The loss of dollars due to trips abroad was added to the early transfer of foreign currency to New York to guarantee the payment of interest to bondholders and sent the current exchange account into red. Credit in foreign currency compensated for it.

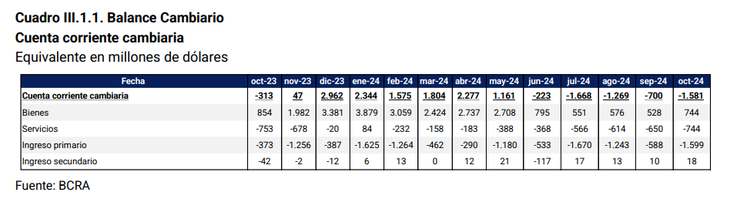

The policy of real exchange rate appreciation that the Government promotes as an anchor against inflation leaves an increasingly marked mark on the accounts of the Central Bank (BCRA). In October, the loss of foreign currency due to tourism and expenses abroad caused the deficit in the balance of services to jump US$744 millionthe highest level in twelve months. This factor, together with the anticipated turn of dollars to New York that Economía carried out to guarantee bondholders the January interest payment, promoted a sharp increase in the current exchange account red until the US$1,581 million.

The content you want to access is exclusive to subscribers.

“The current exchange account recorded a deficit of US$1,581 million, explained by net expenditures in the ‘Primary Income’ and ‘Services’ accounts for US$1,599 million and US$744 million, respectively, partially offset by the surpluses of the ‘Property’ and ‘Secondary Income’ accounts for US$744 million and US$18 million, respectively,” detailed the BCRA in its October Exchange Balance report, published this Friday.

This meant that the exchange surplus of goods was barely enough to cover the red in services during the past month. In this problem the scheme of the dollar blendsince 20% of the export settlement enters through the CCL market and, therefore, does not impact the official exchange balance.

image.png

Tourist deficit and dollar card

The BCRA explained that “Human Persons” recorded net expenses of US$562 million, mainly for travel expenses, tickets and other consumption made with cards abroad. Furthermore, the entity chaired by Santiago Bausili revealed that “around 50% of these card consumptions are subsequently paid directly by customers with their own funds in foreign currencywhich reduces the deficit impact of this consumption on the exchange market and international reserves.”

This is a relevant point, especially in view of the expected tourism boom to Brazil and other countries. This means that, even though the dollar card is by far the most expensive on the marketabout half of card payments come from BCRA reserves. Besides, The PAIS Tax expires in December and the Government is moving to validate a nominal reduction dollar card.

Credit in dollars, the BCRA’s emergency wheel

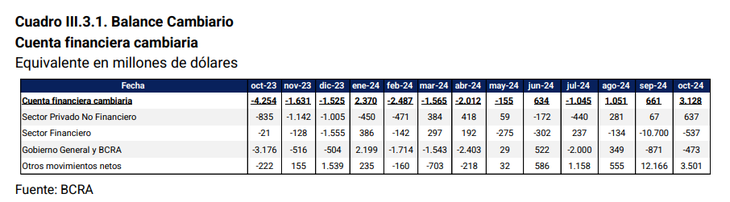

The very large foreign exchange current account deficit was covered by the financial side. The rescue wheel, which in fact allowed the BCRA to sustain an important foreign currency purchasing streak, was the credit boom in foreign currency. that flowed to companies (via banks and placements of negotiable obligations) supported by the dollars that entered the bleach.

“The exchange financial account resulted in a surplus of US$3,128 million. This result was mainly explained by the increase in private deposits recorded in the surplus of ‘Other Net Movements’ for US$3,501 million within the framework of the Asset Regularization Regime, followed by the surplus of the ‘Non-Financial Private Sector’ for US$637 million. For their part, the financial accounts of the ‘Financial Sector’ and the ‘National Government and BCRA’ were in deficit by US$537 million and US$473 million,” the monetary authority report stated.

image.png

Yet, Gross international reserves increased US$1,446 million in October and ended the month at US$28,618 million. “This increase was mainly explained by the increase in foreign currency holdings of the entities in the BCRA for US$1,913 million and by the settlements of net purchases of the BCRA in the exchange market for US$1,626 million” , indicated the Central.

And he added: “The aforementioned movements were partially offset by net expenditures for capital and interest payments on loans from international organizations (excluding the IMF), public securities and other financial debts of the National Treasury and BCRA for US$1,861 million. due to the fall in the price in US dollars of the assets that make up the reserves for US$111 million and due to the net payments made by the BCRA through the Local Currency Payment System (SML) for US$78 million.”

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.