Financial entities will turn to the capital market in 2025 to obtain financing. They do this with the objective of being able to meet the high demand for mortgage loans in an economy with lower inflation.

The banks they evaluate in 2025 to issue Negotiable Obligations (ON) and actions in the capital market to have more loanable capacity in response to the demand of its clients for mortgage loans. “Next year there will be issues of bank bonds and even shares to be able to grow in capital and continue banking credit,” said Claudio Cesario, president of the Association of Banks of Argentina (ABA), which brings together private entities. .

The content you want to access is exclusive to subscribers.

Looking ahead to 2025, the president of ABA projected that “The trend is going to consolidate, something fundamental for the growth of the economy and beneficial for families and companies.”. In addition, banks will continue investing in technology, cybersecurity and promoting electronic payment methods.

“Next year there will be bank bond issues”. And he added that: “To be able to download, this requires two conditions, first important institutions such as insurance companies, and that the credits that are originated and downloaded have a rate such that it is the discount rate that when I receive what I download, it allows me keep lending”.

It is worth remembering that money laundering triggered demand for negotiable obligations. This investment, which is usually recommended for the most conservative profiles because it is a fixed income instrument, was and continues to be one of the alternatives enabled by the Ministry of Economy so that those who regularize more than US$100,000 avoid paying the rate. of 5%. On the other hand, with the strong demand, the ONs also adjusted yields that today are around 7% and 9%.

Strong growth in mortgage loans

Mortgage loans are the line of credit that is growing the most, according to data from the Central Bank. In October, they increased 16.9% at constant prices. This demand is driven by disinflation and the exchange rate calm of recent months.

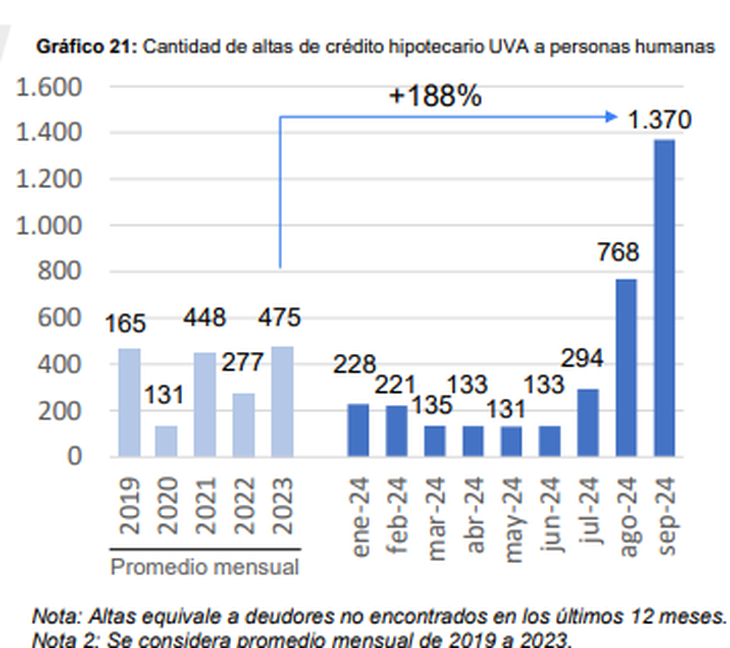

According to a report from ADEBA, banks granted 1,370 new UVA mortgage loans to individuals in September 2024. This figure represents an increase of 78% compared to the previous month and 188% compared to the monthly average for 2023.

Screenshot 2024-11-28 091154.png

According to a report from ADEBA, banks granted 1,370 new UVA mortgage loans to individuals in September 2024.

In the sector, they highlight that growth was possible thanks to the drop in inflation, the macroeconomic order that generated medium and long-term perspectives, a robust position of the banks where they stopped financing the Treasury and that legislative projects that aimed to to change the conditions of current mortgage loans.

This impulse, however, alerts the banking system with the Azzimonti Case that is going to reach the Supreme Court. The ruling in favor of Renzo Azzimonti, which includes the change of the inflation adjustment system to a negative real interest rate, generated deep discomfort among the main banking associations, which warned that these decisions modify the conditions of the UVA contract, generate legal uncertainty , and undermine confidence in the credit tool.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.