It is likely that inflation will not show significant advances in October, in a context where the Federal Reserve is considering cutting interest rates towards the end of the year. The Consumer Price Index (CPI) is expected to reveal a slight increase.

The Consumer Price Index (CPI) for October in the US showed results consistent with market expectations, as they reflected a slight increase in prices. The October figure rose 0.2%, in line with the increase recorded the previous month.

The content you want to access is exclusive to subscribers.

In annual terms, the CPI reached a 2.6%exceeding the 2.4% recorded in September, but aligning with market expectations, which also anticipated an increase of 2.6%.

On the other hand, the Underlying Consumer Price Index (Underlying CPI)which excludes the most volatile food and energy prices, showed the following results:

- In the month of October, the Monthly Underlying CPI grew a 0.3%matching the September increase and market forecasts.

- In annual terms, the Underlying CPI remained in 3.3%unchanged from the previous month and in line with expectations.

This is the latest test of whether resurgence in inflation poses a risk to the US economy, as the Federal Reserve debates its next decision on interest rates after cutting them by a quarter of a percentage point last week.

Inflation in the United States: what the market expects

In “underlying” terms, which exclude the more volatile costs of food and energy, prices in October are expected to have increased 3.3% from a year ago for the third consecutive month. Economists expect monthly increases in core prices to also match the 0.3% recorded in September, according to Bloomberg data.

Core inflation has remained persistently elevated due to higher costs for housing and services such as insurance and healthcare.

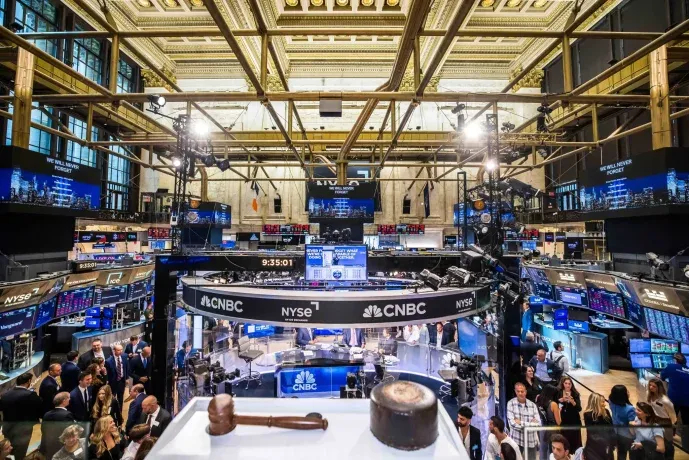

wall street markets NYSE.jpg

NYSE

“The October CPI report is likely to support the idea that the last leg of inflation’s path toward the target will be the most difficult,” Jay Bryson, chief economist at Wells Fargo, wrote in a note to clients on Friday. .

Bank of America economists Stephen Juneau and Jeseo Park agreed, writing in a previous note Monday that “inflation is unlikely to show much progress” and that the next CPI report will likely reflect inflation “moving sideways after a period of substantial disinflation.”

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.