BCRA REM: expected inflation in May

In the current survey, carried out between the 29th and 31st of last month, Analysts estimated monthly inflation of 9% for May, above the 8.4% registered in April, although The Central Bank estimates that the official data -which INDEC will announce next Wednesday, June 14 at 4:00 p.m.- will even be below the figure for the fourth month of the year.

“After the REM participants provided their forecasts to the BCRA, new information was released suggesting that monthly inflation moderated compared to the 8.4% observed in April. Both the various high-frequency indicators of wholesale and retail prices monitored by the BCRA as well as the CPI of the Autonomous City of Buenos Aires suggest a more contained evolution than in the previous month”they pointed out from the BCRA.

rem may 23 – 1.jpg

In this context, an official source explained to Ambit that “in April (analysts) had fallen short and now they exaggerate May to compensate.” In the economic team, in fact, They talk about inflation that starts with seven, not with eight, nor with nine. But they still don’t claim victory until they have the number closed.

Although it is never the same, the economic team is excited and believes that the CPI for May can imitate (or at least be very close to) the 7.5% increase registered in CABA during the fifth month of the year. “The safe thing is below 8”they emphasize.

For the next six months, from June to November, market analysts project a ceiling for the monthly inflation of 8% (June and October), and a floor of 7.6% (November), that is, they corrected the expected values upwards for all the months surveyed, between 0.7 pp and 1.6 pp

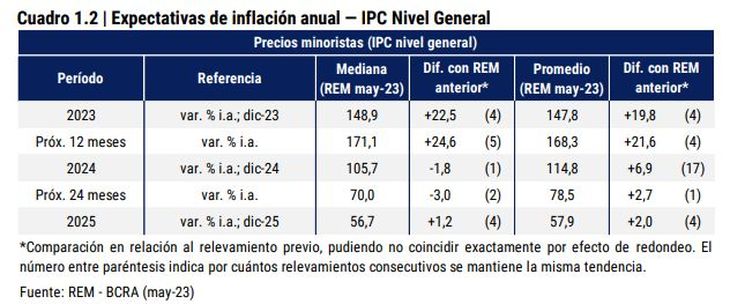

BCRA REM: inflation for the next 12 months, above 170%

Compared to the previous survey, the inflation forecast for the next 12 months, which covers a good part of the first semester of the next government, it rose to 171.1% yoy (+24.6 pp compared to the previous REM).

Meanwhile, projected inflation for the next 24 months (between June 2024 and May 2025) decreased to 70.0% yoy (-3.0 pp compared to the previous REM).

rem may 23 – 2.jpg

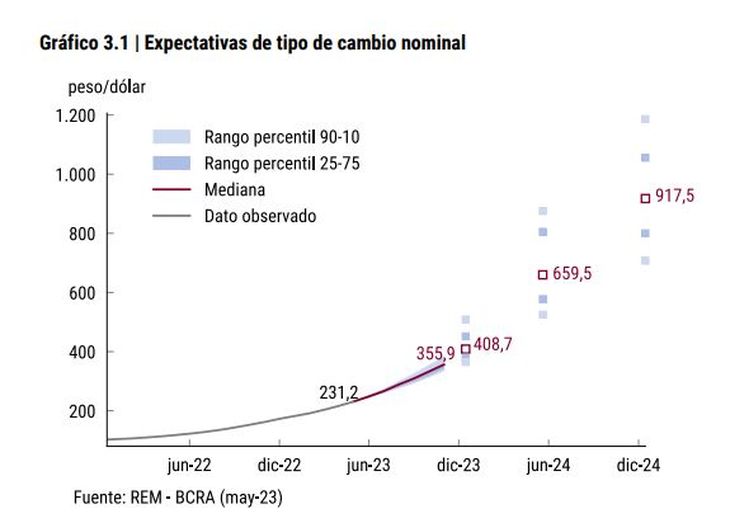

BCRA REM: official dollar

The monthly average nominal wholesale exchange rate on business days was $231.19 per dollar in May 2023. The forecast of those who respond to the REM indicates a monthly increase of $16.92 (+7.3% per month) per dollar, up to $248.11 per dollar in June.

In turn, the nominal exchange rate variation forecast by REM participants is 136.4% yoy for December, reaching $408.68 at the end of 2023. Regarding the previous survey, upward corrections were evidenced in all the following months.

For its part, the analysts’ projection for December 2024 was $917.54 per dollar.

rem may 23 – 3.jpg

The average of those who best predicted this variable in the past for the short term indicated that the nominal exchange rate for December 2023 would be located at $412.37higher by $3.69 than the set of REM participants and higher than the value predicted at the end of last month by those who made up the TOP-10 (+$16.37).

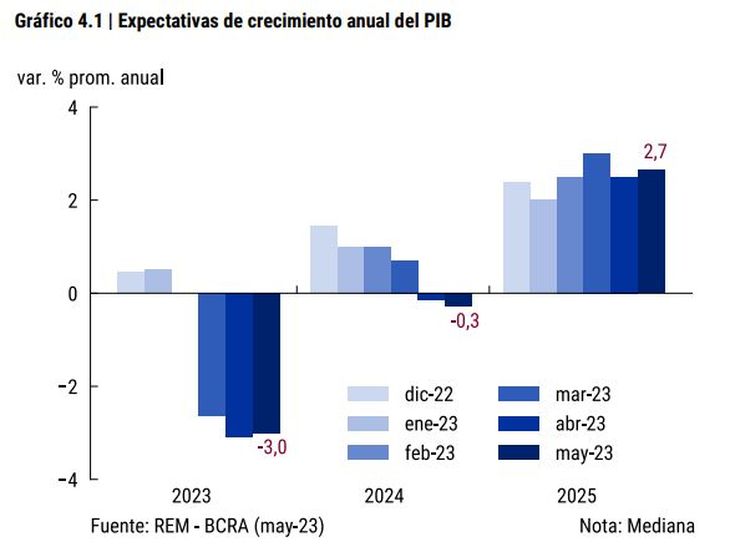

BCRA REM: GDP

Those who participate in REM project a real drop in Gross Domestic Product (GDP) by 2023 of 3% yoyreducing its reversal forecast with respect to the value contemplated in the previous REM in 0.1 pp

Meanwhile, by 2024, analysts expect a annual drop in GDP of 0.3%, which implies a greater drop in GDP of 0.1 pp compared to the previous survey. By 2025, survey participants indicated that they project real GDP growth of 2.7% (+0.2 pp compared to the previous survey).

GDP.jpg

Analysts estimate that during the first quarter of 2023 the GDP would have grown 0.8% if., implying a correction of the forecast of variation of the level of activity of +1.5 pp with respect to the previous survey.

As a result of the drought that hit agricultural exports hard, analysts expect that during the second quarter of 2023 there is a contraction of 3.1% the level of activity (1.2 pp more contraction than in the previous survey).

The GDP change forecast for the third quarter of 2023 is -0.8% quarterly se, that is, a downward correction of the forecast change in the level of activity of 0.8 pp with respect to the previous survey.

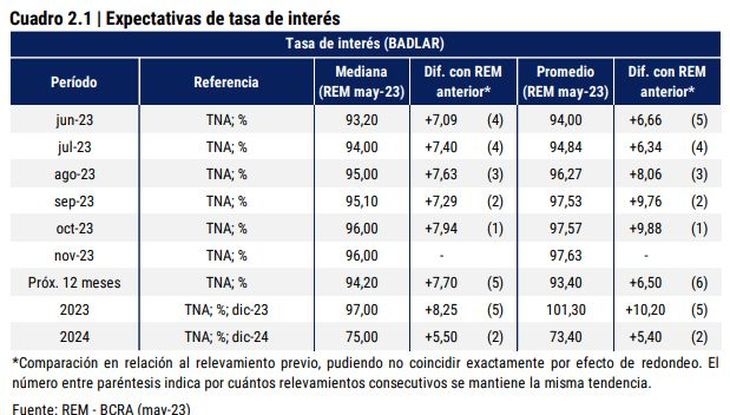

BCRA REM: interest rate

Those who participate in the REM anticipate that the annual nominal interest rate (TNA) corresponding to fixed-term deposits of 30 to 35 days in private banks, of more than one million pesos, BADLAR average of business days in May (90, 05%) it will increase 3.15 pp in June (93.20%).

Compared to the previous survey, there were upward corrections in the estimates collected for the next few months until next December of between 7 and 8.25 pp A level of 97% is forecast for December (+8.25 pp compared to the previous survey).

rate.jpg

BCRA REM: exports and imports

Regarding the value of exports (FOB), those who participate in the REM estimate an amount, for 2023, of US$71,053 million, higher than the forecast of the members of the TOP-10, who projected the value of exports in US$ s70.444 million.

Regarding imports (CIF) for 2023, the projections for the REM participants as a whole were located at US$70.400 million, while the members of the TOP-10 estimated them at US$69.429 million.

Thus, REM participants contemplate, by 2023, an interannual drop of 19.7% in the value of exports and 13.6% for imports.

BCRA REM: unemployment

Those who participate in the REM estimate that in the first quarter of 2023 there would have been a unemployment level of 7% of the Economically Active Population (EAP). For the members of the TOP-10, the unemployment rate would have been 6.8% during the first quarter of 2023.

The group of participants anticipates a rise in the unemployment rate during the rest of the year to 7.5% for the last quarter of 2023.

REM of the BCRA: primary deficit

The projection of the nominal primary fiscal deficit of the Non-Financial National Public Sector (SPNF) was located at $4,500 billion for 2023 and at $3,500 billion for 2024.

The average of the 10 most accurate forecasters over the past year for this variable expects a deficit of $3.974 billion by 2023.

In this report, the BCRA indicated that it contemplated forecasts from 38 participants, including 24 local and international consultancies and research centers and 14 financial entities from Argentina.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.