The indicator that elaborates the Electronic Stock Exchange of Uruguay increased more than 20% so far this year.

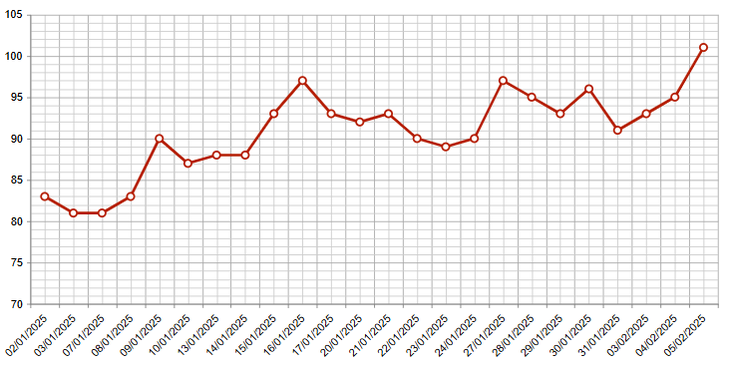

He country risk More than 20% increased so far this year and exceeded on Wednesday the 100 basic points (PB), something that did not happen almost five months ago, according to the values of the historical series of the Uruguay Risk Index (Iubevsa), that measures the debt yield spread compared to United States (us treasuries).

The content you want to access is exclusive to subscribers.

The indicator that elaborates the Uruguay Electronic Stock Exchange (Bevsa) arrived this Wednesday at 101 PB, product of an increase of 10.99% so far this month, which reaches 20.24% for 2025, moving away from the minimums it had touched in 2024.

Anyway, the current level of Iubevsa does not imply an alarm signal, since on September 16 of last year it reached the same level, while on August 2 he had reached 114 points, and then back back .

In parallel, the Uruguay Bond Index (UBI) what measures AFAP Republic, He registered the Sovereign Spread in 87 basic points, maintaining a relatively similar value to this year’s average.

Country risk

The importance of country risk

Already away from the shadow of Pit-cnt plebiscite about social security and far from the volatility that the dollar At the end of last year, the rise in the indicator can put pressure in the middle of the presidential transition, despite the fact that the country risk remains the lowest in the region.

However, factors such as recent crosses between the elected government of Yamandú Orsi and the outgoing of Luis Lacalle Pou, whose economic references criticism about the fiscal deficit and a possible tax rise in the management of the Broad Front (FA), added to the “competitive crisis” denouncing companies from different sectors, can configure alerts for investors.

The country risk works as the reflection of the perception of markets on the ability of a country to pay their debts and maintaining the indicator far from high levels is a lower cost of financing In international markets.

On the contrary, an increase could dismiss the arrival of investments and affect the credibility that cemented Uruguay In recent years, which led him to maintain the investor degree and achieve the greatest credit rating in his history.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.