A report by CREATEthe civil association that brings together agricultural businessmenanalyzed key aspects for the sector facing 2025. The study addressed relevant topics such as business trustthe exchange expectationsthe impact of the interest ratesthe climate challenges and the international price fluctuationsamong other crucial points for decision-making in the sector.

The report for the month of November points out some key points that reflect the expectation for 2025 and the points in which an alarm signal is noted, especially in the exchange rate outlook.

1. Business confidence

The index that measures business confidence maintains the upward trend that began at the beginning of the year and reached its highest level since 2017. The improvement was explained by the good evaluation of the country’s situation, given that, the subindex of the company’s situation and that of the situation of the agricultural sector remained stable. This evolution suggests that businessmen positively value the macroeconomic ordering achieved in the last year. However, at the micro level, a series of factors persist that affect the economic and financial situation of companies, such as exchange restrictions, tax pressure (mainly DD.EE.), low international prices, inter alia.

create1.png

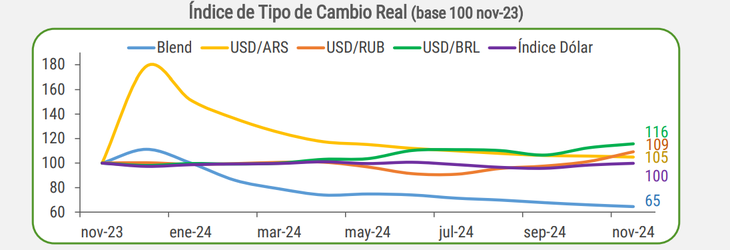

2. The blend dollar, below the levels recorded before devaluation

About to complete a year since Milei took office and took the official exchange rate from 367 to 800 u$s/$, the official dollar is at real values close to those recorded before the devaluation, while the blend dollar is already located below. Although inflation experienced a significant reduction from 25.5% monthly in Dec-23, it always remained above the 2% monthly increase in the dollar, resulting in a real appreciation of the exchange rate. Furthermore, the monthly devaluation is expected to reduce to 1% in the coming months.

For businessmen, it is also added that two key countries in the agricultural business such as Russia and Brazil devalued their currency, thus reinforcing the loss of competitiveness of the peso. “Both local factors and the international context contribute to the appreciation of the Argentine peso, making the country more expensive in dollars. In this framework, It is urgent to work on the microeconomic reform agenda to improve local competitiveness: access to markets, lower tax pressure, investment in infrastructure and increased productivity, etc.,” they warned.

3. Improvement in financing

On the other hand, the report highlights that the exchange appreciation generated changes in the financing pattern of the agricultural sector. Before, with exchange instability, credit was taken in pesos. But now, the taking of credit with a devaluation of 2% monthly, favored financing in dollars.

“In this way, starting from values close to historical lows when Milei took office in Dec-23, as of Sep-24 the stock of credit in dollars to the agricultural sector in real terms is US$1,202 million, a variation of 180% vs Dec-23 (173% AGR, 242% GAN, 175% LEC). On the contrary, real financing in pesos had a decrease of 2% in the same way. period (-3% AGR, -2% GAN, +7% LEC)”.

Screenshot 2024-12-17 185034.png

Despite the positive sign, another warning is also made in relation to a regulation that governs convertibility: which is that those who do not have income in foreign currency, the possibility of financing themselves in dollars is restricted to avoid the insolvency of debtors in the event of a devaluation. .

“This limitation restricts credit subjects and explains the low rates in dollars. Currently, given the abundance of dollars in banks, there is a “temptation” to relax regulations. Going forward, growth in dollar financing would be expected, although if macroprudential regulations are made more flexible, financing could become more expensive due to the potential increase in applicants”they added.

The exchange market, on alert for the sector

Agricultural businessmen, according to the report, finally point out that the lowering of import prices and the loss of competitiveness in exports impact the decrease in the trade surplus and the deficit in the exchange current account.

“The National Executive Branch (PEN) appears calm, and has even adopted measures such as making the payment of imports more flexible and eliminating the Country tax. In this way, it aims for the losses in the commercial channel to be recovered through the financial channel. The risk is that, if not, the Government would be forced to sell reserves to finance the current account deficit, which would negatively impact net reservesraising doubts about the sustainability of the exchange rate scheme,” the CREA report concluded.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.