Luis Caputoholder of the Ministry of Economyled the first broadcast of the organization’s stream and referred to the financial perspectives of the current administration, considering that “the idea of this program is to make people understand the benefits of money laundering,” which he described as “totally flexible.” “The money laundering will accelerate the coexistence of currencies,” he predicted.

At the beginning of the conversation, the official described the Country risk “as a lagging indicator” and downplayed its value: “I don’t care much, as bondholders do, but I say this because Argentina does not need to convince the markets today because it will not have to go to them in the next year and a half.” “In that year and a half, the perspective is that reality will be very forceful and that Argentina will be able to refinance their capital probably at single-digit rates”he predicted.

In this regard, he pointed out that the “Today the most important thing is to look at realitybecause it is a country that has lost so much credibility in terms of economic policy that people want to see results: reality changing in concrete data.”

Embed – https://publish.twitter.com/oembed?url=https://x.com/MinEconomia_Ar/status/1829666625185866031?t=N8mZilWQjSStMOTfegHVzA&s=08&partner=&hide_thread=false

Before leaving the program, Caputo clarified that “today you can buy dollars and pay in that currency, without having to go through Congress because it is absolutely legal. In fact, One of the most important cards is finishing the technical process to launch a debit card in dollars.” The minister clarified that the use of this card will be exempt from fines.

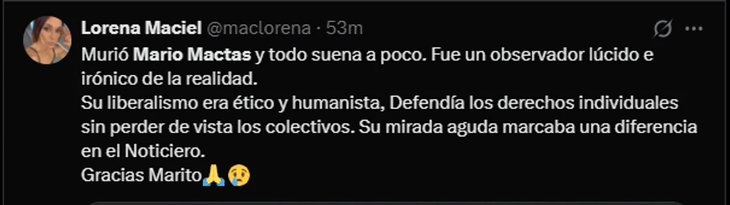

Stream Ministry of Economy.jpeg

The first broadcast of the Ministry of Economy was attended by Luis Caputo.

Government changed the conditions of money laundering: the keys

The Government expanded the regulatory framework for the regularization of assets, better known as money laundering. This was done by means of a Decree, which introduced a set of fiscal measures aimed at regularizing assets and establishing a special regime for the tax on personal property.

Through the Decree 773/2024 Published in the Official Gazette this Friday, it was recalled that said regime is designed for tax residents in Argentina as of December 31, 2023, and also extends to individuals who were previously tax residentsalthough they are no longer. Thus, the Government again invited taxpayers to declare property or assets that have not been previously reported to the tax authoritiesoffering them the opportunity to catch up with their tax obligations.

The Decree sets out three key stages for laundering, each with specific requirements that include the manifestation of adherence to the regime, the making of a mandatory advance payment, the filing of a sworn statement, and the payment of a special tax known as “regularization tax”“This tax varies depending on the stage at which the taxpayer decides to regularize his assets, the stages being a sort of temporal escalation where different tax rates are applied.

On the other hand, the Law also creates a Special Income Regime for Personal Property Tax (REIBP). This regime is available to the same people who can access the Asset Regularization Regime, that is, tax residents in Argentina as of December 31, 2023 and people who were tax residents previously. The purpose of the REIBP is to facilitate the payment of the Personal Property Tax, allowing taxpayers who regularize their assets within this scheme to benefit from special tax treatment.

A key part of this special regime is that it establishes an additional tax on gifts and other types of “liberalities” (i.e. transfers of property or money without receiving equivalent consideration)). This tax applies to those who accept or acquire, before December 31, 2027, a donation or an asset worth less than its market value from a taxpayer who has not joined the Regime. This means that if a person receives a donated asset from someone who has not regularized their tax situation, the recipient may have to pay additional tax if the donation is considered to be below market value.

The decree also introduces modifications and additional details to the original regime, such as the inclusion of construction works and improvements in the regularization of real estate, the definition of who is considered “dependent relatives” from a tax point of view, and how disputed tax obligations should be treated in different administrative or judicial instances.

Finally, the official text addresses the way in which payments must be made under the REIBP, including how the tax base of regularized assets is converted to Argentine pesos using the US dollar exchange rate. at the value of the last business day prior to filing the sworn statement.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.