The Minister of Economy Sergio Massa announced a battery of measures, among which were some specific announcements for the countryside. One of them and the one that collected the most interest for the sector is linked to a new soybean dollar, in its fourth edition, which went unnoticed but represents an improvement for the soybean producers taking into account that, after the devaluation, the settlements were reluctant.

As disclosed by Ministry of Economythe novelty of Agro-export Increase Program (PIE, as the “soybean dollar” is commonly called) is that it guarantees a 25% availability of foreign currency to buy soybeans for processing. All this within the framework of a strong contraction in the reserves available to the Central Bank (BCRA).

David Miazzo, FADA Economist In his Twitter account, he indicated that this measure represents a dollar at $437.50 for agro-exporters, better than the $350 of the official market.

Starting from a FAS (theoretical soybean export price) of US$340, agro-exporters will be able to settle a 75% to the official dollar ($350) and 25% to the CCL dollar ($700). This gives a new “soybean dollar” of $437.50, an increase of 25% over the official dollar.

How does it affect the price of soybeans? “The purchasing power of exports would rise from the current $120,000 to $150,000 per ton of soybeans. Although the available market was at $130,000-$135,000,” Miazzo said.

“It would be a kind of new soybean dollar, but this time the increase, instead of generating it with the Central Bank paying more, is generated with the exporter liquidating the free dollar (counted with liqui). This would not generate a greater accumulation of foreign currency, because that 25% goes to the private market, the Central does not buy it Yes, it would help generate supply of dollars in the free marketwhich could help reduce the gap, I don’t know to what extent,” he added.

embed

My first impressions of the new soybean dollar announced by Massa

From a soybean FAS of USD 340

Exporters can liquidate:

-75% to the official TC ($350)

-25% to CCL ($700)

=Dollar soybeans $437.50+25% on official TC

—David Miazzo (@DavidMiazzo) August 27, 2023

The economist explained that the CCL dollar, at the close of Friday, if it was done with AL30 it gave $699, if it was done with GD30 $710: “With this I want to clarify that depending on the instrument with which the resulting exchange rate is made can improve a few pesos”.

Soy+Dollar.jpg

What happened after the devaluation?

The devaluation that was implemented last Monday caused the wholesale dollar to trade at $350. Since then, the grain exporters and regional economies Those who accessed this differentiated exchange rate (through the CAM 9 wheel of the MAE), began to operate through the official dollar as was traditionally done (CAM 1).

What finally happened is that there began to be a distortion between the price of the agro-corn dollar at $340 and the price of the official dollar ($350). But added to that, the incentive to liquidate decreased. According to a report from the Austral University last week, “the advantage of obtaining a “plus” for the grain disappeared and the intention to sell decreased.”

The “carrot” offered by the Government for the field to liquidate ended up not being a sufficient incentive, and many decided to retain grains to liquidate at a higher price. “The validated industry a significant counter-margin. But since future turbulence is not ruled out, and Milei’s platform points to eliminating the gap, lowering export duties and greater opening, not many reasons to sell”, he deepened.

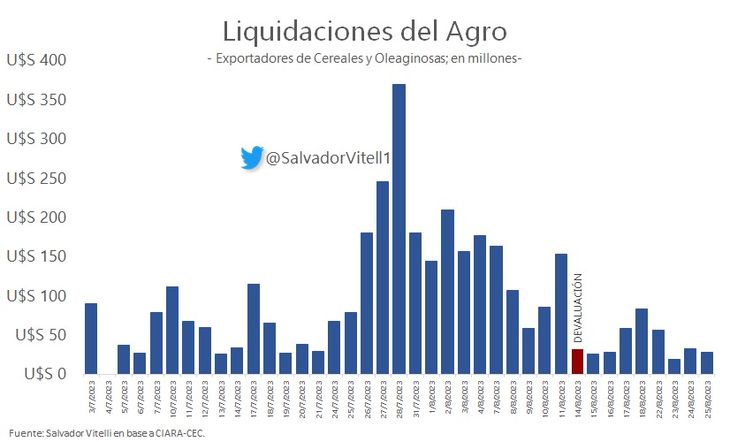

The numbers are compelling. According to the data provided by the economist Salvador Vitelli, In the 9 pre-devaluation rounds, agriculture liquidated US$1,254 million. After the devaluation and until Friday (also a total of 9 wheels), the only US$365 million. “In that period, there was a 71% drop,” the economist informed this medium.

WhatsApp Image 2023-08-28 at 10.45.19 AM.jpeg

On the other hand, presidential candidates like Javier Milei and Patricia Bullrich talking about the elimination of withholdings, also acts as an incentive to withhold. This was also explained by the report from the Austral University: “If this is so, it becomes a strong incentive to retain grainsand neither to sell from the new campaign, unless the values imply very good profitability ”, he analyzes.

New soybean dollar: what is the opinion of the field?

At the moment, some details of the fine print on the measure are missing, but it is estimated that through the purchase and sale of bonds, the agro-exporters grouped in CIARA-CEC (Chamber of the Oil Industry of the Argentine Republic and Center for Grain Exporters) would operate in the Cash with Liquidation segment.

CIARA-CEC spokespersons stated that they did not have further details of the measures. “From the Ministry of Economy it was anticipated that we will be summoned in the week for the purposes of know the form, deadlines and conditions of its implementation”, they indicated.

On the reaction of the producers, the specialist Roman Dante, of the Austral University considers that It would be interesting if the producer had a way to dollarize those pesos at the official exchange rate. “This can be done in the chacarero account, but there is already a lot of money there, and many are beginning to express fear. Others could reduce debt or buy inputs. Many have already done so, and others are going to run into the problem that suppliers continue with a lot of uncertainty due to the famous country tax of 7.5%, so there are no prices given ”, he estimates.

Similarly, for Romano what happens to political level with the october elections It is also a factor to consider: “If it is possible that being able to sell at $454, and repurchase in the area of $380 for November, or $340 for May, the intermediaries who think that the producers will not fix, make the decision for them to sell and repurchase. Once again the problem will be where to place the weights in such a complex electoral year”.

What is the impact?

Agro-exporters would thus have the possibility of improving the purchase price of soybeans by 25%, which would bring the value of the ton to $150,000. It is a way of encouraging a greater commercialization of soybeans, at least a part of the 9 million tons that remain in storage.

The particularity of this system is that a part of the currencies enter the Central Bank (what is operated with the official dollar) while another part does not (what is operated with CCL). However, those dollar bills that enter from the conversion of grains into money are expected to help maintain the price of free dollars.

Source: Ambito