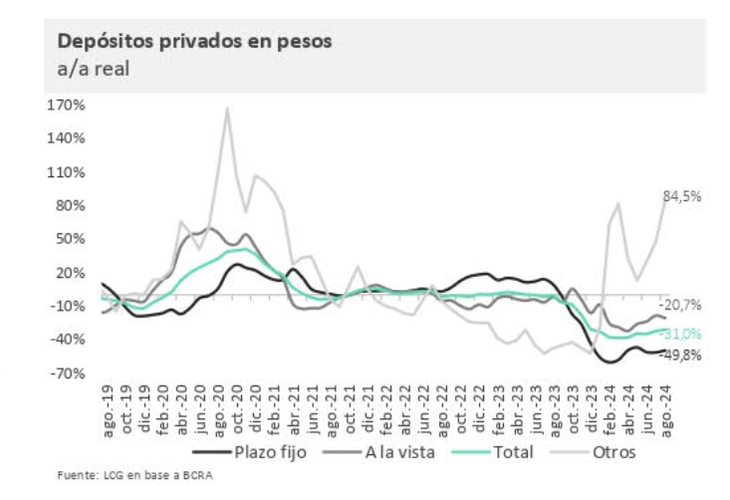

Deposits in pesos fell in almost all their forms. The negative interest rate against inflation continues to hit fixed-term deposits and savers are looking for better strategies.

In August, the fixed terms remained almost stable, with a slight fall of 0.2% monthly (the previous month they had grown), although they are still on a low floor. This is due to the negative interest rate that would seem to be one month older in the face of inflation, where the consultants They forecast a floor of 4%.

The content you want to access is exclusive for subscribers.

In this context, Another instrument became one of the most chosen by savers: the remunerated deposits of Mutual Investment Funds (MIF).

FCIs grew more than other peso-denominated deposits: 19.2% monthly in real terms (vs. 7.4% in July), consistent with an 84.5% year-on-year increase in real terms. This is the opposite of money market funds, which showed an 8% real increase in August. The data is from the “Loans and Deposits” report, prepared by the LCG consultancy.

fixed-term.png

FCI’s remunerated accounts beat fixed-term deposits in August

the remunerated deposits They offer returns of up to 42%, taking advantage of fixed-term deposits, in addition to the benefit of immediate withdrawal.

Besides, LCG says that deposits in pesos in general fell in all their variants except for the latter, contrasting with the real growth in July. Demand deposits fell 3.7% m/m, which includes current account and savings account deposits.

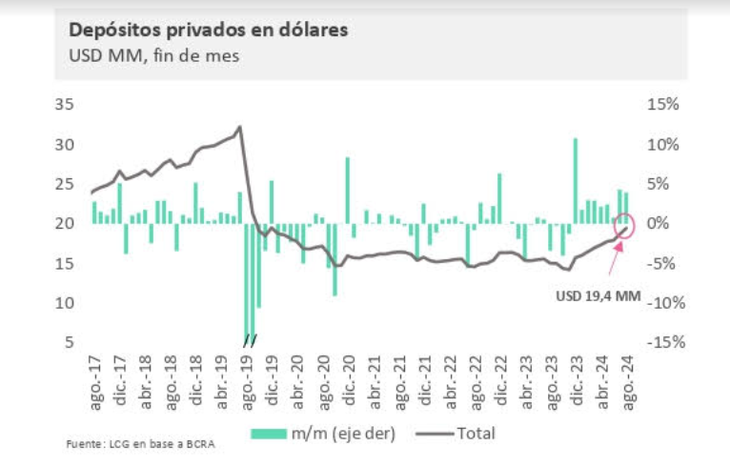

Dollar deposits: what happened in August

The dollar deposits continue to grow strong: two months in a row at 4% monthlyshowing some acceleration at the end of the month. In absolute terms meant an increase of US$739 million, totaling US$19.4 billion. Part of the increase is explained by the effect of the money laundering, although we understand that it still only reflects a minor portion and that the bulk will begin to be felt during September. The deadline for disclosure is until 9/30 with the possibility of paying a fine of up to 5%.

whitening.png

In recent weeks, dollar deposits have grown as a result of money laundering

“Going forward, the gradual decline in inflation – still stagnating above the Government’s target levels – will contribute to maintaining higher remunerated deposits – for the least negative rates – or unpaid. However, Everything will depend on the exchange rate dynamics and general uncertainty: movements in the official exchange rate or the gap will increase doubtsdecreasing the demand for assets in pesos to move towards dollarized assets. That is why the evolution of reserves will be fundamental. In the short term, we will see how deposits in dollars evolve after the money laundering,” they explained.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.