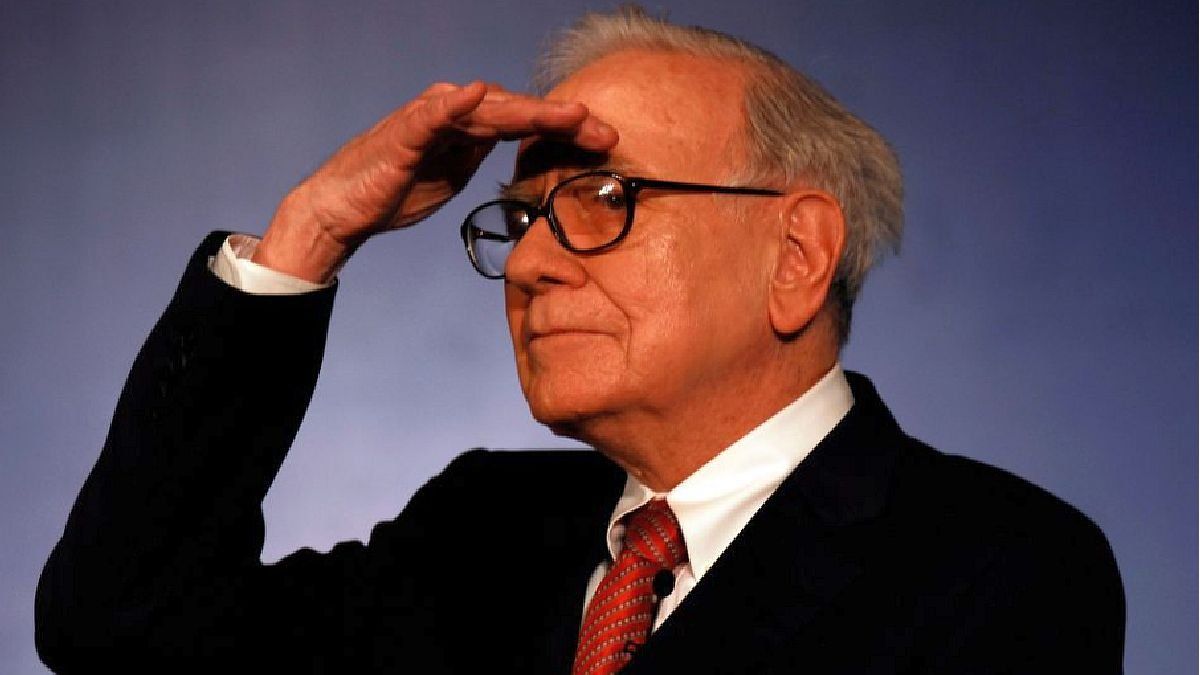

At 93 years old, the legendary investor confirmed to his shareholders who will take his place when he is no longer here. He did it, 7 months after the death of his right-hand man Charlie Munger.

Warren Buffett At 93 years old he confirmed that Greg Abel would be his designated successor. This was the first time the “Oracle of Ohama” spoke at his annual Berkshire Hathaway shareholder meeting without Charlie Munger, who died in November. At 93 years old, one of the greatest investors of all time, he wants to leave everything tied up, although he hopes to continue living for a while longer.

The content you want to access is exclusive to subscribers.

“I would leave the capital allocation to Greg, he understands business extremely well,” Buffett told an arena full of shareholders at Berkshire’s annual meeting. ““If you understand business, you will understand common stock,” he said.

Buffett, president and CEO of Berkshire Hathaway, clarified that Abel will have the final say on capital allocation in the company. Abel, 61 years old, He has been overseeing key areas such as energy, railways and retail tradeand was appointed successor in 2021.

Who is Greg Abel?

This 61-year-old Canadian businessman is the current president of the group’s energy division, as well as vice president of unsecured operations of the parent company. In 1984 graduated in Commerce from the University of Alberta, in Canada. In 1992 He joined CalEnergy, a producer of geothermal electricity that in 1999 would become MidAmerican Energy. That same year, Berkshire Hathaway bought a majority stake in the company and Buffett began to get closer to Abel. A decade ago, when Abel had already been leading the entity for more than five years, MidAmerican Energy became Berkshire Hathaway Energy.

Since 2018, Abel has been a director of Buffett’s holding company, as well as vice president of unsecured operations of the group.

On numerous occasions, Charlie Munger showed that Greg Abel was his right eye in the fight for the succession of Berkshire Hathaway. Although Buffett wanted his inseparable companion to succeed him, Buffett always preferred him to be someone younger.

NYO73ZVCMNIUJG5LHICVGWCSOA.jpg

Greg Abel has been a Berkshire consultant since 2018

Greg Abel and the future of Berkshire Hathaway

Berkshire’s stock portfolio is worth 362 billion dollars, and the company has almost 189 billion in cash. Buffett stressed that the responsibility of managing these assets falls entirely on Abel, emphasizing their ability to make strategic decisions in large investments.

After years of speculation about the exact roles of Berkshire’s top executives, this is the clearest view of the succession plan to date. The investing icon, who will turn 94 in August, said his decision is influenced by how much Berkshire’s assets have grown.

“I used to think differently about how it would be managed, but I think that responsibility should be on the CEO and whatever that CEO decides can be useful,” Buffett said. “The sums have grown so much in Berkshire, and we don’t want to try to have 200 people managing a billion each. “It just doesn’t work.”

“I think that when the sums that we will have are handled, you have to think very strategically about how to do very big things“added Buffett, and he is convinced that “the responsibility must fall entirely on Greg.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.