For a long time, we have been in the habit of buying dollars with any excess money we have, due to our economic history that has seen the continuous devaluation of the peso against the dollar. It always seemed that the dollar was safer than the peso; However, conditions have changed. If everything continues its current course, Buying dollars could become one of the worst decisions in terms of investment.

The reason why buying dollars is reassuring to us is because we believe that we avoid losing with the devaluation of the peso. However, we often don’t consider the potential gains we are passing up by not investing those dollars.

A clear example It was in 2024, where buying dollars in the parallel market only yielded less than 13%. Let’s contrast this with other investment options available in the same period. If at the beginning of the year you had pesos to invest, you could have chosen between several alternatives that far exceeded the performance of the blue dollar.

image.png

(Data from January 2024 to 11/8/2024. BTC is Bitcoin, ON: Negotiable Obligation)

It’s easy to say with Monday’s newspaper, but the intention here is to emphasize the importance of diversifying our investments. The key is to evaluate what level of risk we are willing to take and how long we can maintain our investments.

Additionally, it is important to remember that, in the capital market, most assets are liquid, which means that you can sell them and get your money back within 48 hours, or even the same day.

What to do with the dollars bleach

On November 8, the laundering process that managed to incorporate more than twenty billion dollars into the financial system concluded. Many people are undecided about what to do with those funds: Keep them at home or invest them? This is an opportune time to start investing, using the principles mentioned above.

For those who have never invested, I recommend starting small. A conservative option would be to form a portfolio with corporate bonds, which offer semiannual interest payments and amortization coupons, providing stable cash flow. These dollars can be withdrawn or reinvested.

Money laundering: tax and permanence implications

Those who laundered assets for less than 100 thousand dollars can be bought and sold without incurring additional taxes. However, those who exceeded this amount face certain restrictions, such as the impossibility of purchasing certain assets, such as Cedears.

Furthermore, to avoid a 5% tax, they must maintain their investments until December 31, 2025. But it must be taken into account that the profits generated are freely available.

How to build an investment portfolio

As you feel more comfortable and your risk profile allows it, you can add Argentine and international stocks (through CEDEARS) to your portfolio, and sovereign bonds that could benefit from a decrease in country risk.

For different risk profiles, annual returns in dollars can be forecast that range between 5% and 15 (they are not fixed returns).

What should be done with pesos and dollars?

Investment Strategies:

Short Term:

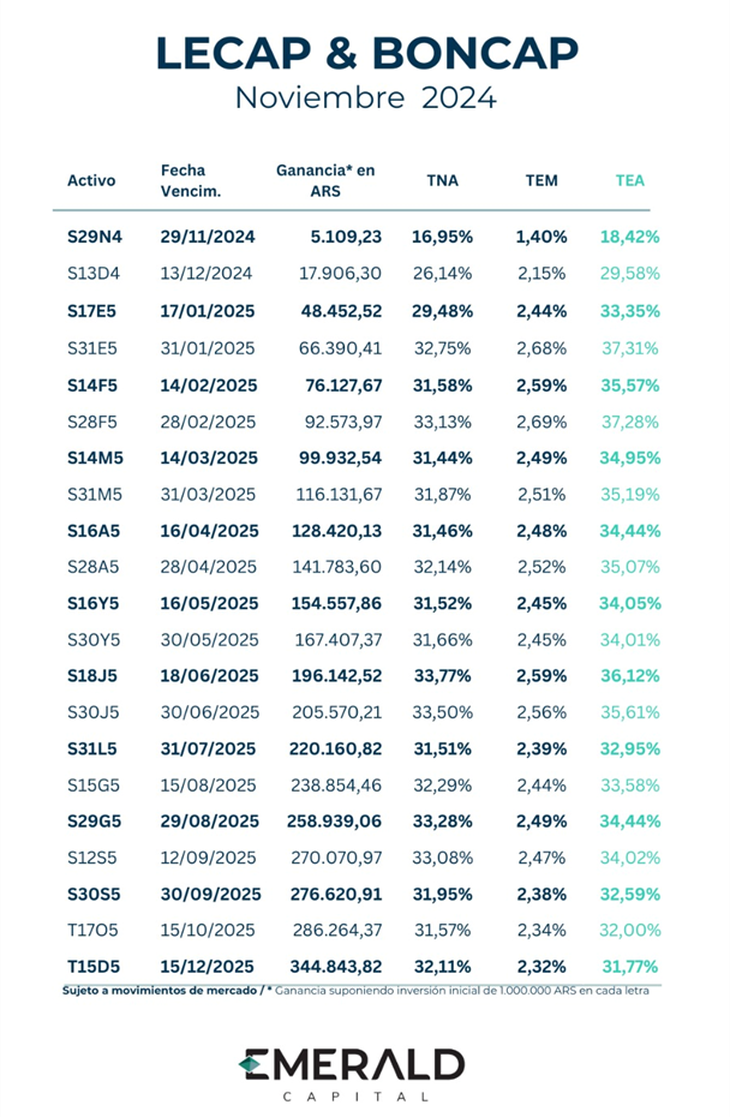

- 1. Capitalizable Bills and Bonds: Invest in compounding bills that offer a fixed rate return if left to maturity. Which can be: S31E5 (VTO 01/31/2025), S28A5 (VTO 04/28/2025) with yields of approximately 37% annually and T17O5 (BONCAP vto. 10/17/2025) with yields of 32%, ensuring a fixed rate in the long term.

- Inflation Adjusted Bonds: Consider bonds that are also adjusted for inflation, which helps maintain the purchasing power of the investment in the short term just like capitalizable bills. For example, some are: TX26 and TZX27, with inflation yields plus approximately 9%.

image.png

Medium and Long Term:

Expand your portfolio with a combination of:

- Argentine Actions: Invest in local companies that can benefit from economic stability. Some recommended ones are: YPF and Loma Negra.

- Negotiable Obligations: Buy bonds from companies with good credit ratings. Debt from the following companies seems appropriate to us: TELECOM 2031 and EDENOR 2030, yields 8.5% average USD.

- Sovereign Bonds: Consider bonds issued by the Government, adjusted by CER or in dollars. Some that we still see potential in:

- Cedars: Investments in shares of US companies through Argentine depositary certificates, such as: XLE (energy ETF), XLF (financial sector), GOOGL (Google) and GLOB (Globant).

Coverage Position:

One strategy comes from the sale of future dollars, guaranteed by instruments such as bonds adjusted by CER or dollar linked.

Not investing your dollars could cause them to lose value over time, especially considering the effect of compound interest. It is essential to start investing as soon as possible.

However, do not get carried away by promises of high returns if you are more conservative, as this could lead to significant losses. It is essential diversifyoperate through your own accounts in brokers and avoid investments that promise unrealistic returns, and that assure you a fixed rate per month because that is surely not the capital market.

Economist. @elena.financiera @emerald.cap

Source: Ambito