The Federal Reserve appears to be on track to lower interest rates on Wednesday. The question the market is asking is how much the cut will be to reconfigure the investment compass.

Let’s get the basics straight: The Federal Reserve will announce its latest interest rate decision at 3 p.m.along with the latest summary of economic projections (i.e. the dot plot). This will be followed by a press conference with central bank Chairman Jerome Powell at 3:30 p.m.

The content you want to access is exclusive for subscribers.

As of Wednesday morning, the market was pricing in a 63 percent chance of a half-point rate cut and a 37 percent chance of a quarter-point cut. By year-end, the market is projecting a federal funds rate between 4 percent and 4.25 percent, down from the current range of 5.25 percent to 5.5 percent.

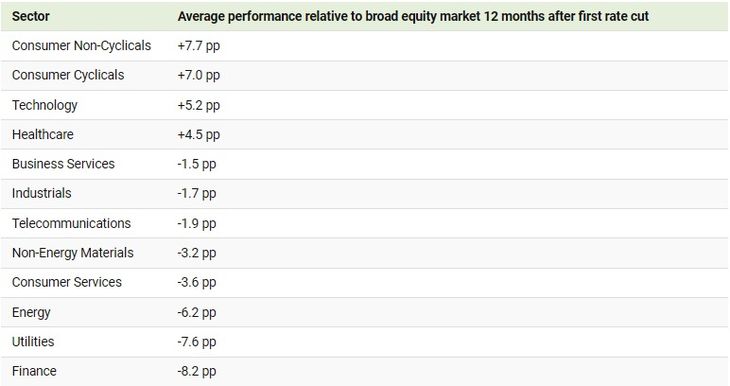

Winning and losing sectors after the cut

Non-cyclical consumer goods show the highest returns after the first rate cut, especially during recessionsthanks to the constant demand for basic products.

This traditionally defensive sector includes companies such as Procter & Gamble, Walmart and Coca-ColaIt should be noted that basic consumer goods They are the only sector of the S&P 500 that has generated positive returnson average, during the downturn stage of the business cycle since 1960. During the downturn stage, it also outperformed the vast majority of sectors, with an average return of 15% over those periods.

This further underlines the attractiveness of this sector as a reliable investment option in times of volatility, as it continues to provide relatively high returns when most sectors are struggling to stay afloat.

Wall Street Sectors.jpeg

Growing investor interest in AI-related stocks.

On the other hand, Tech sector underperforms market six months after first rate cutbut their performance improves over a 12-month period, as lower interest rates typically benefit growth stocks by reducing borrowing costs.

However, some of today’s largest tech companies are more resilient to higher rates due to their large cash reserves and growing investor interest in AI-related stocks.

Instead, The financial sector historically experiences the worst performanceThis is because interest rate cuts are typically a sign that the economy is slowing, putting pressure on loan growth, credit losses and default risk.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.