Just a couple of days ago, Trump said: “If Harris wins this election, you will very quickly have an economic crisis, you will have a collapse,” the Republican told his audience at a rally in Georgia.You could also have a crash like in 1929, more specifically, because that’s where we’re headed.“, he anticipated.

Thus, the market “crash” was not unrelated to the presidential election, as Trump quickly came out to blame Kamala for what happened and called it “Kamala Krash“Unfortunately, for many investors, the stock market crash did not wait for Harris’ election.

Donald Trump’s post.png

Donald Trump’s post on Truth Social.

Spillover effect from the US to emerging economies

David Reessenior emerging markets economist at Schroders explains that US economic growth would slow down with Harris (or another possible Democratic candidate), while a Trump victory would tilt the US economy “in a reflationary direction”.

For its part, Jorge Compagnuccicontent director at Global Target Market (TMG), believes that, “without a doubt, a possible Trump victory will sharpen the cyclical crash that emerging markets have been experiencing since his last administration.”

Additional fiscal spending, deregulation of parts of the US economy such as fossil fuels, and eventual aggressive Fed cuts once Powell is replaced in 2026would likely boost activity, Rees analyses. While the Harris scenario foresees US Gross Domestic Product (GDP) growth of 2%, 2.1% and 1.9% between 2025 and 2027, the Harris scenario Trump has a faster growth of 2.2%, 2.7% and 2.3%, respectively.

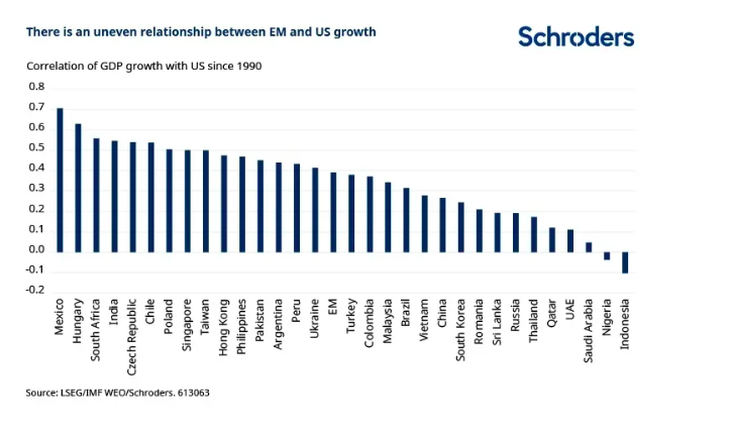

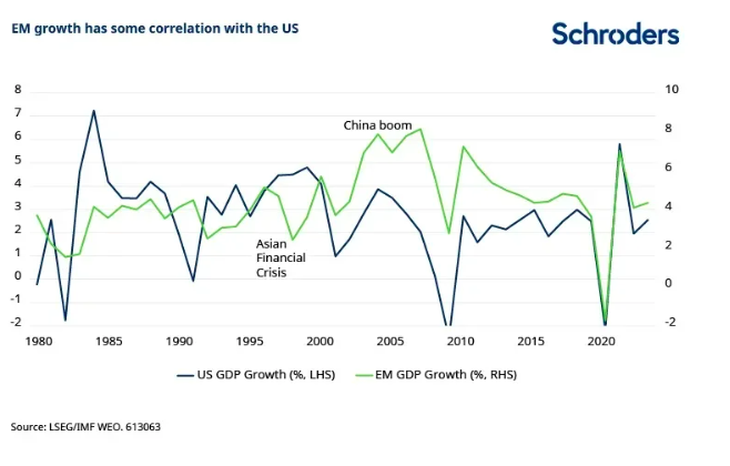

The Schroders analyst argues that, viewed from the top down, “There is some relationship between US GDP growth and that of emerging markets”. Although this relationship has tended to vary over time, with a decoupling of emerging market growth in the late 1990s, during the Asian financial crisis and also during the rise of China during the 2000s.

Correlation of the US economy and the emerging economies.png

Despite these problems, a simple regression of emerging market GDP growth against the two scenarios implies that Stronger US growth under Trump would give a slight boost to emerging markets between 0.1 and 0.2 percentage points in 2026 and 2027, to 4.4% and 4.3%, respectively, says Rees.

In fact, the impact on emerging market growth would be uneven across regions and individual economies, he notes. Some economies, such as Mexico, “show a very strong correlation with US growth, but others, such as Indonesia and parts of the Gulf Cooperation Council (GCC), have shown no correlation at all.”

Three keys: trade, raw materials and capital flows

As soon as to tradeRees argues that Trump could implement more aggressive policies than Biden, which would generate volatility in the markets, especially in Mexico and China. However, he recalls that Trump’s tariffs in his first term were largely economically inefficientand stronger US growth is likely to boost more imports, benefiting emerging exporters.

About raw materialsa reflationary scenario with Trump could initially raise pricesbut this could be temporary if fossil fuel deregulation increases production and lowers prices in the long term. Higher commodity prices would benefit exporters of natural resourcesbut inflation in emerging markets could rise, Rees warns, potentially leading to a delay in interest rate cuts.

Finally, in terms of Capital fluxes, Both candidates (Harris and Trump) will likely face upward pressure on long-term interest rates. However, a more lax fiscal policy under Trump could increase the risk to the Treasury bond market, “causing potential capital outflows from emerging markets.” Although few of them are at immediate risk, “there could be additional pressure on their currencies and greater caution from their central banks,” the Schroders strategist analyses.

US economy.png

Finally, he suggests that if Trump replaces Powell at the Fed in 2026 with a president willing to cut rates aggressively, “There could be an eventual depreciation of the dollar, benefiting the returns of emerging market assets in the future”.

Argentina, Trump and the alignment with Milei

Compagnucci from TMG is not so optimistic about a Trump victory for Argentina. He argues that “without a doubt, a possible Republican victory will exacerbate the cyclical crash that emerging markets are facing have been experiencing since their last administration.” And that, although in Argentina there is speculation that the proximity between Milei and Trump could be beneficial, for the strategist “That speculation is completely inappropriate.”.

Explains that a Trump victory “will undoubtedly have a significant impact on emerging marketsas it is likely to trigger a new round of tariffs against China.” And remember that this trade tension with the Asian giant contributed to the fall of the government of Mauricio Macri in 2018 and at dollar rallyas well as the sinking of the raw Materialswhich if repeated would be bad for the Argentine economy.

“I am convinced that this situation will occur, and recent market movements, such as the collapse of the Japanese market, demonstrate this. These falls generate global aftershocks and affect economic expectations,” says Compagnucci.

Regarding the possible cut in interest rates in the US in September, TMG believes that it is “an alarming sign”. In a global inflationary cyclical environment, if the Fed suggests it might cut rates, “it is not indicative of a balanced economy, but quite the opposite.” In fact, it is a resource that should be reserved for when the markets enter a global crash, which, by all indications, began last week.

The global market crash

Compagnucci warns that a virtual victory for Trump would have serious consequences for emerging markets, and In Argentina, conditions could become adverse for the Government in the coming years, given that under Trump there would be a stronger dollar. US governments have learned that they must protect the dollar as a global store of value, and the last decade has seen a dimming of its luster due to the debt bubble they are immersed in and the need for global financing. Therefore, they must keep the dollar strong despite its geopolitical component.

At TMG, they argue that The dollar’s glow also has a warlike dimension, given the growing global geopolitical conflict over the past two years.Some speculate that Trump might pressure the IMF to provide some kind of aid to Argentina, “but the reality is that Argentina is not alone in need of help; many emerging markets are facing an unprecedented cyclical crisis in risk assets.”

And, as Compagnucci mentions, “We are in the midst of the largest decapitalization process in the history of emerging markets, with fewer and fewer business opportunities.” And this crisis is not exclusive to Argentina, but affects all emerging markets globally, due to regulations that have reduced the available money and the growing concentration of operations in funds such as Vanguard and BlackRock.

Thus, the uncertainty about Harris or Trump presidency poses significant impacts for emerging markets, including ArgentinaAccording to Rees, a Trump victory could tip the US economy into a reflationary phase, with faster growth benefiting emerging markets, albeit unevenly.

In contrast, Compagnucci argues that A Trump victory will exacerbate the cyclical crash that already affects these markets, with possible negative effects on the Argentine economy. due to the likelihood of renewed trade tensions with China and a stronger dollar. Both analysts agree that the global impact will be significant, but their perspectives differ as to the magnitude and nature of the effects on emerging markets.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.