Market analyst Salvador Di Stéfano is one of the most listened to in the city of Buenos Aires. He reviewed the progress of the investments and recommended what to bet on.

Below, the column of one of the star gurus of the local market.

Since the new government took office, the treasury debt has decreased by 5.3%. It is interesting to note that the government has strongly reduced the debt in pesos, maintains the debt in dollars, and strongly increased the debt in pesos adjusted for inflation.

In this way we see that the treasury aims to borrow in pesos adjusted for inflation, to honor the debt in dollars, it trusts that, having a fiscal surplus, and ceasing to issue, inflation will fall sharply in the years to come, and this would bring with it certain peace of mind in economic matters.

Clipboard03.jpg

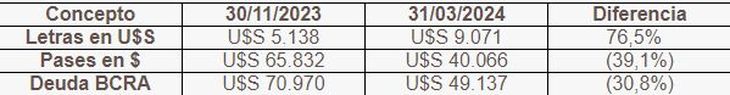

The debt of the Central Bank of the Argentine Republic (BCRA) fell by 30.8% measured in dollars between November 30, 2023 and March 31, 2024, this was due to the liquefaction effect caused by the rise in the exchange rate, plus a sharp decrease in the interest rate in the face of growing inflation. The data is extracted from the summarized balance sheet of the Central Bank

Debt in dollars grew by 76.5% as a result of the cancellation of Letters denominated Levid and the placement of Bopreal. The well-known Leliq were replaced by shorter-term repos and measured in dollars showed a drop of 39.1%. In total, the Central Bank debt measured in dollars fell 30.8%.

Clipboard04.jpg

If we add the treasury debt and the debt of the Central Bank of the Republic of Argentina, as of November both amounted to US$ 493,796 million, and fell to US$ 449,734 million, which implied a decrease of 8.9%.

Conclusions

. – The Argentine debt showed a considerable drop in a few months, as a result of a change in the economic regime, which showed a fiscal surplus, and measures aimed at a framework of monetary issuance backed by dollars, which is leaving us with a deceleration in the prices, which for the moment is hindered by the relative price adjustments of the tariffs.

. – Inflation has been showing strong drops, this week we were surprised by the wholesale inflation that for the month of December 2023 was 54.0%, for January 2024 it was 18.0%, February 2024 it was 10.2% and March 2024 year 2024 of 5.4%. To highlight in the month of March is the deflation of 1.7% in imported products, a product of the liquidation of stock and the slight rise in the wholesale dollar.

. – In a scenario of high recession, combined with low prices, the market is oversupplied with dollar bills that seek pesos to be able to overcome the problems of deficit in business and family budgets, leaving the dollar with a negative result in its price in the last months. The CCL dollar was worth $834.4 on November 30, while on March 31 it was $1,085.70, an increase of 30.1% versus inflation in the same period of 90.2%.

. – The AL30 Bond as of November 30 was worth US$ 34.80, while as of March 31, 2024 it was worth US$ 54.08, reflecting an increase of 55.4%. The Merval index in dollars went from being at US$974.82 on November 30, 2023, to being at US$1,117.70 on March 31, which represents an increase of 14.7%.

. – In recent months the big winner was the one who bought sovereign debt dollar bonds, and the one who bet on the UVA fixed term. Those who bet on a bond in pesos adjusted for inflation, such as the TX 28, saw a huge gain since it went from being worth $689 on November 30, 2023, to being worth $1,579.5 on March 31, which represents an increase of 129.2%, this represents 20.5% more than inflation, and 76.2% in CCL dollars.

. – The Argentine assets linked to the State debt and those who bet on the UVA fixed term won. The actions showed a timid improvement of 14.7% in dollars, which reflects that they have not yet taken off and that they are awaiting definitions regarding specific policies for the sector.

. – If the government continues to show fiscal surplus, Argentine bonds will travel at parities around 70%, they continue to be a great success for investors.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.