The gap between the MEP dollar quotes and he Cash with Settlement (CCL), known in financial jargon as exchange, reached a peak of 8% this Wednesday. Beyond the fact that the distance is inherent to the validity of exchange restrictions, the growing magnitude caught the attention of operators and unleashed a debate among analysts. What was it due to?

Although they are not exclusive, the opinions are distributed among those who assign greater weight to the fact that a portion of the export settlement is being carried out through the MEP and those who maintain that the main reason is the movement of importing companies to the CCL to make payment for their purchases abroad.

In the last two wheels, the exchange compressed quite a bit, although it ended the week at higher levels than in previous years, around 4.8%. For example, the average difference during the Alberto Fernández government, when there were also stocks, was 3.9%. Although what was surprising was the escalation of the previous weeks. This gap marks the additional cost paid for taking foreign currency out of the country compared to buying and maintaining it in the local market. The general expectation is that, when the government lifts exchange restrictions, the exchange will tend to disappear. Meanwhile, the aforementioned debate is going through the operating tables.

image.png

A hypothesis gained strength in recent days. That the unusual distance between both financial quotes is due to that a portion of exporters are liquidating part of their currencies through the MEP. It is something that, in principle, was not contemplated in the blend dollar scheme, which stipulates that 80% must be settled in the official exchange market (MULC) and 20% in the CCL.

Ambit was able to confirm with various sources that this occurs. There are some exporters, especially SMEs, who do not have a bank account abroad and, therefore, appeal to the banks to convert the foreign currency received from their sales abroad into dollars in local bank accounts. A report of Outlier He points out that this also helps financial entities to simplify operations. Thus, in these cases, the settlement of 20% of the blend is not carried out over the wire, but rather takes place directly in the local market. Thus, the report states that “the banks would be generating offer in the MEPbut does not offer in the CCL”, which contributes to expanding the exchange.

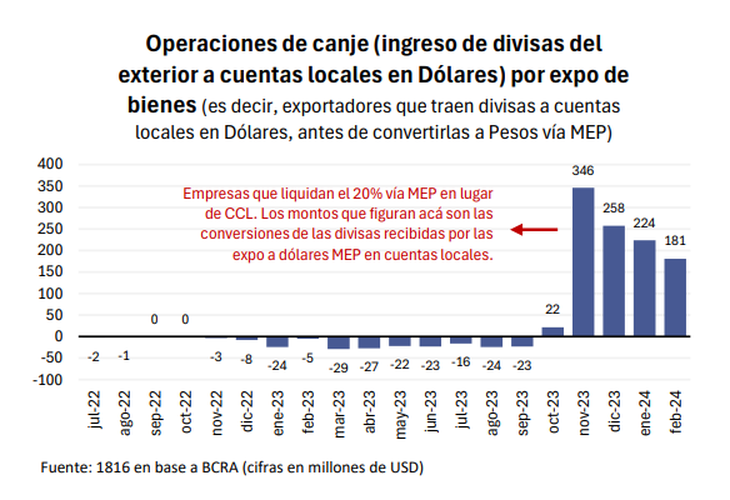

A special report from the consulting firm 1816 admitted that this happens, although qualified its impact in the phenomenon of widening of the gap between financial prices since this mechanism covers “a small portion of total exports”. And he cited data from the Central Bank’s exchange balance: in February, there was a conversion of dollars from abroad to MEP dollars (to later be exchanged for pesos) linked to exports of goods for US$181 million. Instead, he estimated that the settlement of exports via CCL was US$1,006 million. For this reason, he concluded that “the 80-20 blend generates much more CCL supply than MEP supply.”

image.png

In addition, 1816 pointed out that the offer of exporters in the MEP represented just 10% of the US$1,864 million traded in February between AL30D and GD30D. For this reason, he considered that, “in the best of cases, this phenomenon contributes at the margin but is not enough to understand why the CCL-MEP exchange is so high.”

Do importers turn to CCL?

Then they appear other hypotheses in the debate. As this media reported, the reduction of the exchange gap between the official dollar plus taxes and the cash with liquid means that some companies abandon the MULC and turn to canceling commercial debts with their suppliers through the CCL, according to private sector sources. It should be remembered that the exchange rate prevents those who operate in the official market from carrying out MEP or CCL, except for those who subscribe to BOPREAL in a primary tender.

In addition to the contraction of the gap, the restrictions still in force to access the official dollar and the fact that the BOPREAL series 3 had an implicit exchange rate 30% higher than the “liqui” in the average of the four primary tenders carried out, according to estimates by Salvador Vitelli, head of research at Romano Group.

In 1816 they ascribed to the hypothesis of this phenomenon as one of the possible determining factors of the high level of the exchange, although they clarified that it is “incontrovertible.” In addition to add demand to the CCL, the consulting firm stated that “if these importers had dollars in local accounts (which they could not get rid of while they were active in the MULC due to the ‘MULC/CCL cross restriction’), perhaps they are now selling them via MEP, generating a constant supply in that market.” In that sense, she calculated that private corporate deposits in dollars today are around US$5.4 billion.

As an additional factor, the consultant added the hypothesis of dissaving effect by natural persons due to the collapse of income in real terms. “Because ‘there is no money’, it is possible that retailers have reduced their level of MEP purchases and/or that some have begun to sell to maintain (or not reduce as much) consumption levels. This is another untestable hypothesis, but it is worth keeping in mind that individuals have deposits in dollars for about US$10.2 billion,” 1816 said.

In the short term, as long as the stocks remain in force in general and there are no changes in the composition of the export blend dollar, an extra demand driver will be added to the CCL that could affect the level of the exchange. The CNV eliminated, as of April 1, the restrictions that weigh on the operation of financial dollars so that importers who subscribed to BOPREAL can complete the payment of debts with their foreign suppliers through cash with liquid for an equivalent amount. to the difference between the nominal value purchased of the bond and the price at which it can be sold in the secondary market.

The 1816 report weighed this factor: “At the extreme, if importers had already sold 100% of the US$7,981 million nominal value of BOPREAL issued by the BCRA on the market, they could buy CCL for around u $2,000 million”, according to the average price of BOPREAL in the secondary market against cable.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.