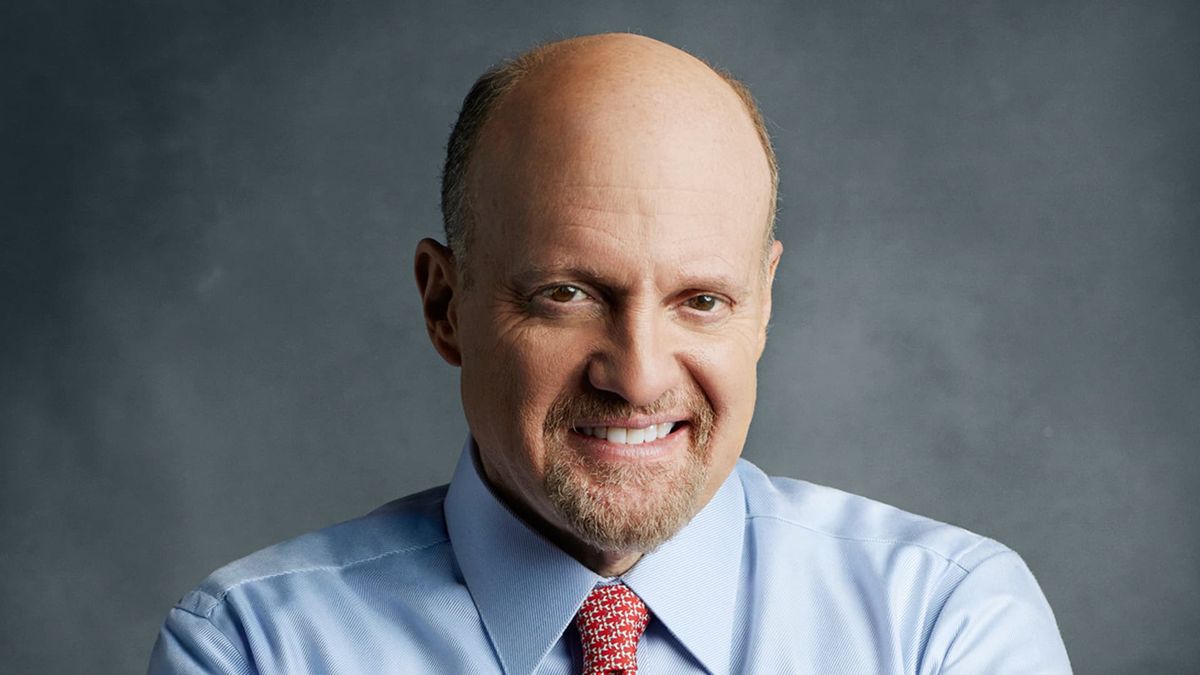

The presenter of “Mad Money” of CNBC announced that it will reinvest its profits from GameStop in quantum computing stocks, especially after Rigetti Computing will record an extraordinary trading volume of US$352 million shares compared to its US$280 million shares in circulation.

The quantum computing sector, including IonQ and D-Wave Quantum showed a strong recovery despite recent skepticism from industry giants.

What happened was that the CEO of NvidiaJensen Huang, who indicated that Practical applications of quantum computing could be 15-30 years away, with 20 years being the most likely timeframe.

In turn, the CEO of Meta Platforms, Mark Zuckerbergexpressed similar opinions about the current limitations of the technology.

Tips for investing in 2025

“You don’t have to be perfect at money management, you just have to be good enough, and that means you don’t have to waste time trying to anticipate every little swing in the market,” he said.

He then indicated that, in most cases, betting on a simple S&P 500 index fund will be more than enough to protect and increase capital in the long term.

“If you manage your portfolio well, do your homework and maintain discipline, I believe you can outperform the S&P 500 with a diversified group of individual stocks. But not everyone has the time, not everyone has the temperament, not everyone feels comfortable taking more risks to achieve higher returns. And that’s perfectly fine too. “You have to do what is best for yourself,” said the famous driver.

He later advised make progressive purchases instead of investing all the money at once. For example, you would have to make 100 trades of 500 shares and not 1 of 50,000. In this way, if financial assets go down, the average purchase price will be lower and the recovery will be faster.

“When you buy everything at once, you’re basically declaring that the stock is not going to go down any further. It’s crazy. Nobody has that kind of perception all the time. Buying gradually, in stages, is about recognizing that our judgment is fallible,” he said Cramer.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.