Different private reports maintain that, despite the enormous rise in sovereign bonds this year, they still have a further rise, if Argentina manages to keep the country’s risk on the decline, which would allow it to return to international credit markets.

Based on a country risk at five-year lows (769 points), a disinflation process consolidated, which could reduce the “crawling peg”and an influx of “fresh” dollars, product of the first stage of bleaching -raised the stock of deposits in dollarsvarious private studies maintain that Argentina could reach the international credit market, what would generate an improvement in the rating of its debt and, therefore, in the value of the bonds.

The content you want to access is exclusive to subscribers.

According to Gabriel Vidal RRII director of Criteriathe objective that the country has to consider today is to reach the rate levels of El Salvador or Egypt, that have returns between 9/10%. He also highlighted that if Argentina manages to access international credit markets, something that could be feasible with a country risk of 500 basis points, and which is estimated for the first half of 2025, The potential increase that the “hard dollar” debt still has is up to 27%.

These observations occurred during a working breakfast with journalists, in which Scope. Within your description of the state of affairs, The expert also assured that although the Government does not need net debt, the current national administration It could extend the terms (with some debt exchange), which would give it more breathing space to face the maturities.

For its part, since Aurum Values agree on this forecast. When reviewing the country risk projections, if the “hard dollar” curve is adjusted to levels such as those of Egyptan optimistic scenario, with a return of 9%, the Global 2038 bond could rise up to 29% to June of next year, while the one that would increase the least would be Global 2029 (+20%). For its part, if it is adjusted to levels Pakistan, which would be a normal/good case, with values around 11%, the greatest advance would be that of Global 2041 (+23%) and the lowest Global 2029 (+17%).

From this report they also projected the percentage increases that could occur in each scenario: Thus they raised those of the optimist to 15% (from 5%)those of the good scenario to 60% (from 55%) and reduced those of the bad one to 20% (from 35%).

As to why the conditions under which local debt could be normalized improved, they explained: “It is due to the continuity of the improvement in the stock of deposits in dollars, a product of laundering that expands the loanable capacity of the financial system, which would allow the BCRA to continue its foreign currency purchasing streak, even though seasonally it is not the best time of year.

Dollar bonds: prospects for an optimistic scenario improve

image.png

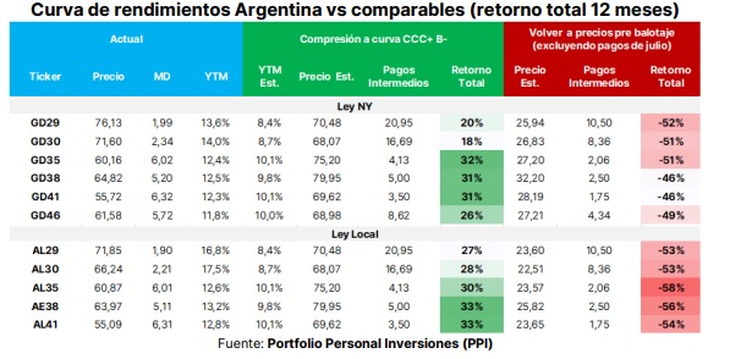

From PPI, For its part, reading is also similar. If the bonds compress the CCC+ or B- curvefor New York law, returns could rise up to 32% thanks to Global 203531% if it is the case of Global 2038, 31% if it is positioned in Global 2041 and 26% for Global 2046. Regarding Argentine law, Bonares 2038 and 2041 share a potential increase of 33%, while Bonar 2035 30%.

In one of his last “Markets Daily”highlighted the firm decline in country risk, reaching a minimum level in more than five years. It should be noted that “we are still about 100 basis points away from the 20Y median. Let us remember that the GD35 offers the most efficient mix of low price/upside potential/CY within New York law options, providing an expected total return of +32%, in the event of a risk compression scenario to CCC+/Bin a period of 12 months“.

Other reports circulating around the city, such as that of the consultant 1816they are going down the same path. From there, they continue to weigh the Globals, despite the “overwhelming rally of the last two months.”

“They are now worth much more than before for the simple fact that the risks of having them are much lower: There is a President who says to cut off his hands before having a fiscal deficit or defaulting on a payment, a citizenry that at least so far supports this economic direction, a money laundering that provided the dollars that were missing to transition to a 2025 transition, a Congress that does not limit the Executive (which manages to defend with a third of the Deputies the vetoes and almost all the DNU) and, As of January, a president in the United States with a lot of affinity with Milei“, they expressed.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.