The Sovereign bonds have been in the news this week for amortizations and coupons. US$2.6 billion was paid to the holders of Bonares (AL, under Argentine law) and Globales (GD, under foreign law).

Recall that these bonds were issued during the sovereign debt restructuring in August 2020.

What does it mean when a bond makes payments? Bond payments are the money transfers that the issuer makes to the investor during the term of the bond.. These are divided into two parts:

- Coupon: This is the interest that the bond pays periodically, as a percentage of the bond’s face value. For example, if a $100 bond has a 5% coupon, it will pay $5 per year in interest.

- Amortization: It is the payment as a “return of the capital lent” to the investor. It can be in several installments or all at once at the end. For example, if you bought a $100 bond with amortization at maturity, at the end of the period you will get those $100 back.

In short, bond payments consist of regular interest payments (coupons) and the repayment of borrowed money (amortization).

Let’s look at the details of sovereign bond payments:

Clipboard01.jpg

All bonds paid interest this week. The only one that paid principal was the AL30/GD30.

Of all these, Which one returns all the money invested during Milei’s term? The correct answer is the bond with the shortest duration, that is, the AL29/GD29.

It is worth noting that the payment structure is the same between AL and GD bonds, the only thing that changes is the legislation. Since New York Law (GD) bonds have stronger legal protection, they tend to be a bit more expensive, therefore their yield is slightly lower.

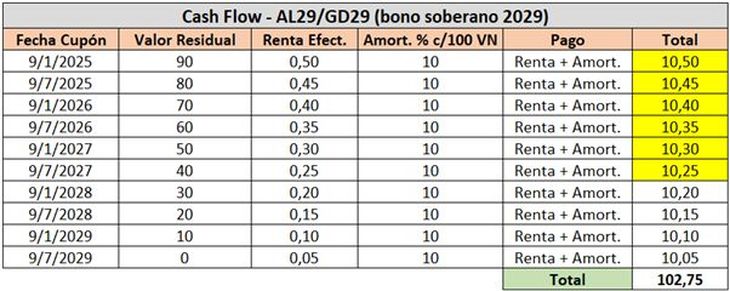

Let’s look at the AL29/GD29 payment structure:

Clipboard02.jpg

In yellow I highlight the flows collected within Milei’s government. Taking into account the current price (AL29: USD 57.1 and GD29: USD 58.4), USD 62.5 would be collected until 2027, when Milei ends his term. That is, even more than USD 4 would be collected above what was invested today.

It is worth clarifying that until 2027, AL29/GD29 would amortize 60% of the capital owed, leaving 40% to be collected afterwards.

Why do I speak in terms of potential and say “would collect” and “would amortize”? Because we are still in Argentina, and no income is 100% guaranteed. There is a reason why bonds are worth what they are worth.

How has AL29 fared?

Clipboard03.jpg

After having risen 150% since the day before Milei’s victory, the AL29 has corrected more than 20% from its highs and this week resumed its upward path. Will it go to new highs? Let us remember that this bond yields 27% in dollars.

What does it mean to have a 27% yield in dollars? If the interest payments are reinvested, an annual yield of 27% could be achieved through the maturity date (2029), provided payments are made on time.

That is, the performance potential is enormousBut the risk is also great, and it is not for nothing that bonds remain at very low values compared to the region. How can this be seen? With the Country Risk.

The RCountry risk of Argentina is practically at levels of 1,500 basis points. In contrast, neighbouring countries such as Brazil, Uruguay, Chile and Peru are below 250 points.

It is important to note that Argentina has achieved a fiscal surplus for five consecutive months, a record not seen in more than 15 years. And June is even expected to be a surplus, despite the payment of bonuses.

Given the current starting point and the direction the government is taking, it is possible to think that the Country Risk has a lot of room to fall. Therefore, sovereign bonds continue to offer great return potential.

If you want to know more about investments, I invite you to visit our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be construed in any way as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents only the opinion of the author. In all cases it is advisable to seek professional advice before investing.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.