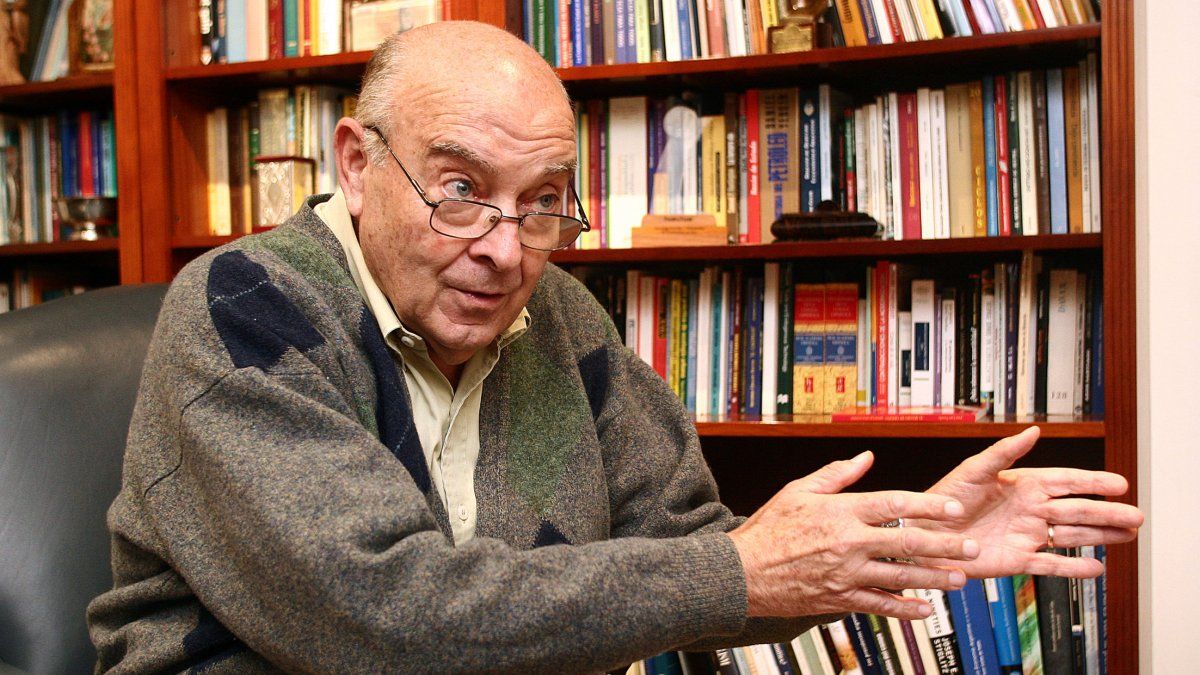

In the framework of a seminar of the economic consultancy GlobalSource Partnersthe former Minister of Economy Sunday Cavallo analyzed the current macroeconomic situation in Argentina, the administration that is currently running Javier Milei and the projections present in the Budget 2025.

Firstly, the economist referred to the presidential speech during the presentation of the project, considering that “Milei is convinced that in order to successfully carry out the A comprehensive reorganization of the economy will require legislative support, which is far from being achieved.”. In this context, he understood that the president “has all his mind focused on the midterm elections in October 2025.”

After highlighting the reduction in primary spending of GDP (from 19.8% in 2023 to 13.8% this year), he said that “the evolution of fiscal accounts until August 2024, the projections until the end of the year and the budgetary goals for 2025 suggest that The goal of zero fiscal deficit will be very close to being met”.

Regarding the projections for the 2025 Budget, he was skeptical: “In September, in order to achieve the budget inflation targets, Inflation should be 1.2% per month until December and 1.4% per month on average during 2025″. However, he said that GDP growth of 5% is possible in 2025, “led by the industrial and commercial sectors, with estimated increases of 6.2% and 6.7%,” plus a boost from agriculture, the production of goods and services.

Domingo Cavallo Former Minister of Foreign Affairs of the Argentine Nation

Mariano Fuchila

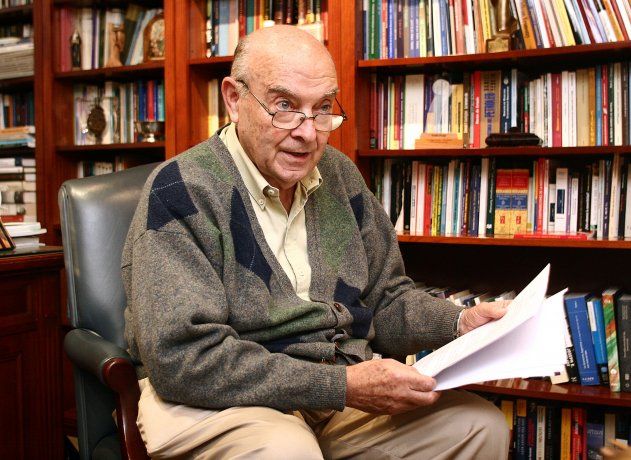

The former minister also expressed doubts regarding how the collection could be offset the elimination of the PAIS tax in 2025also aligned with optimistic export growth (100%). Although he described them as “weaknesses” of the project’s fiscal adjustment, he stressed “the determination of President Milei and the audacity with which he confronts calls for spending increases and demands for budget cuts.”

Central Bank and bills

Cavallo pointed against the growth of the Central Bank’s monetary basewhich went from $10 billion to $23 billion between January and September, and the Exchange of bills of exchange between the Treasury and the BCRA: “It is an accounting trick” which transfers remunerated liabilities from the Central Bank to the Treasury.” In this regard, he assessed that the interests of the LEFIs are not recorded and do not increase the monetary base, although the Treasury’s debt with the BCRA grows due to the interests on that debt: “The monetary base may rise due to the entire stock of LEFIs. That is why the Central Bank has said that the objective in terms of freezing the monetary base amounts to $47.7 billion, which is the stock of expanded monetary base that existed in June, when the transfer of remunerated liabilities from the Central Bank to the Treasury began.”

He then stressed that “Banks are divesting themselves of LEFIs to lend to businesses and families” and in “the strange measure of intervene in the CCL market “Selling foreign currency for the amount in pesos equivalent to the payment for the net reserves purchased.” “It is striking that despite this debt increase mechanism, the interest bill is reduced from 3.3% of GDP in 2023 to 2.5% in 2024 and 1.3% in 2025,” he added.

“The sum of both interest accounts represents 1.3% of the GDP of 2025, coinciding with the interest payments recorded in the fiscal accounts.“, the former minister stated and opined that the interest in pesos “is clearly underestimated because both in 2024 and 2025 the Treasury renews its debt in pesos by issuing bills with the interest charged, in such a way that they do not appear as paid interest, but are simply charged to the debt stock.”

Debt

At one point in his speech, Sunday Cavallo He estimated that “with a real interest rate of around 3%, the debt in pesos that matures in 2025 and that will surely be refinanced should be accruing interest of around 2% of GDP. Under normal accounting, interest in 2025 should amount to 3.3% of GDP and the financial deficit would not be close to zero but rather in the order of 2% of GDP.”

Domingo Cavallo Former Minister of Foreign Affairs of the Argentine Nation

Mariano Fuchila

That is why he assured that “No one doubts that the capital maturities in the remainder of 2024 will be refinanced, but there are more doubts about the maturities that expire during 2025.” “As long as the current restrictions are maintained, it is very likely that Refinancing will be achieved, in any case paying slightly higher interest rates in pesos to those of the latest Treasury bill placements.”

He expressed greater concern when referring to the maturities of debt in dollars: “The Government’s plans include a new agreement which at least means disbursements equivalent to the payments that must be made to the Fund, as occurred with the agreement that is expiring, and with swaps that could be guaranteed with long-term debt securities and, if necessary, with part of the BCRA’s gold holdings”. He also criticized the Government for “is not willing to completely eliminate the exchange rate restrictions, something that would be essential to achieve the collapse of the country risk”.

Finally, the former minister stressed the importance of the fiscal surplus for the payment of interest on the debt, but noted that “the relevant issue is How much of this trade surplus will be transformed into net income to the market controlled by the BCRAtaking into account that 20% of exports, practically equivalent to the trade surplus, will be settled in the CCL market if the current exchange policy does not change.”

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.