Cavallo highlighted the government’s achievements in macroeconomic stabilization, although he warned about the risks derived from the appreciation of the peso against the dollar and its implications for economic competitiveness.

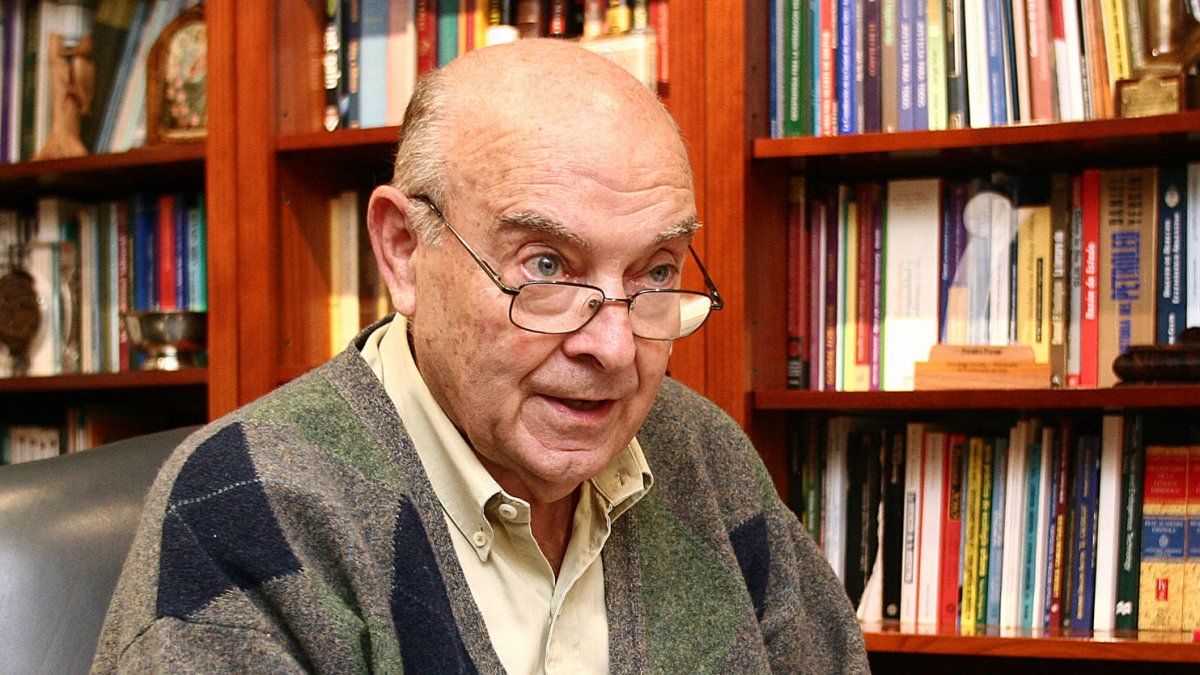

The former Minister of Economy Sunday Cavallo He carried out a detailed analysis on his blog about the economic situation in Argentina in the context of the reforms implemented by President Javier Milei.

The content you want to access is exclusive to subscribers.

In his evaluation, Cavallo highlighted the government’s achievements in macroeconomic stabilization, although he warned about the risks derived from the appreciation of the peso against the dollar and its implications for economic competitiveness..

Disinflation and exchange rate

Cavallo acknowledged that inflation in 2024 decreased more than expected, partly thanks to monetary control and the elimination of the fiscal deficit. However, he stressed that exchange rate policy, marked by the intervention of the Central Bank to manage multiple exchange rates, was a crucial factor. Although this strategy helped control prices, it also generated a real appreciation of the peso that negatively affects exporters, industrialists, and sectors that compete with imports.

Weight Appreciation: Effects and Concerns

The economist pointed out that the Argentine peso is at a level similar to the convertibility period, which poses important challenges:

- Increase in imports: The competitiveness of national products is compromised compared to imported goods.

- Export discouragement: Especially in key sectors such as agriculture and manufacturing.

- Impact on the balance of payments: Appreciation makes it difficult to accumulate international reserves necessary to cover external obligations.

Cavallo also highlighted the recent devaluation of the Brazilian real, which deepens the competitiveness gap between both countries. According to Cavallo data, Argentina is currently 19% more expensive than Brazil in dollars for a basket of similar products.

Historical comparisons: lessons from convertibility

The analysis includes references to the period 1991-2001, when exchange rate stability was accompanied by real appreciation. Cavallo recalled that during convertibility, the lack of structural adjustment measures, such as low withholdings and lower fiscal pressure, contributed to the economic collapse. In this sense, he warned that the current situation presents worrying parallels.

Economic recommendations

Cavallo proposed two possible strategies to address the effects of appreciation:

Elimination of the exchange rate

- Proposed as the most effective solution, Cavallo suggested unifying the exchange market and allowing currency competition within three months. This measure, although it would imply an exchange rate jump, could stabilize the exchange rate at competitive levels and attract capital.

Temporary palliative measures:

- Reduce withholdings on exports.

- Implement temporary reductions in employer contributions to reduce labor costs without affecting salaries.

The political factor and the electoral impact

The economist stressed that any economic measure must consider its political impact in an election year. Cavallo emphasized the importance of consolidating popular support for the reforms to ensure their continuity and long-term success.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.