The opening of exchange controls, or more precisely the date on which the Government will decide to carry it out, is the topic that obsesses the market. The signals from the economic team seem to convince more and more City representatives that “there will be a clampdown for a while”. In the last few hours, the discussion focused on One of the graphs shown by the vice president of the Central Bank, Vladimir Werningin a presentation to US investors. The figure was read by several analysts as a implicit message about the continuity of exchange restrictions throughout the current mandate of Javier Milei.

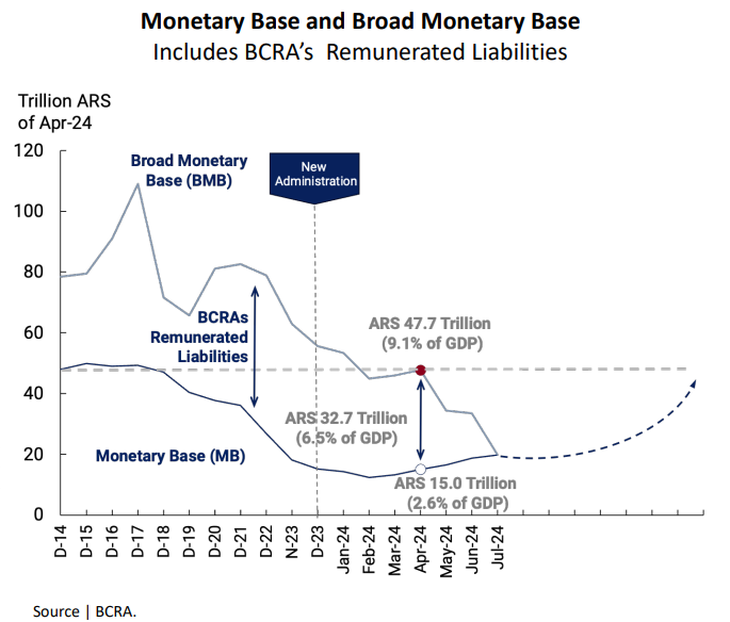

The truth is that the President was adding new ones month after month. requirements prior to the lifting of the restrictions. One of the last was that the traditional monetary base (money in circulation plus current account deposits that banks have at the BCRA) is equal to the broad monetary base (in the current scheme, the monetary base plus the stock of LEFI held by banks and the Government’s deposits in the Central Bank), at the maximum level established by the entity chaired by Santiago Bausili de $47.7 billion.

It is clear that for this to happen, a considerable amount of time will pass. For example, banks will have to dismantle the $9.3 trillion they currently have placed in LEFI (the Treasury bills that replaced the repos and that the BCRA manages to manage the liquidity of the system). In an optimistic scenario, this could happen to supply the credit supply to the private sector in the context of a recovering economy. Although it could also happen in the event of a run on deposits. Beyond the latter, the big question is how long does the Government expect to demand this process of eliminating the surplus of pesos?

Werning showed in his presentation before the US Business Council last Friday a graphic which had already been included in the report on the new Monetary Framework of the BCRA last month. It is a figure (the one seen below) that shows the evolution of the monetary base projected by the entity. With one caveat: The version that Werning exhibited illustrates that the convergence of the base to the target level of $47.7 billion would occur only in December 2027.; the original version placed it in December 2026.

image.png

One of the economists who read a message there about the continuation of the restrictions until the end of Milei’s term was Juan Manuel Telechea. “There is restrictions until the end of 2027,” he posted on his X account.

Roberto Cachanosky also echoed this, reviewing the different conditions that the Government imposed to lift the exchange controls and pointing out that “they are now changing the date of convergence of the broad monetary base with the traditional one.” “They extended it for another year. They fell in love with the exchange controls,” he said.

Surprisingly, in the face of the commotion generated, the BCRA modified the PDF file of Werning’s presentation on its website and included a different version of the same graphthis time without temporal references beyond July 2024 (see the modified figure below).

image.png

However, in his presentation, the official said that phase 1 of the economic program consisted of the implementation of an “immediate fiscal exit strategy” (the strong adjustment of the first semester), that phase 2 (the one we are currently going through) involves the “establishment of an orthodox monetary framework” and that The upcoming phase 3 will be the “transition towards currency competition and the prudent lifting of exchange controls.”

The message coincides with the statements of Caputo and Javier Milei aimed at trying Contain market anxieties regarding the opening of the cepoThe Government believes that the conditions are not yet met and that it will only do so when there are no risks of exchange rate shocks. The Minister of Economy assures that they aim to remove exchange rate restrictions without a devaluation jump, since the unification of the exchange rate will occur through a downward convergence of the parallel dollars, something that the vast majority of economists do not trust (even more so in a context of negative net reserves).

Yet, The vice president of the Central Bank stressed that the monetary authority will seek to relax exchange controls “prudently” as “the exchange rate gap decreases”. In this regard, he listed other preconditions set by the economic team: he stated that the closing of “all the money supply taps” was achieved; that the shorter installments for the payment of imports and the extension of the export blend dollar “are reducing the debt of importers”; that “the monetary markets must be normalized” before relaxing the restrictions through “a significant revaluation of the peso and real interest rates without triggering systemic risk”; and normalizing the goods markets.

Beyond the restrictions, the BCRA sees a recovery in activity

Werning’s presentation was entitled “The Argentine stabilization program: moving from controlled demolition to economic reconstruction.” There, he listed the measures implemented so far and outlined the guidelines of the economic team for the next phases of the economic plan that aims to lead to the aforementioned currency competition.

In presenting his report, The official stated that according to the BCRA’s leading indicator “the economy has turned around” and showed a high-frequency data dashboard for July that, he considered, “show very clear signs of improvement.” The statement is supported by some sector variables but does not take into account some indicators that show a continuation of the deterioration: according to Scentia, mass consumption fell 16.1% year-on-year last month and, as anticipated by Ámbito, so far in August supermarket sales have fallen 22.6%. “The economy has overcome the crisis,” he said.

The Werning dashboard estimates, for July, monthly increases without seasonality in VAT collection (2.8%), imported quantities (12.8%), personal and secured loans (30.4%), electricity demand from the commercial sector (7.4%), car sales for the domestic market (36.5%), motorcycle registrations (10.8%), industrial production of FIEL (0.6%), cement shipments (6.4%) and oil and gas production (2.3% and 2.2%), among others.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.