Inflation in the US set a record for the last 40 years. In this environment and taking into account that the labor market is very strong, the Federal Reserve began to raise interest rates to cool down the economy and deal with the inflationary scourge.

Contrary to popular belief, inflation is bad for business. Thinking that companies will make more money since prices are rising is a very serious mistake. Why? Let’s look at the basic reasoning.

A final consumer, faced with the increase in inflation, cannot pay any price, since his real income is deteriorated. And what do companies do? In order to continue selling, they are forced to do so at a lower price.

Final score? They earn less money. It should be noted that there are companies, such as laboratories, that can transfer their cost increases to the final price, due to the inelasticity of their products. But this luck does not run the majority of the companies.

In addition, if costs also increase (a situation that is occurring, mainly due to the conflict between Russia and Ukraine), profit margins are reduced even more. That is, they not only sell at a lower price, but also cost them more and more. Bottom line = profit margins negatively affected.

The cases of Walmart and Target

Supermarket and warehouse sales, adjusted for inflation, are not growing. And the costs of fuel, transportation, and inventory just keep going up.

Walmart and Target suffered first hand from the impossibility of passing on all the cost increases to the final consumer. And it was reflected in the quarterly balance sheets that they presented this week, with a common denominator: lower profits than expected and a brutal fall compared to the previous year. Reason? Compression of profit margins, due to inflation.

How did the market react to the bad balances? He showed no mercy: Walmart fell 11.4% and Target fell 24.9%. Yes, Target lost a quarter of its value in just one day. And the fall of both was the worst daily record since 1987, on the famous Black Monday.

For your reference: in a single day, Walmart lost $50 billion in valuation and Target lost $25 billion. Where did that money go? To nowhere. It vanished. Destruction of value.

Let’s see the graphs, with the accumulated performance so far this year:

Boggiano1.png

Walmart was one of the few stocks that was positive in 2022. Target, for its part, came in with a slight loss. It is worth clarifying that most of the actions, mainly the technological ones, began this year with fierce falls. Why? Because they were affected by the rise in interest rates.

Companies will have to redefine their strategies to deal with inflation and better understand consumer habits, which are changing. Not everyone maintains the same capacity or purchasing habits.

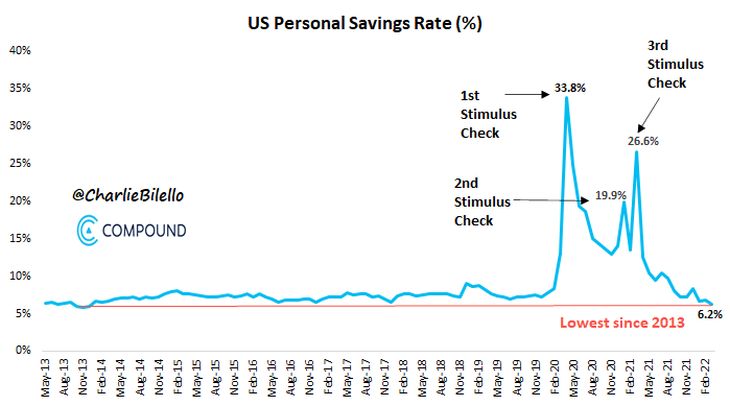

Let’s look at the following graph that shows the savings rate in the US:

Boggiano2.png

The savings rate has dropped to 6.2%, the lowest level in the last 9 years. In addition, they are taking on more debt (and at a higher rate), in order to maintain their lifestyle. If inflation does not stop, the situation may worsen even more.

The market is revealing the shortcomings of companies in this context. Walmart and Target act as a thermometer of the American economy. And the signs of a possible economic recession are lighting up. Undoubtedly, the coming months will be vital in defining the course of the economy and the stock market.

Stocks and bonds are already pricing in a recession. And company balance sheets are showing fragility. Be careful that these falls could be just the beginning.

To finish, I would like to invite you to download for free a report that I prepared with a list of companies with potential and a good risk/return ratio, in this context of high inflation. I think it will be very useful to you. You can download it at the following link: Financial letter – actions.

Source: Ambito