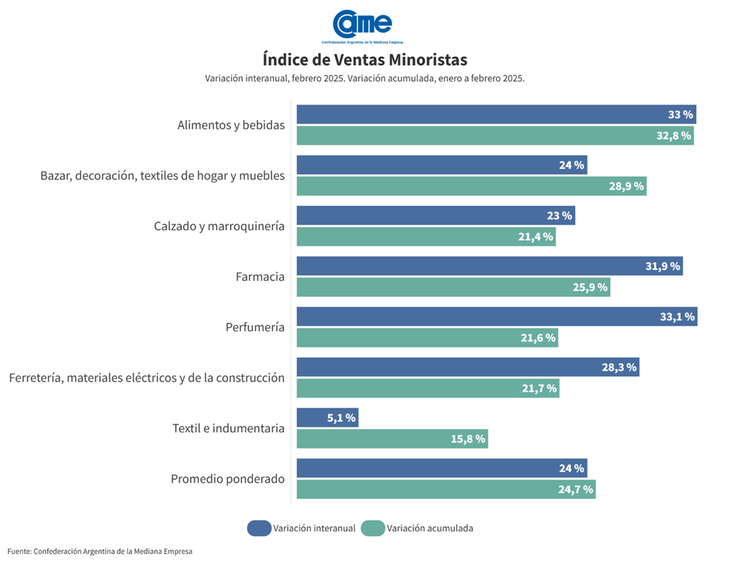

In February, the seven surveyed items registered year -on -year increases in their sales. The greatest increase was detected in perfumery (+33.1%), followed by food and drinks (+33%) and pharmacy (+31.9%). In the accumulated bimester, it leads food and drinks with an increase of +32.8%. It is worth remembering that the annual comparison takes into account the worst time of the activity, after the devaluation of 2023.

In the intermennsual comparison, all the branches presented negative variations, being footwear and leather goods that had the largest decrease (-5.4%) escorted by hardware store, electrical and construction materials (-4.3%).

UNNemed (5) .png

In February, the seven surveyed items registered year -on -year increases in their sales.

SME Sales: The analysis category by item

Sales rose 33% in the year -on -year comparison -in constant prices -accumulating a 32.8% increase in the first two -month period of the year. However, in the endless comparison, a 2.1%drop was recorded.

This interannual recovery of the sector contrasts with the pronounced decreases in February 2024, when minimum values of -33.3% and an accumulated of -35.2% were reached.

- Bazaar, decoration, home textiles and furniture

Sales increased 24% year -on -year -always at constant prices -adding an increase of 28.9%. In the unstacted intermennsual contrast, a 1.3%decrease was observed. This performance responds, in part, to the base of comparison with February 2024, when sales had contracted 22.7% and the first bimester accumulated a retraction of 21.9%.

Banking promotions and quota financing were valuable methods to sustain the activity, although several merchants expressed concern about the reduction of installment options and their possible impact on future sales.

Sales grew 23% year -on -year, accumulating an increase of 21.4%. Although, in the Intermenual a drop of 5.4%was measured, the most pronounced within the month. In this field, the comparison base is February 2024, when sales had retreated 21.4%, with a negative accumulated of 21.1%.

The sector showed a strong impulse in the operations due to the start of the school year, with a greater demand for products such as collegial footwear, backpacks and cartridges. In several places, bank promotions and discounts in installments without interest were important to boost activity in a context where purchasing power remains a concern. In turn, from some premises they pointed out that competition with informal trade and purchases in neighboring countries affected sales in border areas.

Sales improved 31.9% year -on -year and carry a 25.9% rise in the first two -month period of 2025. Meanwhile, in the intermennsual comparison – always unstacted – a decline of 2.3% was recorded. This is product, in part, of the comparison base with February 2024, when sales had collapsed 39% and accumulated a 42.4% retraction. Despite the recovery observed, pharmacies have not yet managed to completely compensate the losses suffered in the first two -month period of last year.

Sales rose 33.1% year -on -year, and add an increase of 21.6% in the first bimester. But, in the intermennsual comparison, there was a decline of -1.9%. Although the item shows positive values, the comparison base remains low, since in February last year a -40.9% collapsed and accumulated a retraction of -36.7% in the first two months of 2024. Although the perfumeries could reverse part of the fall of last year, there is still room for a stronger compensation in the coming months.

- Hardware store, electrical materials and construction materials

Sales had a 28.3% rise and thus reached a growth of 21.7% in the bimester. On the other hand, in the intermensual contrast they dropped 4.3%. In this area, the comparison base is a February 2024 with a fall of -28.2% and an accumulated of 29.8%. This indicates that, despite positive values in interannual and accumulated terms, there is still recovery margin.

Sales prospered 5.1% year -on -year -in constant prices -accumulating a 15.8% growth. In any case, in the intermennsual comparison desestationalized, a decrease of -3%was observed. Unlike other sectors, this maintains a stable evolution, both in 2024 and so far this year. In interannual terms, the comparison base is a February 2024 that had increased 3.5% and accumulated a 2.2% increase in the first two -month period.

The clothing bouquet showed a good performance in February, with a segmented market between school purchases and seasonal settlements. While some places took advantage of the start of classes to increase the exit of uniforms and school shoes, others indicated that the demand remained weak product of seasonality and less consumers circulating.

UNNemed (6) .png

In the annual comparison an improvement is recorded

SMEs: challenges and opportunities for the sector

Retail trade faces a series of challenges that directly impact their stability and growth. One of the main problems lies in the Lack of sales, mentioned by 50.7% of SME entrepreneurs as the greatest difficulty today. This is added the high production and logistics costs, which affect almost 30% of respondents, generating pressure on profitability margins. Although to a lesser extent, access to credit also represents an obstacle to 8.6%, making it difficult to support operations or make investments. In this context, from some businesses they expressed Collection problems, although with a smaller impact.

Source: Ambito