Would you rather keep the money together or treat yourself to something despite the high prices? A survey shows that consumers are torn.

Life in Germany continues to get more expensive: According to preliminary information from the Federal Statistical Office, the inflation rate in April was 7.2 percent more than in April 2022. Compared to March, prices rose by 0.4 percent. Nevertheless, according to a survey, many Germans no longer feel like being frugal.

The price comparison platform, which asked around 2,000 people about their current consumer behavior for a savings report, calls this “inflation defiance”. According to this, 45 percent of those surveyed say that they sometimes treat themselves to things “that I actually find too expensive because I no longer feel like limiting myself”. A narrow majority of 52 percent, on the other hand, remains adamant and does not treat themselves to things that are perceived as too expensive. What is striking here is that the younger the respondents, the more likely they are to buy than to restrict themselves.

The market researchers at GfK had recently noticed an increase in the mood to buy. The consumer climate, which measures the mood among consumers, has recently risen for several months in a row. In a long-term comparison, however, the level is still low. According to GfK, private consumption will be weak overall this year.

The majority of respondents in the Idealo survey are worried about their finances. 75 percent have to pay more attention to how much money they spend. 61 percent worry that they can no longer get by with their money. And 57 percent have the feeling that they “can no longer afford their old life”.

When it comes to saving for old age, many people seem to have fatalistic thoughts. For example, every second person agrees with the statement: “Sometimes I think that I can never save enough anyway and therefore don’t even have to try.” Here too, according to the evaluation, younger people think more like this than the baby boomer generation.

You save on clothing and dining out

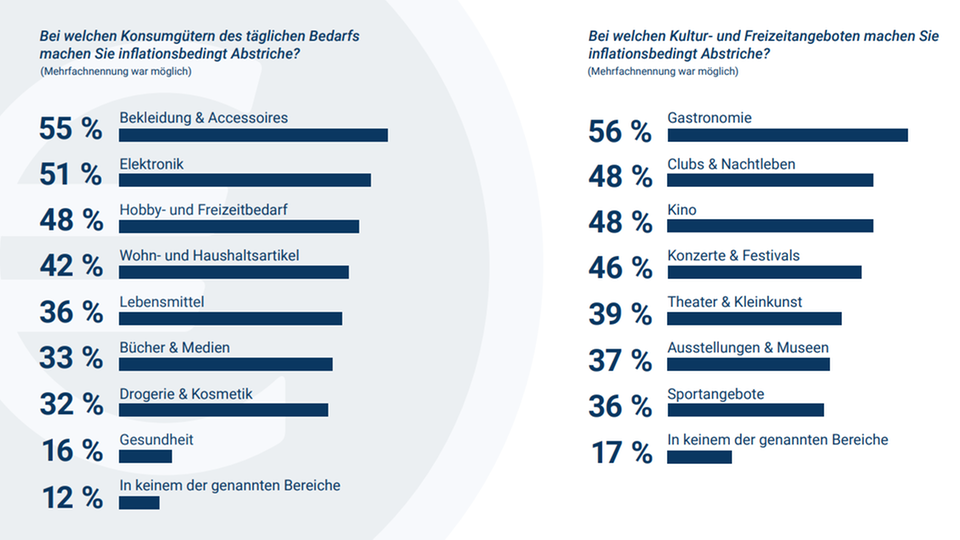

When asked which consumer goods people restrict themselves to due to inflation, there are clear tendencies. 55 percent make cutbacks when buying clothing and accessories, around half buy less electronics and hobby and leisure supplies. In the case of books and media as well as drugstores and cosmetics, on the other hand, only one in three wants to restrict themselves. It is 36 percent for groceries and 42 percent for home and household items. People make the fewest compromises when it comes to health products.

Many people are also cutting corners when it comes to cultural and leisure activities due to inflation. The biggest savings lever here is going to the restaurant: 56 percent of those surveyed currently spend less money on gastronomy. Almost every second person saves on spending on clubs and nightlife (48 percent), cinema (also 48 percent) and concerts and festivals (46 percent). The willingness to do without sports offers is lowest here (36 percent). The survey was conducted by the market research company Kantar and, according to Idealo, is representative of online shoppers between the ages of 18 and 64.

Source: Stern