“The significant increase in the price since 2016 has been driven mainly by the expectation of increasing consumption for the manufacture of batteries for electric vehicles. Although there are other sources of demand with positive prospects, such as energy storage systems and batteries for electronic items such as cell phones and notebooks, this is lower than expected for the automotive sector,” detailed the specialist’s analysis.

It was not until 2019 that the market situation reversed: supply rose for a given level of demand and prices fell. The tight supply due to COVID in 2021 led to a new recovery, which brought prices to extraordinarily high levels in 2022 (average of US$69,500 per ton), beginning a period of great volatility.

However, the expansion of supply in a context of a lower than expected demand increase is increasing stocks, which has led to the current significant drop in prices. For 2024, a final average of US$16,500 per ton is estimated, although on the spot market it is currently trading at around US$10,000. Many of the supply contracts were signed in previous years – up to 3 years before – at average prices, which today allow this industry to sustain its activities. On the one hand, these were minor trade agreements during the boom of the US$80,000 tonne, but today they are greater than the market record, which is why they bring some relief to Argentine production companies.

And while there is still some uncertainty about price behavior in a changing international context, the latest market estimates indicate that Between the period 2025-2027 they would be around US$20,800 per tonwhich places them 53% above the 2005-2023 average.

Strong increase in lithium production expected in Argentina

The national government estimates that the completion of the first projects of the Large Investment Incentive Scheme (RIGI) will inject US$47.1 billion in the country’s economyas specified in the Management Report provided to Congress by the Chief of Staff, Guillermo Francos.

The document specified the investment initiatives that were activated after the launch of the RIGI, in different parts of the country and in various sectors, such as lithium, copper, steel, gold and liquefied natural gas.

As regards the lithiumforeign mining companies intend to invest in the province of Salta. This is the case of the South Korean Gossamer, which will advance the second and third phases of its $2 billion lithium project at Salar del Hombre Muerto. The company is seeking to build a plant to expand its facilities in its development Gold Saltits largest investment outside South Korea in the past 60 years.

Eramine South America -formed by the French Eramet (50.1%) and the Chinese Tsingshan (49.9%) – inaugurated the first lithium mine in Salta and the fourth in the country in the Centenario-Ratones salt flat, which will begin production in November and required US$870 million. It has a second installation in the pipeline with an outlay of US$800 million.

The Chinese giant Ganfeng -the world’s largest supplier for the production of lithium batteries- is evaluating an investment of US$1 billion. It has the project Mariana in the Salar Llullaillaco and is building a solar park with which it plans to be self-sufficient in energy. In March, it bought 15% of the project Large Pastureswhich will begin construction in 2025 and is owned by Lithium Argentinaa subsidiary of the Canadian company Lithium AmericasThey are partners in other projects such as Caucharí-Olaroz, the largest lithium mine in the country, located in Jujuy. They participate together with Jujuy Energy and Mining State Company (Jemse).

It also appears to take advantage of the RIGI Rio Tintowhich operates in Salar de Rincón and plans a second plant worth US$300 million.

Meanwhile, company executives Plasa, which has a project in the Salar de Diablillos, will meet in the second half of September with the Ministry of Production and Sustainable Development of Salta de Martin of the Rivers to inform you of details of its expansion, while the Chinese Hanakis reorganizing its investments to advance RIGI through.

According to Maximilian Ramirezone of the keys to the industrialization of lithium The reason is that knowledge, technology and production are closely linked, as in many other processes. “Therefore, it will be vital for countries that possess the resource to draw up some kind of strategy, either individually or jointly, in the process of technological and energy transition that is already beginning,” he stressed.

In this sense, the economist highlighted the possibility of having in the country a company that produces the main input of lithium, such as natural sodium carbonate (the well-known “soda ash”)which is vital for thinking about the future development of added value both in the production of the chemical industry in general and in electromobility in particular.

“Argentina has historically had a significant presence in the production of artificial sodium carbonate since 2005 when it began producing Álcalis de la Patagonia (Alpat). Argentina’s relevance in the global sodium carbonate value chain lies in its ability to supply the local glass industry and other sectors that require this chemical input,” the expert said.

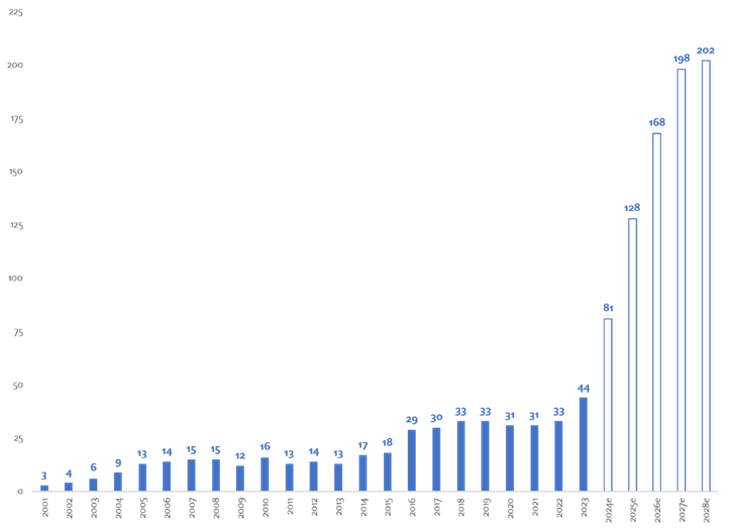

In the first half of 2024, lithium production almost doubles the value of 2023, but For the next five years, national production could reach 202,000 tons of LCE, 373% more than last year’s 44,000 tonnes. By the end of 2024, total production of lithium carbonate above 80,000 tons.

image.png

Evolution of lithium production in Argentina (in thousands of tons LCE).

In this context, if the lithium projects are implemented by 2027, In Argentina alone, 1,000,000 tons of “soda ash” would be consumed annually. between the lithium industry and other sectors such as pharmaceuticals, food and glass. And if this number is extrapolated to South America (adding Brazil, Chile and Peru) the need would multiply by three to around 3 million tons of “soda ash”taking into account that the Brazilian industrial hub demands 1.5 million annually.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.