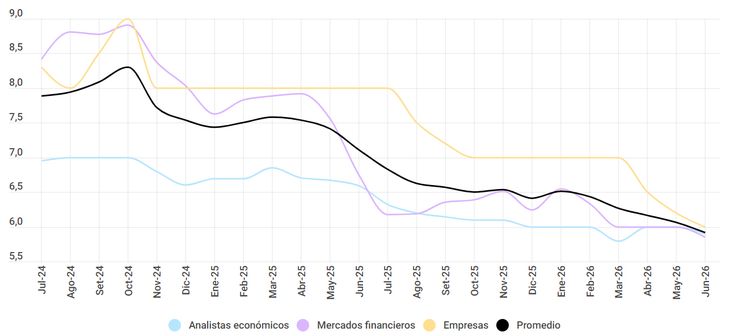

The projections showed a general decline among economic agents, the financial system and companies.

The market reduced its inflation expectations by June 2026 to a new low after projections related to price increases fell across the board among economic agents, the financial system and Uruguayan companies.

The content you want to access is exclusive for subscribers.

The latest report from “Evolution and expectations of prices in Uruguay” Posted by the Central Bank of Uruguay (BCU) reveals that financial markets’ inflation expectations for two years (June 2026) fell by 0.15% to 5.85%, which places them within the state agency’s target range of 3% to 6%, and which represents a new low for the series.

In turn, economic agents made a 0.10% cut to their forecasts in relation to the previous monthly record, which was already a minimum in the series, bringing the two-year projections to 5.90%.

Businessmen, for their part, remain the most skeptical, as the inflation projection within national companies is 6% for the said period, despite also achieving a new series low after another 0.20% cut.

BCU.jpg

Main factors affecting inflation in July

In July, year-on-year inflation climbed 0.49% to 5.45%, managing to remain within the target range for fourteen consecutive months, and 0.66% below the same month in 2023.

The main factors influencing the monthly increase include the rise in the price of vehicles and chauffeur-driven transport services. On the other hand, there was a decrease in the prices of food and non-alcoholic beverages (particularly meat), as well as fruit and vegetables.

The BCU itself maintains its projected inflation at 4.5% for the end of the year. Monetary Policy Horizon (HPM), which is updated quarterly in each Monetary Policy Report.

Source: Ambito