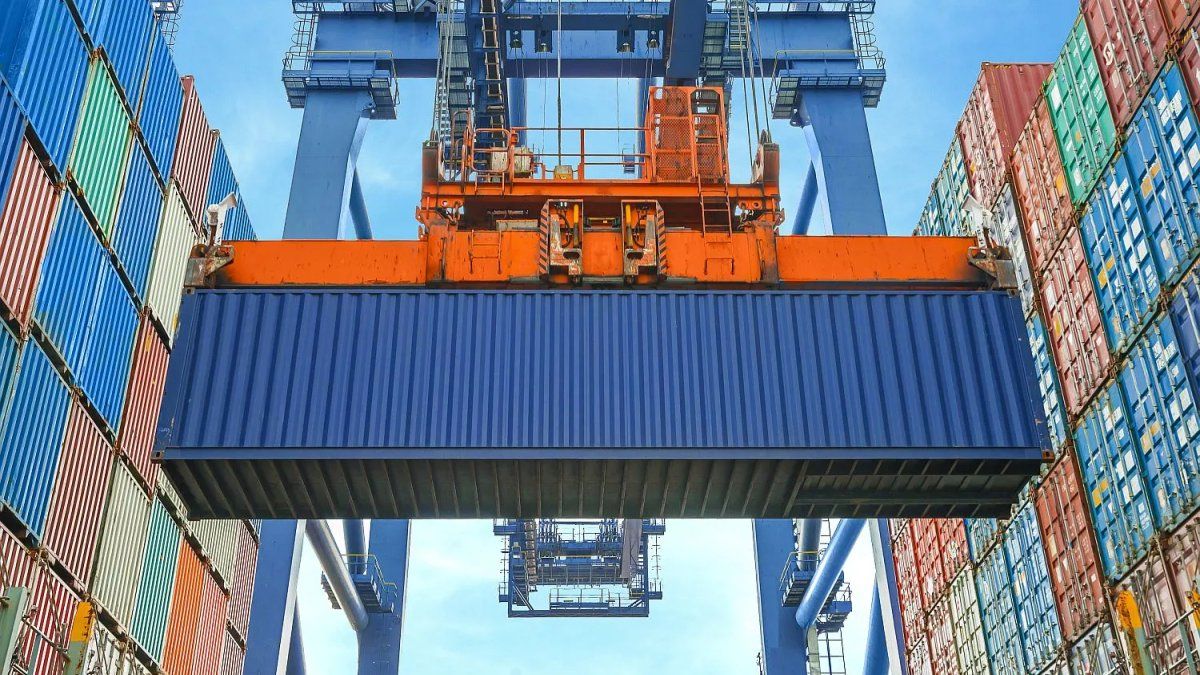

This is the statistical rate, set at 3%, on imported products for consumption, both for companies and individuals by courier.

The Government extended the payment of the statistics fee, set at 3%, until the end of 2027on products imported for consumption, which expired at the end of the current calendar, through Decree 1140/2024, published this Tuesday in the Official Gazette.

The content you want to access is exclusive to subscribers.

In this way, it was stipulated that the new expiration date is December 31, 2027, maintaining the charge that companies and individuals must face when importing. In the case of individuals, when they purchase products by courier on foreign platforms.

With this decision, importers will not benefit from another reduction in tax costs that weigh on the process, as happened recently with the elimination of the PAIS Tax and other deregulatory regulations that Javier Milei’s administration has been implementing.

Among the arguments for the extension, the Executive indicated that considering that “in the face of the current global economic context, the increase in international commercial operations and the streamlining and simplification of foreign trade, it is essential to maintain the statistical service provided on imports. definitive and continue with the application of the current regulations applicable to the statistical rate that remunerates said service”.

How much is the statistical rate

The statistical rate rate is 0% for the importation of certain capital goods intended for the hydrocarbon production coming from unconventional reservoirs, as well as for certain used production lines and products for the hydrocarbon industry.

In addition, “those destinations registered within the framework of Preferential Agreements signed by the Argentine Republic that specifically contemplate an exemption, for those destinations that include merchandise originating from the States Parties to the Southern Common Market (MERCOSUR), will also continue to be exempt from payment of the fee. )”.

The application of said rate may not exceed the maximum amounts indicated below:

When the tax base has a cost of less than US$10,000, the maximum is US$180.

Between US$10,000 and US$100,000, the limit is US$3,000.

Between US$00,000 and US$1,000,000, the maximum rises to US$30,000.

Greater than US$1,000,000, the maximum disbursement is US$150,000.

The extension of the validity of the statistical rate has been carried out periodically at each expiration, the last time was in 2020 during the government of Alberto Fernández when the term was extended until December 31, 2024.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.