The announced investments will allow exports of energy products to scale. On the one hand, a consortium of oil companies presented the project Vaca Muerta Southern Pipeline (VMOS)through which, according to the representatives of the firms, the country could displace Venezuela as the third oil leader in the region, behind Brazil and Mexico. This would be achieved since the development of this infrastructure would generate annual exports of US$21,000 million.

The authors of the work highlighted that the projects They can act “as a bridge towards a certain export leap” and thus help to “interrupt the long stagnation that goods exports have been experiencing, one of the determining factors of which has been the lack of investment in tradable activities.”

image.png

The RIGI neglects exports of differentiated goods

However, they maintained that “the weak flank of the RIGI is the absence of a broader strategy to promote investments in sectors and activities capable of competing internationally in products and services with a greater degree of differentiation“, since the scheme is oriented towards intensive activities in the exploitation of natural resources and commodity producers, with greater exposure than others to the fluctuations of international prices.

Indeed, Almost all the projects are divided between the energy sector and mining and only five cover industrial sectors: two to the automotive industry, one to the steel industry and two to the fertilizer sector, although, in the latter case, it is worth highlighting its high dependence on natural gas as a key input.

Although it is positive that investment and exports are growing, analysts warn of some problems in the fact that they are focused on a limited range of sectors.

Diego Fasánone of the economists who created the aforementioned report, explained in dialogue with Scope that “commodities are easier to export because, in general, they go to global markets and are homogeneous goods, so they do not need to be differentiated from products sold by other countries (that’s where our classification comes from).”

Instead, he noted, “Differentiated goods face greater competition, requiring more efforts in their marketing, brand positioning, design, quality, etc. “Any policy that will help improve these aspects is what we believe is correct.”. In many cases, they do not require large outlays of money, but are based on providing public goods and coordinating sectoral actors,” he explained.

The risk of primarization

In a similar vein, Federico Vaccarezzafrom the Economic Observatory of Argentine SMEs (IPA), warned that “if investment is going to be oriented towards food, oil and mining, it is likely that the export basket will be prioritized even more” and does not see a change in trend going forward, since “the Government is a faithful believer in the motto ‘the best Industrial policy is not having an industrial policy'”.

In that sense, he questioned the official idea that “having a relative abundance of natural resources will open new markets for us.” “If we do not commit to Brazilian-style industrial policy, but with steroids, Argentines are going to be poorer every day and it is going to be increasingly difficult for them to win markets.

For his part, the director of Fundar’s Productive Planning area, Daniel Schteingartexplained that the RIGI could help diversify the export basket given that, today, 55% of exports are agroindustrial and the projects are not as oriented towards that sector as they are towards energy and mining, although he clarified that “it is still a basket of three or four sectors” and asserted that “The Government’s economic policy does not generate incentives to develop exports that are not intensive in natural resources, which in the long run are those that correlate with greater future growth.“.

The potential of exports of differentiated goods in Argentina

The IIEP’s “Quarterly Report on Argentine Exports” (also written by Federico Bernini, Juan Carlos Hallak and Ricardo Carciofi) reflected that, despite the general stagnation of exports of differentiated goods in the last decade, The country demonstrated a certain degree of success in several products “where, a priori, it does not present obvious comparative advantages”.

The examples mentioned were those of the sales of agricultural machinery engines, steel cables, antisera and displays with refrigeration equipment.

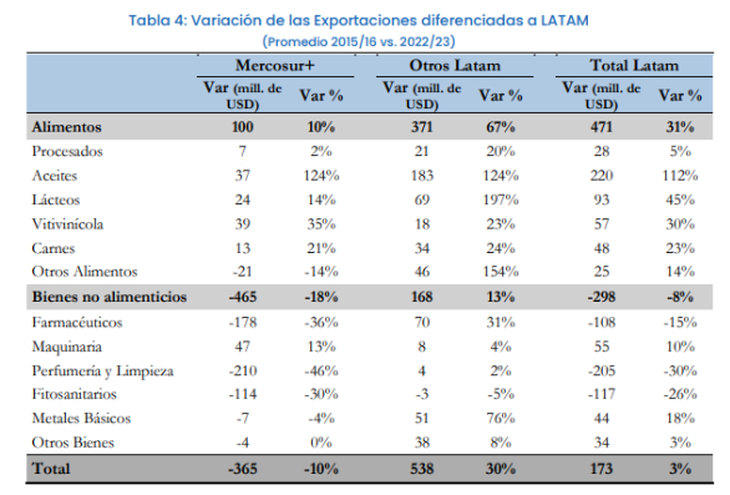

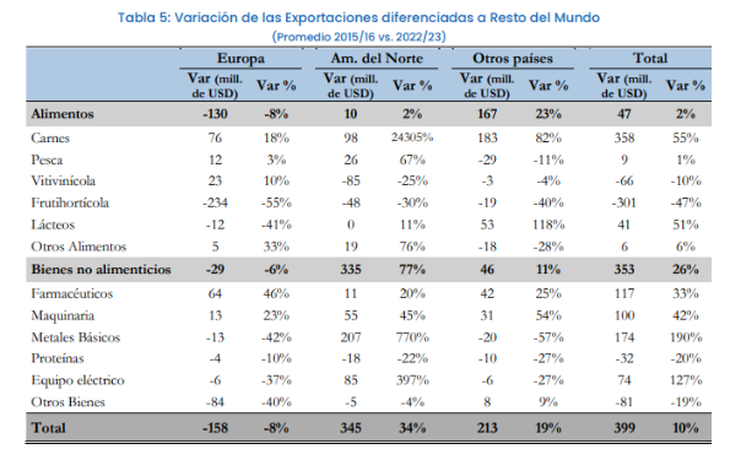

According to the sectoralization of exports carried out in the work, four items can be identified in which the average external shipments for the 2022/2023 period exceeded the average for 2015/2016.

The most notable was that of base metals (includes aluminum and steel), with an increase of US$218 million, driven by the North American market and by Latin American countries outside MERCOSUR.

Behind, they followed machinery and electrical equipment: In the first case, increases were verified towards all destinations, while, in the second case, the increase was driven from North America. Finally, with a much smaller balance, the pharmaceutical industrywhere the decline in exports to MERCOSUR was offset by higher sales to the rest of the world.

image.png

image.png

Will exports be able to offset the growth in imports?

In September and October, the trade surplus slowed down at the rate of greater dynamism in imports. The reduction of taxes and the growing trade openness, the appreciation of the exchange rate and a slight rebound in economic activity are the causes that economists highlight.

“Going forward, it is important to monitor that the exchange rate appreciation does not lead the economy to demand more imported products or, at least, it does not do so at a faster rate than exports can grow. Dead cow and mining will surely contribute positively in the coming years, in differentiated goods we do not yet see that they can reverse the stagnation of the last decade“Fasan projected.

Despite the country’s aforementioned difficulties in inserting products with high added value abroad, the IIEP highlighted the numbers that show the existence of “export growth opportunities in a wide variety of sectors and destinations”.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.