The government has been demanding that the International Monetary Fund consider the greater expenditures that the war in Ukraine implied and implies in the public accounts. This demand was also raised to the multilateral organization by other countries.

Sergio Massa, who is currently in India participating in the G20 meeting, is estimated to hold meetings on Saturday with both the Managing Director of the IMF, Kristalina Georgieva as with Gita Gopinath, deputy director general of the IMF, who on the occasion of Massa’s visit to Washington last year was able to participate in the technical talks.

Impact of the rise in international prices in US$ million:

Liliana 1.png

Fuels and Freight

The largest loss is recorded in the fuel category. Before the war, imports for this concept were estimated at US$1,999 million and it is calculated that they reached US$5,756 million, that is to say an extra expense of US$3,757 million.

The second item that had an impact on the trade balance was freight. The projected pre-war amounted to US$3,000 million, US$ 1,800 million less than the US$4.8 billion that, according to estimates, they were earmarked last year.

agricultural prices

These negative effects were counterbalanced to a lesser extent by increases in the prices of agricultural raw materials.

Before the war, the agro-export complex was expected to contribute US$30,181 million, which finally ended up being US$30,798 million, with a profit of US$617 million.

Energy

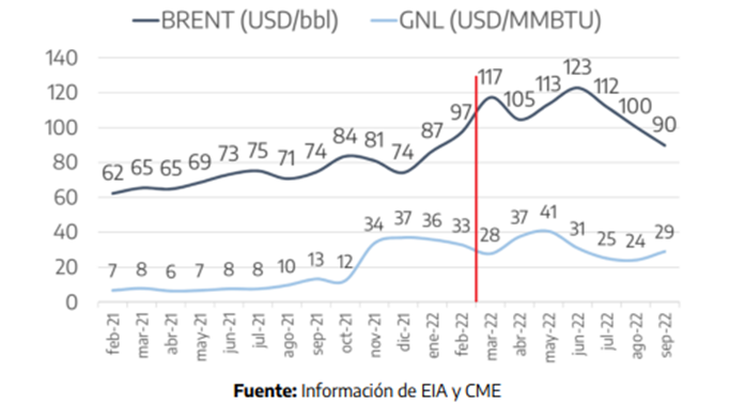

The armed confrontation caused high volatility and rises in energy prices. The price of BRENT oil went from 74 dollars per barrel in December 2021 to a peak of 123 dollars in June of 2022 -an increase of 66%-.

Worse was the case of gas since they appreciate increases of 233% for LNG, 114% for gas from Bolivia and of the alternative fuels imported by CAMMESA for electricity generation, these being 85% for Diesel and 63% for Fuel Oilmeasuring variation as the change between annual averages.

On the other hand, there is a 25% annual average reduction in the price of imported electricity.

Evolution of prices (spot) of Fuels:

Liliana 2.png

projections

To quantify the impact of this increase in energy prices, the official study carries out a simulation exercise of the value of imports during 2022, if the prices were the same as during the previous year.

If prices had remained at the monthly average for 2021, fuel imports would reach US$9,033 million. On the other hand, with the corresponding price increase for 2022, projections indicate that fuel imports reached US$13,279 million.

“The difference of US$4,246 million implies a significant negative effect on the Argentine trade balanceraising the dollar requirements to carry out these imports”.

The report indicates that, given the rigidity of these imports, the National Executive Power used a series of strategies to alleviate the consequences of the change in relative prices, among which are:

- Increase in local gas production.

- Renegotiation with YPFB of the Natural Gas contract from Bolivia.

- Import of electrical energy from Brazil at competitive prices with thermal generation.

- Displacement of scheduled shutdowns of nuclear power plants.

- Dynamic decision rule for alternating fuels to prioritize the cheapest in the face of peak requirements

subsidies

The fuel price shock generated an increase in energy subsidies transferred by the National State during 2022. According to the calculations made, it is expected that the transfers in concept of subsidies amount for this year to $1,799,286 million.

If the 2021 prices and the 2022 energy strategy are taken, that is, the amounts of each energy source are used according to the prices in force during that year, the subsidies to the CAMMESA company would have amounted to $898,117 million.. Within the subsidies to CAMMESA, 60% corresponds to residential demand.

In the gas market, the subsidies would have amounted to $290,425 million, $135,239 million for IEASA for the import of LNG and gas from Bolivia and $76,978 million under the Gas Plan.

After the rise in prices, an expenditure of $1,270,943 million is estimated in subsidies for the electricity market during 2022. This assumes that the war generated an increase in transfers to CAMMESA of $350,578.

The projection of gas subsidies for 2022 is $372.65 million, that is, a growth of $237,416 million with respect to the scenario with 2021 prices.

Thus, it is estimated that the increase in commodity prices due to the war will result in a growth in subsidies of $587,934 million.

Energy Subsidies – Alternative Scenarios:

Liliana 3.png

Agriculture and Fertilizers

After the war began, there was a general price shock that increased the sale values of grains until May of this year. Soybeans rose 9.4%, wheat: 33.7% and corn: 17.8%. However, in the following months there is a reversal in prices as a result of the measures taken by the countries to alleviate the effect of the war and a new rebound in August 2022.

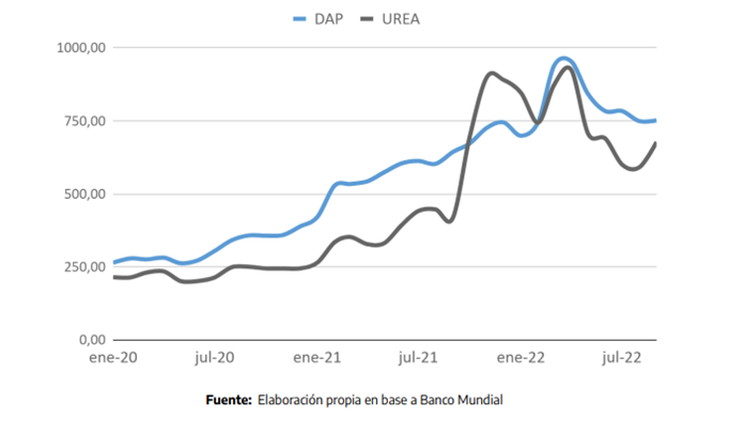

In addition, the sector was affected by the rise in the values of inputs. It is estimated that Argentina imports 70% of the fertilizers it uses for its agricultural production. Assuming an import for the year 2022 equal to that carried out for the period 2020-2021, and maintaining the prices in force during the first half of 2022, imports of fertilizers would amount to u$s4.4 billion during all of 2022. This figure represents an increase of 93% compared to imports in 2021, which amount to US$2,285 million (2021 was a record year in fertilizer consumption).

If the first 8 months of the year are taken into account, it is evident a 29% drop in imports of nitrogenous fertilizers (the most widely used) and a 15% drop in phosphate fertilizers, so the estimate of imports for 2022 could be lower, between US$3.080 million and US$3.784 million to consolidate this trend.

Evolution of the International Fertilizer Price:

Liliana 4.png

Freight

As a result of the pandemic and the Russian-Ukrainian war, the cost of maritime freight increased during the 2021-2022 period. The Rosario Stock Exchange estimates an increase in costs to export the harvest close to 62% compared to the 2020-2021 campaign, which represents an increase of US$1.8 billion.

Shipping Price Index (Europe to South America East Coast):

Liliana 5.png

Source: Ambito