There are months ahead of considerable uncertainty in the markets. With the complex international context and the upcoming elections in November, Choosing a suitable portfolio is not an easy task.

Even so, there are interesting options for investors who want to diversify their capital. In this case, it is two wallets. One of them is more conservative and consists solely of fixed income assets, while the other is a bit more aggressive, with some equities.

Conservative portfolio (Fixed Income)

This wallet is designed for investors who want to invest part of their capital locally, but with a somewhat conservative view. The objective is to be hedged against possible negative scenarios with great exposure to dollar, sovereign and corporate instruments.

Distribution by instrument

image.png

- ONs Hard Dollar/FCIs: Within this category we can find ONs like Telecom Argentina 2025 (TLC5O) with an approximate annual yield of 6.6%, Pampa Energía 2023 (PTSTO) with an IRR of the order of 8.5% and Capex 2024 (CAC2O) 6%.

Telecom Argentina is the leading telecommunications company in Argentina and has a moderate level of indebtedness. Pampa Energía is the largest electricity generation company in Argentina with investments also in gas production in dead cows and public service companies. Lastly, Capex is dedicated to the exploration and exploitation of hydrocarbons and the generation of electrical, thermal and renewable energy.

ONs of this style usually have high minimum sheets (u $ d 1000 in general), therefore a cheaper alternative can be Mutual Funds that are made up mostly of corporate bonds. The minimum in these funds is usually u $ d 100, they are subscribed in MEP and they are an excellent option to diversify.

- FCIs Dólar Linked: Taking into account the expectations of an acceleration in the rate of devaluation for the coming months, an FCI Dollar Linked It can be a good alternative to cover ourselves in this possible scenario. There are many options of this style on the market and, in general, they have been yielding YTDs greater than 20%.

- CER adjustable bonds: CER-adjusted bonds continue to be very attractive in the medium term. These bonds track inflation, which is why they are an excellent hedge against it.

The most interesting positions are in the middle of the curve, that is, in bonds TX23 and TX24. These bonds pay semiannual interest, with rates of 1.4% and 1.5% (respectively) + CER. To give a reference, the CER rate is currently at 35.35% (annual).

- FCIs Funky: The Latam Common Investment Funds invest directly in fixed income -sovereign and corporate- of the main Latin American countries, for example Chile, Brazil or Paraguay. They are a good option to get out of the local risk. These funds are generally operated in cable dollars and the minimum to subscribe is usually u $ d 1,000.

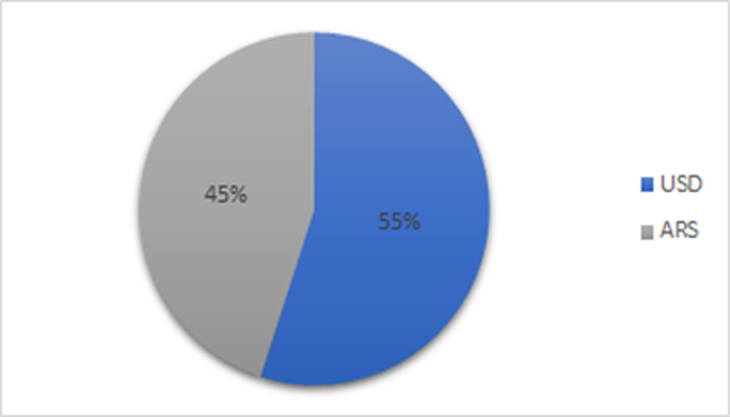

Taking into account these proportions, the distribution of the portfolio by currency would be as follows:

Distribution by currency

image.png

The minimum amount, in dollars, recommended to access this portfolio by opting for Hard Dollar ONs instead of FCIs (in the first instrument) is US $ 3,000. Instead if we opt for FCIs, the recommended minimum would be u $ d 1,500.

Aggressive portfolio (Mixed Income)

This portfolio is aimed at investors seeking a superior return while assuming a higher risk. Without so many hedging instruments and some variable income, it constitutes a much more aggressive portfolio than the previous one. The composition would be as follows:

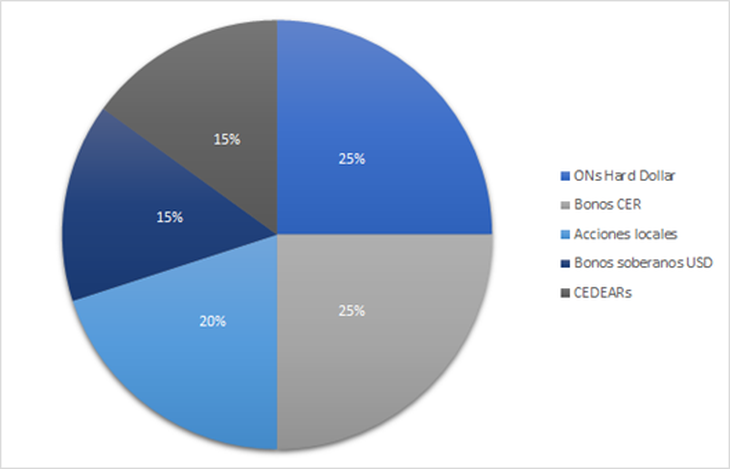

Distribution by instrument

image.png

- ONs Hard Dollar/FCIs and CER adjustable bonds: The recommendation is the same as in the conservative portfolio.

- Local actions: For investors who want to build a position of Argentine stocks, betting on an economic recovery and a change in expectations at the local level, the ideal would be to look for quality companies, with a better financial position, less exposure to regulated markets and benefiting from the rise of commodity prices. This group includes actions of BAD, ALUA, and BMA.

- Sovereign bonds in USD: In this case, for those investors who want to enter directly into local risk, since the sovereign curve has been hit so hard, the GD38 seems the best alternative. But we could also add Cordoba 2026 (CO26). The province of Córdoba restructured its Ley NY bond curve in January, but did not generate any change in conditions on its local instrument. As it is an instrument that returns its capital on a quarterly basis (and at the same time pays coupons), it maximizes payments until 2024 (u $ d 41 c / VN100), which today means a strategic advantage in case Argentina does not achieve avoid a credit event for that time.

- CEDEARs: We cannot leave out of this portfolio the star instrument of this moment, the CEDEARs, which are an excellent alternative to diversify, leaving a little of the local risk but maintaining a hedge against the exchange rate. Some recommended CEDEARs at this time are: VIST, SHIP, GOLD, BRKB O DISN.

Taking into account these proportions, the distribution of the portfolio by currency would be as follows:

Distribution by currency

image.png

The minimum amount, in dollars, recommended to access this portfolio by opting for Hard Dollar ONs instead of FCIs is US $ 5,000. Instead If we opt for FCIs, the recommended minimum would be $ 2,000.

Team Leader of Digital Banking in Personal Investments Portfolio (PPI)