Driven by the Income Tax and VAT, the Federal Co-participation rose 1% real year-on-year in December and It closed 2024 with a drop of 10%. During the last month of the year, the Government national sent a total of $4,245,000 to the consolidated provinces plus CABA, compared to $1,928,000 million transferred during the same period of the previous year, observing a nominal variation of 120%.

The data comes from the monthly report prepared by the Argentine Institute of Fiscal Analysis (IARAF) and indicate that automatic transfers through co-participation, complementary laws and compensation reached $42,133,000 million, compared to $14,356,000 million the previous year.

Federal Co-participation fell 10% in 2024

In this way, they exhibited a nominal variation of 194%, which would translate into a real fall of 10% when discounting the inflation of the period.

At the same time, the IARAF announced that, taking a perspective of the last 9 years, The amount of total real automatic transfers for the year, if the assumed inflation of 2.8% monthly in December is confirmed, would be in eighth place (ordered from highest to lowest).

Regarding the increase in net participation in December, they explained that it occurred “mainly due to the very good performance of income tax collection (+13% real year-on-year) and an increase in VAT collection (+2.6% real year-on-year).”

1.jpg

“As a whole, the collection of VAT and IIGG would have registered a real interannual increase of 6.5%. In the accumulated annual period, the sum of these taxes would register a negative real interannual variation of 9%,” they stated in the report.

At the same time, the disaggregation shows that, when considering the individual evolution in the jurisdictions of shipments by automatic transfers, in all cases the real variation was positive, with the exception of the province of Buenos Aires. Santa Cruz (+8%) was the jurisdiction with the greatest increase and Buenos Aires (-6.5%), the only one with a real interannual decrease.

For its part, Politikón Chaco revealed that Jujuy, Entre Ríos, Río Negro, Corrientes, Chubut, Tucumán, Salta, Misiones, Santa Fe and Neuquén captured between $100,000 and $149,000 per inhabitant. while Córdoba, Mendoza, the province of Buenos Aires and the Autonomous City of Buenos Aires received less than $100,000 per inhabitant. The national average is around $92,512 per inhabitant.

1.jpg

Data from Politikon Chaco.

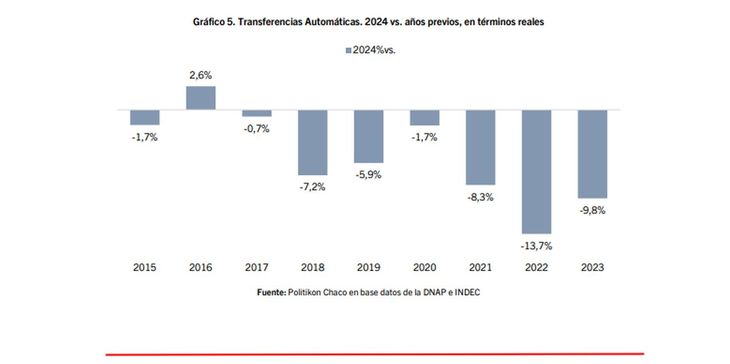

The consulting firm highlighted that, if the result of 2024 is analyzed compared to the last decade, it was the second worst year for automatic shipments. “Not only was it 9.8% below 2023, but it also fell against every year since 2015 with the sole exception of 2016 (compared to that year, 2024 shipments grow 2.6%)”, they noted in the report.

On this point, indicated that the accumulated fall for the year produced resource losses for the consolidated 24 subnational jurisdictions for $4.2 billion, The province of Buenos Aires concentrating a quarter of the total loss.

The fight for funds between the Nation and the provinces

The data is known in the midst of a struggle between the governors and the Nation for the withdrawal of funds, within the framework of the Motosierra plan that Javier Milei implemented after his arrival to power, on December 10, 2023.

That dispute marked a good part of the political pulse of the year and moved to various scenarios, such as the Congress. Over there, the return of the fourth category of Income Tax, which had been eliminated by Alberto Fernandez at the request of Sergio Massabrought some relief to the provincial coffers, after the Government refused to share in the Country Tax, a request that the governors agitated as compensation in the midst of the debate over the Bases law and the Government’s fiscal package.

Months ago, the Salteño Claudio Mohrpresident of the Public Limited Transport Company (SAETA), defended before Scope the initiative: “It would be fairer for this tax to be shared and returned to the provinces. Before, until the end of 2023, we all had, although not proportionally or in parity, the Transportation Compensation Fund and we received something; not even today.”

Mayors Congress.jpg

In June, the Federal Network of Mayors brought to Congress the project to share the fuel tax.

At the moment, 34% of the tax remains with the Nation, 42% is awarded to the National Housing Fund (FONAVI) and 24% is for specific allocation.

Another initiative of the provinces in the same vein is for the State to share in the fuel tax. Different districts have already expressed their intention to move in that direction. Even last June, the Federal Network of Mayors presented a bill in this regard to Congress.

The text contemplates the creation of the Federal Compensation Fund for Public Transportation Systems for Urban and Suburban Passengers in the interior of the country “with the objective of guaranteeing an equitable and federal distribution of fare compensations and the strengthening of public service systems for automotive passenger transportation in urban and suburban areas under municipal and provincial jurisdiction.”

However, despite the initial push, the initiative was never discussed and is frozen in parliament.

Added to this is the Casa Rosada’s refusal to discuss a Budget for 2025, a fact that was confirmed when Milei decided to once again extend the “law of laws” for 2023, as it already did in 2024. In this way, the Government will have discretion to manage funds and negotiations with the leaders will be carried out bilaterally.

Source: Ambito