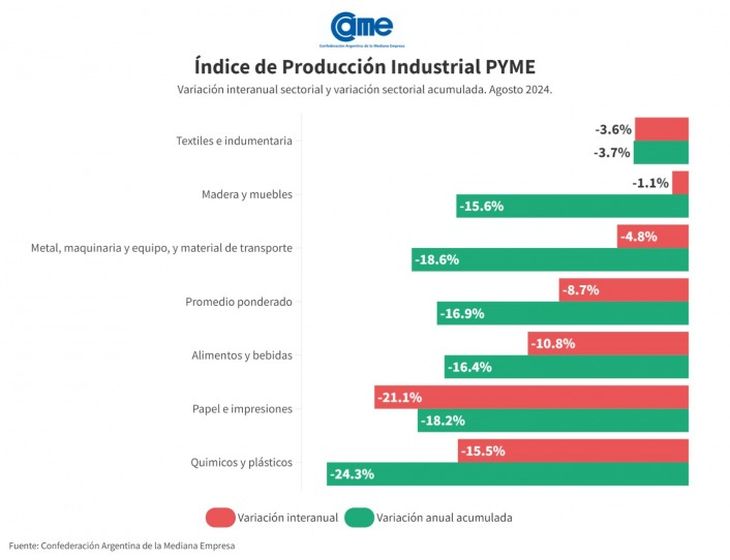

The manufacturing activity of SMEs fell 8.7% year-on-year in August and accumulated a a 16.9% decline in the first eight months of the year compared to the same period in 2023. SME industries have not yet shown any firm signs to confirm the existence of a change in trend or recovery, other than a few pockets which are random from month to month.

In the seasonally adjusted monthly comparison, Activity grew by 3%, a slight increase given the levels of decline that have been occurring.

Regarding the use of installed capacity, stood at 60% in the eighth month of the year, This is 0.6 points below July (60.6%) but 10 points away from the values at the beginning of the year, which were already reflecting the difficulties in domestic demand.

Although in different magnitudes, the six manufacturing sectors of the SME segment had declines in the annual comparison, being the most affected “Paper and Printing” (-21.1%) and “Chemicals and Plastics” (-15.5%). “Wood and Furniture” was the one that fell the least (-1.1%).

66f000c1efc63_706x430.jpg

Activity grew in August but for CAME this does not imply a change in trend

SME industry: sector-by-sector analysis

Food and Drinks

The sector registered a 10.8% annual drop at constant prices in August and a 0.9% improvement in the monthly comparison. For the first eight months of the year, it has accumulated a 16.4% annual drop. Industries operated at 60.4% of their installed capacity in the eighth month of the year, 1.2 points below July.

Textiles and clothing

Production fell by 3.6% year-on-year in August, and by -0.9% compared to July. Through August, the figure has dropped by 3.7%. Industries operated at 60.9% of their installed capacity, the same figures as in July.

Wood and Furniture

In August, the sector shrank by 1.1% year-on-year at constant prices, and grew by 4.3% in the seasonally adjusted monthly comparison. In the January-August period, activity fell by 15.6% compared to the same months last year.

Metal, machinery and equipment, and transportation material

The sector had an annual contraction of 4.8% in August, at constant prices, and grew 5.9% in the monthly comparison. For the first eight months of the year, it has accumulated a decline of 18.6%, always compared to the same months of 2023. Industries operated at 60% of their installed capacity, 0.9 percentage points above the previous month.

Chemicals and plastics

In August, the sector experienced a significant contraction of 15.5% annually, always at constant prices, and a rise of 2.1% in the monthly comparison. For the first eight months of the year, the accumulated fall is 24.3%. During this month, industries operated with only 57.3% of their installed capacity, 3.2 points below July (60.5%).

Paper and prints

Activity fell by 21.1% annually at constant prices, once again being the sector with the greatest decline. In monthly terms, activity grew by 4.2% while the decline through August amounts to 18.2%, compared to the same months in 2023. Companies operated at 60.6% of their installed capacity, levels lower than those in July (62.8%).

66f000c201851_706x542.jpg

Chemicals and plastics were the most affected sector in August

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.