Image: Bernd Wei§brod (German Press Agency GmbH)

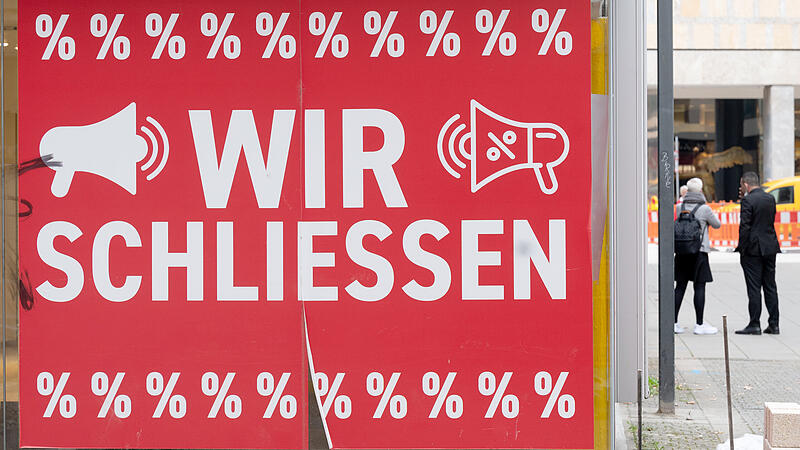

European companies have recently felt the economic pressure: high inflation, lack of energy and macroeconomic problems have led to a significant increase in corporate insolvencies. In Western Europe (EU-14, Great Britain, Switzerland and Norway) there were 139,973 insolvencies in 2022 – 24.12 percent more than in 2021. And in Eastern Europe the number of insolvencies rose by 53.5 percent to 60,010 cases, according to one investigation of Creditreform.

Companies struggled with massive price increases and significantly higher interest expenses as well as a weakening economy over the course of the year. “Many ailing companies could no longer withstand the multiple burdens,” said Patrik-Ludwig Hantzsch, head of Creditreform economic research, according to a broadcast.

However, there were significantly fewer corporate insolvencies in the previous two years. The situation in the previous year should therefore be seen as normalization and a necessary development, said Gerhard Weinhofer, Managing Director of Creditreform Austria. Accordingly, there were catch-up effects in the previous year, even if the insolvency figures had not yet reached the pre-Corona level.

These countries are at the top

The largest increase in insolvencies was recorded in Austria with 59.7 percent, Great Britain with 55.9 percent and France with an increase of 50 percent. In contrast, declines were reported in Denmark, Luxembourg, Portugal, Italy and Greece. However, these figures are not necessarily comparable, since insolvency law is not directly comparable, the creditor protection organization said. Especially in southern countries it is common to close companies without bankruptcy.

According to Creditreform, the fact that Austria is the frontrunner in the increase in insolvencies is also due to the Corona regulations and subsidies. The companies subsidized in this way would not have been able to overcome the supply chain problem and the energy crisis after the pandemic.

“Not reached the end of the road”

“The trend reversal in the insolvency figures has been heralded. The end of the road has probably not yet been reached. The pressure remains on the kettle, so that increasing numbers can also be expected in the coming months,” said Hantzsch.

Individual sectors were hit harder: trade and hospitality recorded an increase of 34.5 percent, followed by the construction industry with an increase in insolvencies of 24.7 percent. Insolvencies rose by a fifth in the service sector and by 13.1 percent in manufacturing.

On the other hand, companies in Western Europe are showing a slight economic recovery. While 26.7 percent of the companies still had a negative operating result (EBIT) in 2021, it was only 21.3 percent in the previous year. And almost a fifth of the companies achieved a margin of more than 25 percent. 47.2 percent of the companies had an equity ratio of more than 50 percent – the value improved by one percentage point.

more from economy