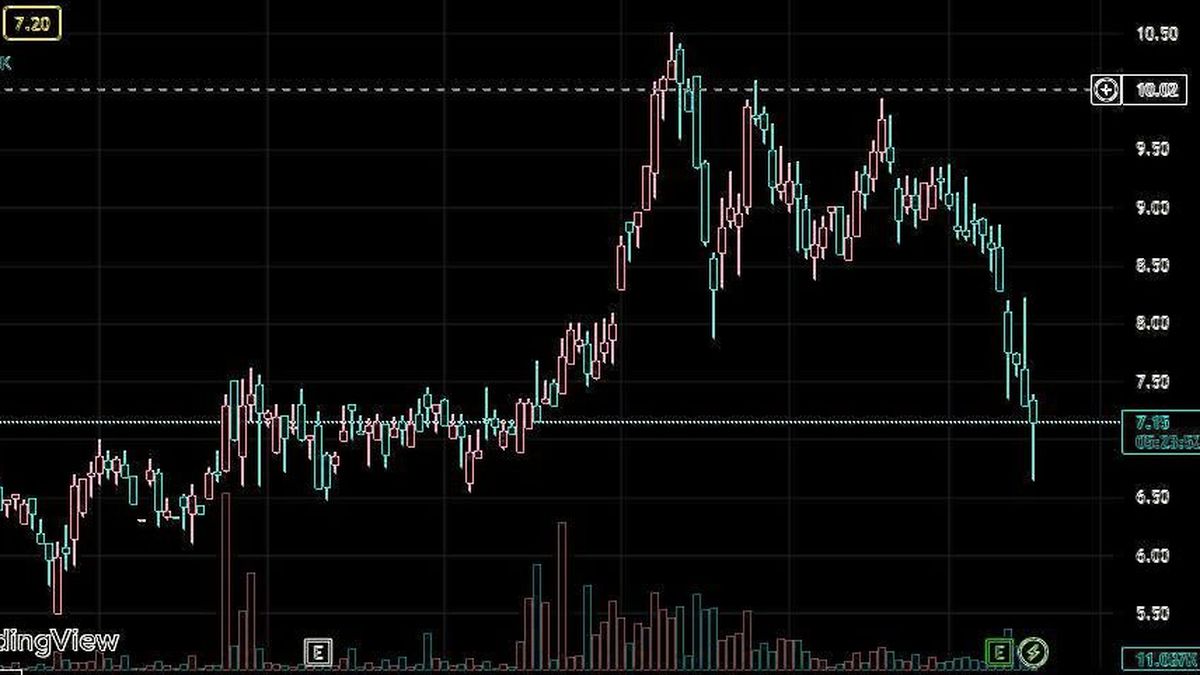

Argentine stocks and bonds plummeted by more than 10% this Wednesday, March 15, in line with another very negative day for foreign markets before growing fears about the situation of banks and one day after they met the inflation data of 6.6% per month in February.

In the leading panel, meanwhile, BYMA’s S&P Merval closed with significant drop of 4.8%, to 209,824.20 units, after falling 2.1% in the previous session. “Any rise is a selling opportunity. Very complicatedsaid a local market analyst.

“The markets are crazy. We went from the problems of the American banks to the problems of the European banks, first of all Credit Suisse”said Carlo Franchini, head of institutional clients at Banca Ifigest in Milan.

In the leading panel, the actions of Edenor sank 9.1%, Following by the Aluar (-7.5%), and the banks BBVA and Supervielle with 7.5% and 6.7%.

In that context, Argentine papers listed on Wall Street fell to almost 11%, with falls led by Banco Supervielle (-10.6%), Corporación América (-9.3%), Irsa (-8.5%), and BBVA ( -8.4%).

“The risk aversion between an inflationary stage and investor discredit drives a widespread dismantling of portfolios, mainly in emerging economies to which other problems are added”, concluded operators.

To the run on deposits from the SVB, now added the withdrawal of support from a Credit Suisse shareholderwhich made shoot insurance clauses on risk assets.

In global crises “You never know where they start and how far they go. This crisis started because a bank in the United States sold a portfolio of bonds to gain liquidity“said Javier Timerman, a partner at Adcap Grupo Financiero.

And he added that “everything happens due to the very abrupt drop in the rate worldwide as a result of the pandemic and a very rapid rise afterwards. That destroys any portfolio and creates a lot of uncertainty.“.

Bonds and country risk

Sovereign titles closed with widespread falls, led by the Bonar 2035 (-3.2%), followed by Global 2038 (-2.9%) and Bonar 2041 (-2.5%). In the accumulated of the last week, the bonds fall 10% on average, while they fall back up to 15% in the last month. Thus, the risk country measured by JPMorgan it shot up 2.9% to 2,390 basis points, the highest level since the end of last November.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.