The US stock market is operating on a positive note thanks to the fall in oil prices and the stabilization of US bond yields, while investors remain attentive to economic and geopolitical developments.

Wall Street rises in two of its indices and thus recovers some losses from the previous day, as the fall in oil prices relieves some of the pressure accumulated in the market.

The content you want to access is exclusive to subscribers.

The S&P 500 rises 0.5% and is approaching its all-time high reached early last week. The Dow Jones Industrial Average lost 0.8%, moving away from its own record. The Nasdaq Composite index increases 0.6%.

Notably, markets around the world plunged following worrying swings in China, as euphoria over a potential stimulus for the world’s second-largest economy gave way to disappointment.

Wall Street: what data the market analyzes

US stocks remain near record levels, relieved that interest rates are finally coming back down as the Federal Reserve broadened its focus to include keeping the economy running, rather than just combating high inflation. . When Treasury bonds, considered the safest investments, offer more interest, investors are less inclined to pay very high prices for stocks and other riskier investments.

For investors, it’s hard to ignore that a 10-year Treasury bond is offering a yield of 4.03%, up from 3.62% three weeks ago. The two-year bond yield, which more closely tracks the Fed’s expectations, fell to 3.98% on Tuesday, after rising to 3.99% a day earlier.

With the start of earnings season, PepsiCo shares fell 1% after the company lowered its organic revenue forecast for the year. US consumers continue to reduce their purchases of their snacks and drinks after years of price increases.

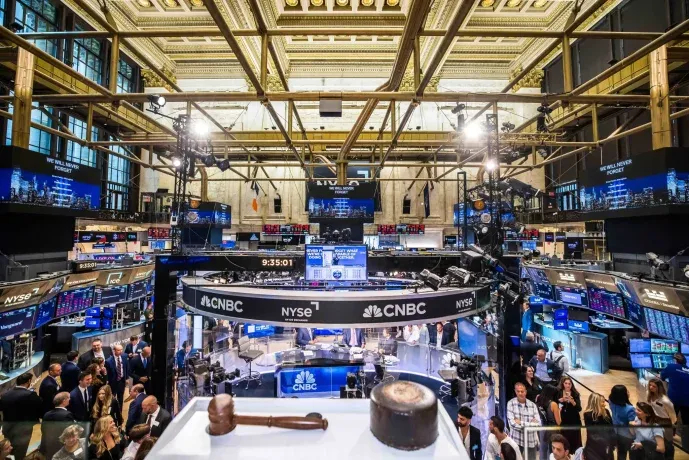

wall street markets NYSE.jpg

With the start of earnings season, PepsiCo shares fell 1%.

NYSE

Investors will be watching economic data on small businesses and the trade deficit on Tuesday. They will also monitor scheduled interventions throughout the day by central bank leaders, including Boston Fed President Susan Collins and Atlanta Fed President Raphael Bostic. An important inflation data, the Consumer Price Index for September, is scheduled for Thursday.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.