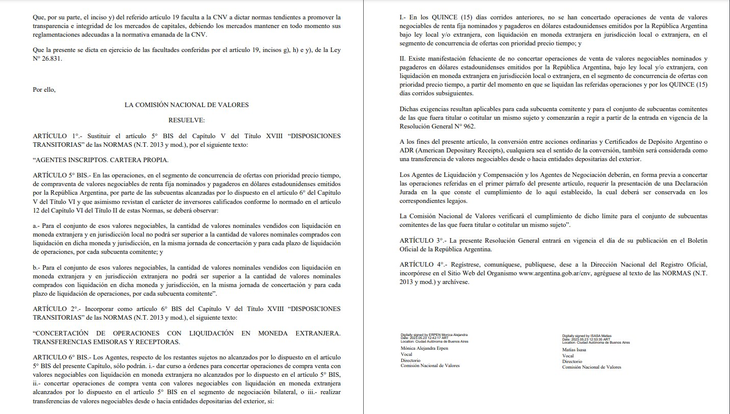

The dollars arising from CCL and MEP operations with foreign currency bonds may not be used for 15 days to purchase other dollarized assets (Cedears, ONs, and other sovereign securities).

The National Securities Commission announced a new restriction that impacts the purchase of financial dollars. The new regulations provide that the dollars resulting from operations with bonds cannot be used for 15 days to buy other dollarized assets as Cedears, Negotiable Obligations, and other sovereign titles.

The content you want to access is exclusive to subscribers.

CNV sources explained to Ámbito what the measure seeks reduce the volatility of financial dollars. But he points, specifically, to financial maneuvers (“curlers” in the market jargon) carried out by some specialized operators to take advantage of the price gap registered among the bonds that the Government uses to intervene in the market (AL30 and GD30) and the rest of the sovereign securities.

Although these currencies cannot be used to buy other assets, they can be transferred to dispose of the money.

image.png

About, Salvador Vitelli, head of research Romano Group explained: “If you buy MEP/CCL via AL30/GD30 ppr PPT, for 15 days you cannot sell those dollars via another asset. In addition, you cannot sell another asset in dollars (also for 15 days) against pesos (it would be selling MEP, by arbitration).

And he expanded: “In short, if one only buys MEP via global/sovereign, it does not change too much. You can continue buying without limit and without waiting 15 days (only parking from before). But if you want to sell them, you have to sell them via AL30/ GD30 (you could not arbitrate if there is a difference in TC with another asset). The question is to avoid arbitrage between MEP spreads between sovereign bonds and LEDs, to give an example.”

A market operator explained to Ambit that one financial curler that had become popular is the so-called “letes curl”. To give an example: cable dollars were bought with AL30 at $470, they were sent abroad and re-entered the country in bills at $490, and the operation was repeated infinite times.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.