Image: OON

It is particularly striking that the banks are not passing on the interest rates on savings, which have meanwhile risen sharply, to savers. With lending rates, on the other hand, they went up quickly. However, there was also praise for the quality of the on-site consultations.

AK was mystery shopping

The “mystery shopping” that AK carried out at 19 banks on savings accounts and the quality of advice brought “overall satisfactory” results. But the websites of the financial institutions need “better service and a better range of savings products,” especially since the number of branches, as well as opening times and thus personal customer service, have been drastically reduced in recent years.

At the same time, online banking crime with fake banking websites is becoming increasingly professional. “Bankomat abuse used to be weekly, now there are waves of phishing,” reported AK finance expert Christian Prantner on Tuesday at a press conference, referring to the example of BAWAG PSK at the end of January. In the case of online banking fraud, the banks actually declined liability, pointing to “gross negligence” on the part of the customer. The customer is to blame. “This problem should be addressed at European level, possibly in Payment Services Directive 3 (PSD3, Note)”, says Prantner.

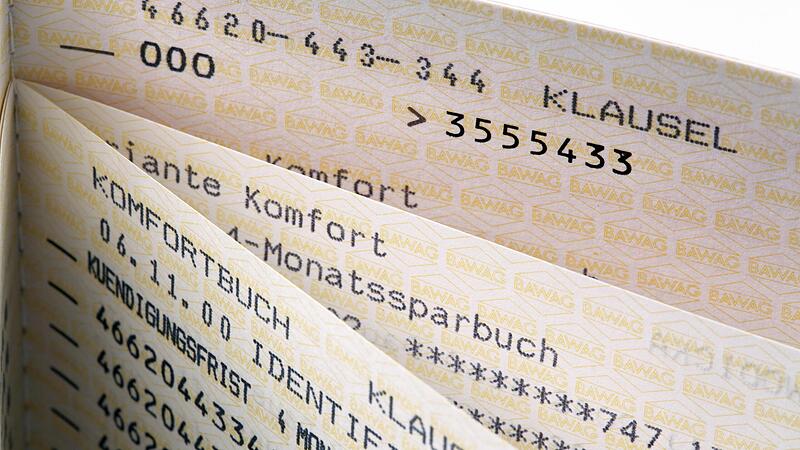

Savings books neglected

Savings books are being neglected to a large extent, despite interest rates being higher again. “It has become complicated when consumers want to open a savings account,” said Gabriele Zgubic, head of the consumer policy department at AK Vienna. There is a whole range of conditions.

At six of the 19 institutions surveyed, a savings account is only available to existing customers. New customers are at a disadvantage. According to the information, this applies to bank99, Erste Bank, Oberbank, Raiffeisenlandesbank NÖ, UniCredit Bank Austria and Volksbank Wien. In many cases one is forced to open a checking account in order to be able to open a savings account. It also happens again and again that no savings book, but only a savings account can be opened.

The still “puny interest rates on savings” also met with severe criticism. “We are demanding from the banks “up with interest rates, away from mini-interest rates,” Prantner clarified.

The savings book is also not a discontinued model, emphasizes the AK. This form of investment “is and will remain the basis for secure savings”. Consumer advocates are demanding that this safe and popular way of putting money aside should not be further restricted. For savers, safety comes before income.

According to the AK, maintaining a minimum analogue infrastructure is also an important point. Older bank customers in particular need personal support. “The fully digitized bank is not in everyone’s interest,” said the AK. In the future, too, there must be equal freedom of choice between analogue and digital means in order to carry out banking transactions securely and cost-effectively.

There are also problems with inventory accounts. “The biggest complaints are when banks terminate current accounts – in the course of campaigns in which an entire product group is to be discontinued. However, the most common thing is that banks cannot be reached – either by telephone or e-mail,” said the AK -lawyer.

The banks fared rather badly when it came to information about the possible development of lending rates. “The sharply rising interest rates on loans are causing many borrowers difficulties,” reports the AK from the consulting practice. This is also due to the fact that banks, especially in the case of mortgage loans, “calculated very low, attractive variable interest rates for their customers – but did not point out possible interest rate increases,” is the accusation.

The consumer advocates demand that in future different interest rate scenarios, i.e. the development of the repayment rate in the best and worst case, be presented. The AK wants better information about interest and expenses on websites, especially for consumer and home loans.

Source: Nachrichten