Wholesale inflation slowed to 2.1% monthly in August, the lowest level since May 2020This decrease was mainly due to the Falling international prices in the agricultural and energy sectors, and at the current pace of adjustment of the official exchange rate (“crawling peg”) that the Central Bank (BCRA) has been defending since January.

This Tuesday, INDEC reported that the Domestic Wholesale Price Index (IPIM) recorded its most limited variation since the worst moment of the Covid-19 pandemic, when trade, both locally and globally, was paralyzed. In July, the benchmark had registered an increase of 3.1%.

Federico Furiasean economist member of Minister Luis Caputo’s team and director of the BCRA, said that the data responds to the “2% monthly crawl functioning as a nominal anchor, in the context of a fiscal surplus and strict control of the amount of money, while rates are corrected and real wages are recovered.”

He particularly highlighted the disinflation in primary products of local origin. agricultural products, Prices went from increasing 7% in July to 2.5% in August, while the slowdown in oil and gas It ranged from 3.3% to 1.8%.

Collapse of international prices and currency appreciation, the causes of the slowdown

The economist from the Ledesma and Outlier consultancy firm, Gabriel Caamanoexplained that most of the goods that make up the IPIM “take a photo” on the 15th of each month. In that sense, the collapse of international commodity prices had a great impact on the slowdown in the eighth month of the year; for example, Between July 15 and August 15, soybeans plummeted by more than 16%while oil fell by 4.7%.

For its part, Sebastian Menescaldidirector of EcoGo, said in dialogue with Scope that “the slowdown of the IPIM was not so significant” and attributed the data of the general index to the fact that ““The goods are rising at the rate of crawling”.

IPIM 1.PNG

On the other hand, the industrial manufacturing Domestic sales rose 2.2%, half a percentage point below the figure recorded in the previous month.

Likewise, the imported products They rose by just 0.2%. It is worth noting that in this segment prices jumped by an extraordinary 80% after the devaluation in December, but then calmed down, even showing deflation in March and May, as a result of a combination influenced by the exchange rate appreciation, the fall in commodities and lower domestic demand.

In the only relevant division where an acceleration of inflation was verified was in food and drinksas prices here rose by 3.4%, when in July they had risen by 2.5%.

Retail inflation had accelerated in August

Last week the INDEC had reported that The Consumer Price Index (CPI) rose by 4.2% in August, above the 4% in July and the 3.9% expected by most private sector analysts.

The acceleration was driven primarily by the increases in servicesmany of them regulated, such as those in electricity and gas rates, and public transport tickets in the Metropolitan Area of Buenos Aires (AMBA).

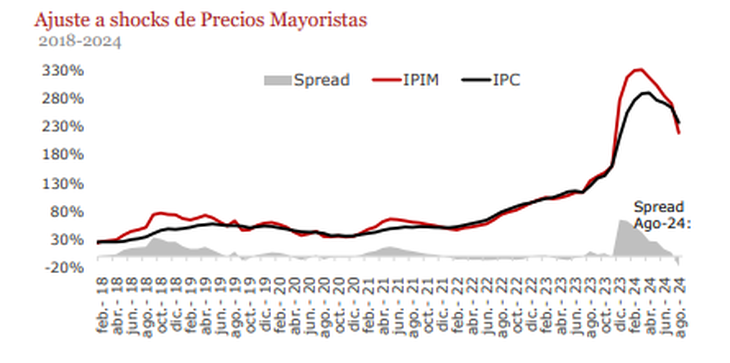

Caamaño clarified that “It is logical that the IPIM converges faster to the crawling peg“compared to the CPI, since the former takes into account almost all inputs traded abroad, while the latter includes “non-tradable” goods and services.

In the same sense, Menescaldi noted that The IPIM measures “only a small part of the goods and services that we consume on a regular basis”if one wants to see it in relation to retail inflation.”

IPIM 2.PNG

Source: ACM based on INDEC.

On a year-on-year basis, Wholesale inflation reached 218.4%, a figure lower than the 236.7% reported for the CPI“After eight consecutive months in which wholesale prices grew above retail prices on an interannual basis, this trend was broken during the month of August,” they stressed from the ACM consultancy.

“For four months now, Retail inflation stagnated around 4% monthly, encountering downward inflexibility due to increases in regulated prices, particularly in services. For its part, Wholesale inflation has been hovering around the crawling peg pace established by the Government,” the entity said.

Construction costs are also on the decline

This Tuesday, INDEC also announced that the Construction Cost Index rose 1.6% in Augustagainst 1.8% in July. The meager 0.7% adjustment in the workforce explained most of this decline.

“Regarding the official exchange rate, it is observed that costs experienced a reduction of close to 3.2% y/y. This is due to the exchange rate jump in December, which adjusts the index measured in pesos downwards compared to the levels recorded the previous year. On the other hand, Measured at the alternative exchange rate (CCL), construction costs increased by 48.5% YoY; although they registered a downward correction, they are still significantly above the average of the previous year,” they noted in ACM.

Source: Ambito