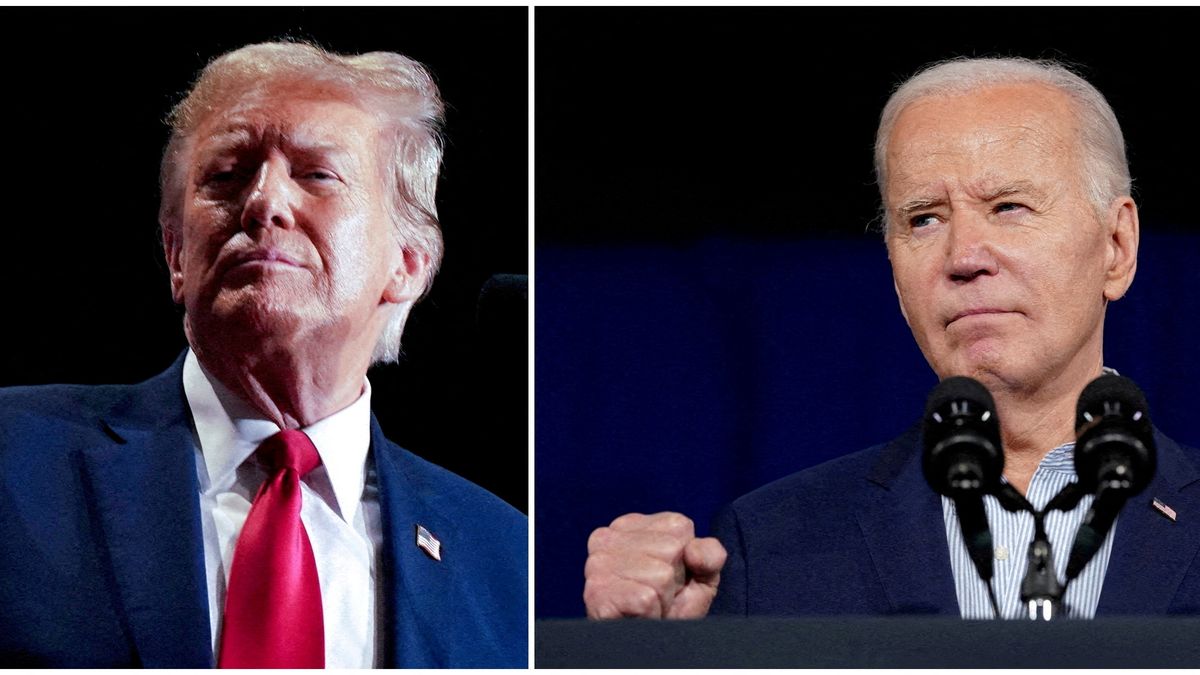

Scenario under Trump 2.0

Trump’s policies tend to favor accelerated industrial growth and less strict regulation, which could benefit large technology companies in the short term. During his previous tenure, the Technology Select Sector SPDR Fund (XLK), which includes tech giants, saw an impressive 179% gain.

A second Trump term is expected tompulse domestic semiconductor manufacturing, crucial in the competition with China. Firms like Applied Materials, KLA Corp, Intel and Texas Instruments could receive further supportpart of a strategy to strengthen the country’s technological self-sufficiency.

In addition, offshoring policies are likely to continue with a focus on tariffs to negotiate better trade deals for American products. Although Trump could favor tax policies to encourage private investment over direct government funding in technological R&D.

Biden scenario 2.0

In contrast, Joe Biden is focusing on rigorous regulations and strategic partnerships, seeking sustainable and secure technological growth. His administration has promoted legislation such as the CHIPS Act, aimed at strengthening domestic chip manufacturing through significant investments in new facilities.

Biden could step up export controls and regulatory oversight, especially on artificial intelligence and antitrust issues. His collaborative approach with tech companies seeks to ensure ethical development of AI, urging federal agencies to follow clear guidelines on its use.

Big companies like Amazon, Apple, Microsoft, Meta, and Alphabet have thrived under both administrations, although regulatory and support approaches have differed.While Trump could relax regulations, which would accelerate innovation but with risks of oversight, Biden favors partnerships for safe and ethical technological growth.

Strategic decisions and business innovations, rather than specific policies, have driven the success of manufacturers like Nvidia, although presidential policies influence the broader technological environment crucial to these expanding sectors.

Biden Trump

Strategists at Portfolio Wealth Advisors anticipate possible tougher trade restrictions with China under a Trump presidency, potentially disrupting supply chains.

Reuters

Strategists at Portfolio Wealth Advisors anticipate possible tougher trade restrictions with China under a Trump presidency, potentially disrupting supply chains. His unpredictable style could lead to abrupt changes, such as halting Nvidia sales to China, deeply impacting the tech sector.

Whatever the outcome, the next US president will need to decisively lead the country’s digital and technology policy, affecting not only the big tech corporations, but also the sector’s innovation and global competitiveness.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.