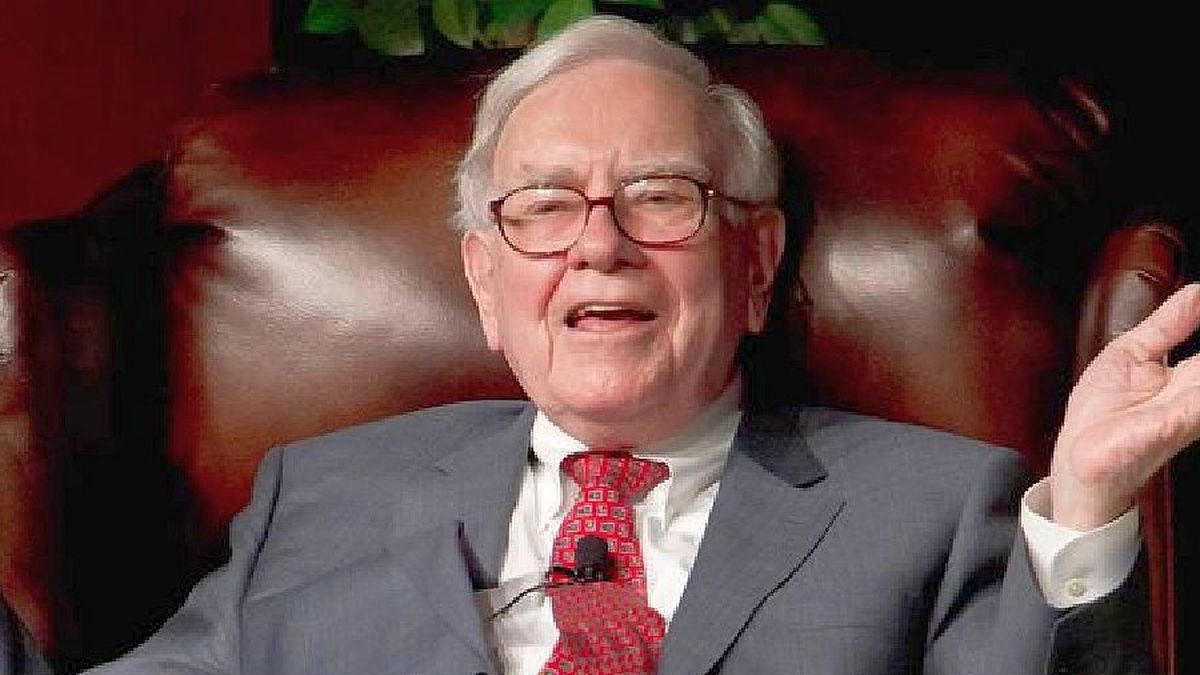

Warren Buffett He is one of the most followed investors in the world. The legendary investor, CEO of Berkshire Hathaway, unveiled his latest movements in the first quarter of 2023.

1. One of its main operations has been the purchase of more shares of Manzana. Specifically, it acquired more than 20 million titles from the iPhone manufacturer. The technology giant is Buffett’s main bet, since it accounts for 46.44% of Berkshire’s portfolio. This stake alone is valued at $150 billion.

2. He also reinforced his commitment to some names in the financial sector, despite the banking crisis in the United States. Thus, he bought almost 23 million shares of Bank of America and almost 10 million shares of Capital One Financial, which has become his most innovative and important bet of the quarter. Bank of America is Berkshire’s second largest holding, having a 9.09% weighting in its portfolio.

3. On the other hand, Buffett continued to increase his participation in Western Petroleum, the sixth value with more weight in its portfolio, since it represents 4%. In the quarter, Berkshire bought more than 17 million shares.

4. In addition, the renowned investor has increased its presence in the computer maker HP, by purchasing more than 16 million titles in the quarter. This company has a 1% weighting in the portfolio and is the 10th largest stock.

What stocks did Warren Buffett sell?

Regarding the largest sales of the quarter, Buffett sold all his shares in four companies, two of them from the American financial sector. The biggest operation has been the departure of Bank of New York Mellon, since it has sold more than 25 million shares; and the sale of more than 6 million shares of US Bancorp.

It has also sold its entire position (more than 8 million shares) in the semiconductor manufacturer TSMCwhich a couple of quarters ago had been one of its main bets.

In addition, Buffett sold more than 30 million shares of the oil company Chevronwhich continues to be one of its main bets in the portfolio, although its weighting has dropped to 6.6%.

Another of the well-known companies in which it divested was General Motors, since it sold 10 million titles. Finally, he has sold more than 3 million shares of Activision Blizzard.

His biggest positions

In addition to Apple, Bank of America, Chevron and Occidental Petroleum, the largest holdings in Berkshire’s portfolio are amexpresswith a weighting of 7.69%; Coca Cola (7.63%), Kraft-Heinz (3.87%) and Moody’s (2.32%).

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.