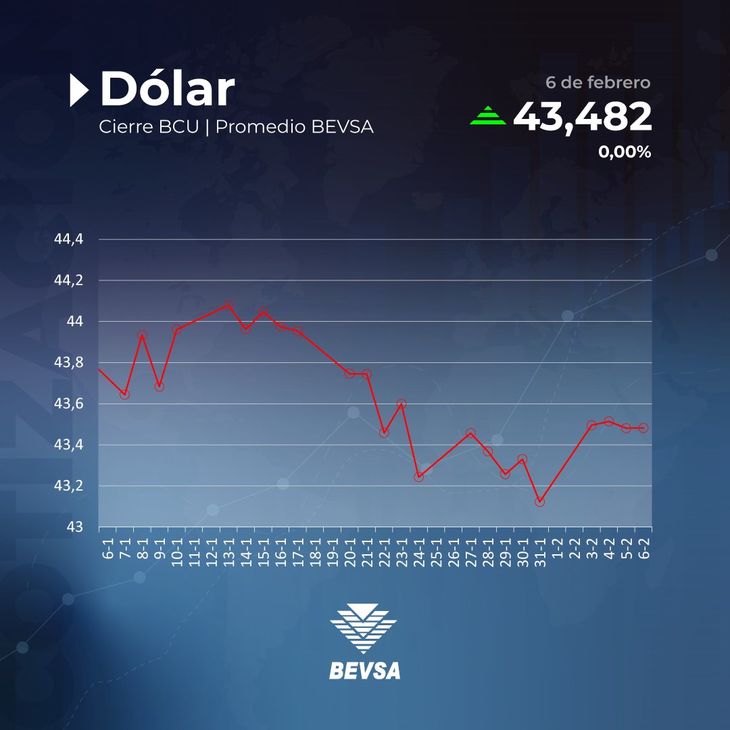

The American currency seems to consolidate in the middle zone of the $ 43 strip, after a positive month start.

He dollar It closed stable this Thursday and quoted at 43,482 pesos, just a penny above its value of the previous day, according to the data of the data of the Central Bank of Uruguay (BCU), within the framework of a week where the American currency seems to consolidate in the middle zone of the 43 pesos strip.

The content you want to access is exclusive to subscribers.

The green ticket thus operated in tune with the international stage, with a global dollarthat today evolved with a slight rise. Thus, it accumulates an appreciation of 0.83% at the start of the month, which contrasts with its evolution throughout the year, with a decrease of 1.33%, product of a negative January.

On the reference board of the Republic Bank (Brou)he dollar Retail ticket offered 42.25 pesos for purchase and 44.65 pesos for sale. For its part, the preferential value of the Ebrou dollar It was 42.75 pesos for the purchase and in 44.15 pesos for sale.

The closure price in the Uruguay Electronic Stock Exchange (Bevsa) It was 43,410 pesos, while the maximum price was 43,500 pesos, and the minimum of 43,410 pesos. A total of 43 transactions were made, with an amount of operations for more than 22 million dollars.

The crypto Tether (USDT), of parity 1 to 1 with the dollarhe quoted this afternoon on an average of 47.22 pesos for the purchase in line with a bank account or by card, and from the 44.99 pesos to 47.91 pesos in the peer-peer (P2P) market (P2P) of Binance .

Placabev.jpg

Is a rise in rates?

Beyond what happened recently with the United States Federal Reserve (Fed), that paused its reduction cycle of interest rates, the scenario in Uruguay It seems to be different from the meeting of the Monetary Policy Committee (Copom), which will take place next Thursday.

Is that, after 20 consecutive months within the target range, some indicators of the inflation They anticipate certain risks and even economic agents raised their expectations, some of them above the target range.

In this way, the BCU could define next week an increase in Monetary policy rate (TPM) of up to 50 basic points, which could have its influence on the value of the dollar, By making the Uruguayan weight.

The dollar in the last days

- January 30 – 43,330

- January 31 – 43,122

- February 3 – 43,495

- February 4 – 43,514

- February 5 – 43,481

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.