A report by PinPoint Macro Analytics He maintains that this Wednesday’s event configures the eighth cycle of monetary policy easing since 1989 by the Fed that leads Jerome Powell. Several key axes emerge from the document, not only related to variable income, since lower interest rates will have a full impact on both the real economy and the financial markets.

According to the study, during the first year of past easing cycles, “U.S. Gross Domestic Product (GDP) growth generally accelerated (the main exceptions are cycles associated with an external shock, such as OPEC conflicts, the collapse of technology companies and the COVID-19 pandemic)”. Unemployment, for its part, rose for a while after declining, “since it is a lagging indicator”.

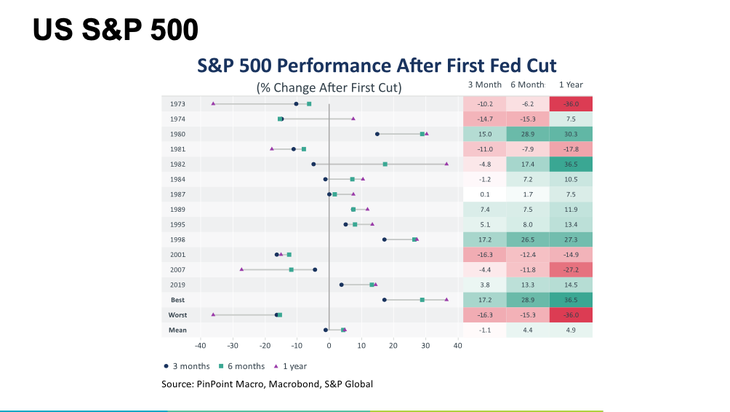

As for inflation rates, they have remained stable in the most recent cycles. Meanwhile, housing price growth has almost always accelerated, except in the case of the global financial crisis of 2007-08. And finally, the report highlights that “there are more rate cuts in which the Stock prices, the US dollar and 10-year bond yields rose“, than in those that do not.

PinPoint2.png

For its part, the values of the raw materials They generally do not have a specific orientation, “but oil prices tend to fall and gold tends to rise. There is no clear trend in market volatility; exogenous factors dominate”, he slides the document.

A key fact to keep in mind is that “When the Fed managed to avoid a recession, stocks tended to trade higher. When it failed to do so, stocks trended lower.“.

From the heart of Wall Street: What reaction is expected in the markets?

Investors will need to take the message the Fed sends on Wednesday about the state of the U.S. economy. The size of the cut could greatly influence market perceptions, and possibly set the tone for the rest of the year.

Expectations of a reduction in 50 basis points (bp) or half a percentage point re-emerged on Friday. By Monday, blockchain-based prediction markets (Polymarket) were already showing a possibility of the 54% for a 50 bp cutcompared to 45% who believe it will be 25 bp.

In dialogue with Scope, Eric Wallersteinchief markets strategist at Yardeni, analyzed what is coming for the market, from the heart of the financial center. He explained that according to his analysis, The Fed will make a 25 basis point cut (0.25%) . And he maintains that he does not believe that the central bank needs to cut by 50 bp, but if it does, “the economy could accelerate, which increases the risks of higher inflation in the future”.

Asked how he expects the market to react, he says, in line with what PinPoint has said, that historically the Fed cuts interest rates in response to a financial crisis or recession. “Therefore, stocks usually do not cut rates until they are lower.” fall when the central bank cuts. However, this time there is no recession or crisis, which is why the markets are celebrating the possibility of cuts.

PinPoint 1.png

For Wallerstein, Fed could cut rates by 50 bps if yen carry trade unravels further. Although he maintains that “this seems unlikely based on current market prices.” The analyst says that he does not believe that a smaller cut, of 25 bp, would be poorly received by the market. In any case, he suggests that it will depend largely on the policy path indicated by the Federal Open Market Committee (FOMC), as well as Powell’s press conference. “As evidenced by Tuesday’s US retail sales data, The US economy remains strong”, he says.

Asked whether the rationale behind the rate cut is more important to markets than the rate cut itself, Wallerstein responds ambiguously: “yes and no”“The reasoning behind the cut – the ‘prevention’ of a recession – is positive for markets,” he says. He explains that if the Fed were cutting in response to a declining economy, “markets would be under pressure from the economic slowdown.”

He adds that, on the other hand, “many borrowers depend on the rates set by the Fed. Interest rate cuts, combined with a relatively strong economy, encourage an economic reacceleration”.

Fed cuts and the impact on Argentina

Diego Martinez Burzacocountry head of Inviu Argentinacomments in an interview with this newspaper that the market has already significantly adjusted its expectations regarding the Fed’s interest rate. “Until recently, there was a consensus in favor of a 50 basis point cut, which we at Inviu consider excessive. We believe that a 25 point adjustment is more appropriate,” he analyzes.

Regardless of how the adjustment is, in the short term there are two key points that Martínez Burzaco recommends observing:

- Macroeconomic projections: The Federal Reserve’s GDP and inflation projections, which are revised quarterly, will be updated on Wednesday. “This will provide a clearer view of the entity’s expectations,” he said.

- Powell press conference: Powell’s stance and openness to future cuts will be crucial. Communication during this presentation will help to understand whether there is room for additional adjustments.

The strategist points out that, looking to the long term, central banks in developed countries are beginning to shift from a restrictive monetary policy to a more flexible one. This, in the absence of a severe global recession, “could have a positive effect for emerging marketsweakening the dollar globally and supporting commodity prices.” This would thus be favorable for Argentina’s economic situationalthough it remains to be seen whether this trend will be confirmed.

As things stand, investors are unlikely to have all the information they need for Wednesday’s meeting with the Fed. The market’s response will depend more on what economic data in the coming months reflect.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.